Money deposited in Jan Dhan accounts drop for the first time

So far, over Rs 14 lakh crore have been deposited, Reserve Bank of India (RBI) data shows.

Money deposited in zero-balance Pradhan Mantri Jan Dhan Yojana (PMJDY) has dropped for the first time since its inception.

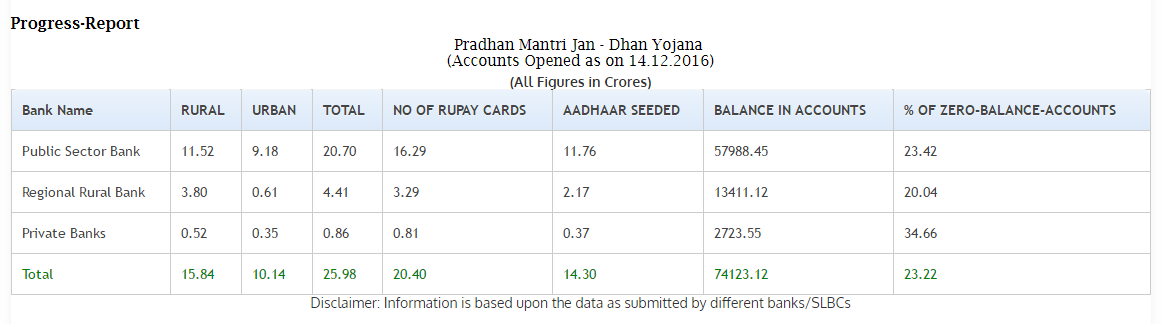

Ministry of Finance data show that as on December 14, 2016, total amount deposited in thise PMJDY accounts stood at Rs 74,123.12 crore. However, in the week ended December 7, 2016, the total money in these accounts stood at Rs 74,609.49 crore. This is a drop of Rs 486.37 crore in a week.

Prime Minister Narendra Modi, on November 8, 2016, announced demonetisation that made 86% of total currency circulated in India in the form of Rs 500 and Rs 1000 notes were declared illegal tender.

PM Modi asked people to deposit all this currency in their bank accounts by December 30, 2016.

The move was initially aimed at curbing black money which is estimated to be around one-fourth of India's economy.

Government of India told the Supreme Court that it expected around Rs 11 lakh crore to be deposited in banks and the rest Rs 3-4 lakh crore would be extinguished.

So far, over Rs 14 lakh crore have been deposited, Reserve Bank of India (RBI) data shows.

Since the announcement, deposits in Jan Dhan accounts rose sharply. Data show that during the first fortnight, over Rs 27,000 crore were deposited in PMJDY accounts. The money in these accounts stood at Rs 47,000 crore till November 8, the evening when PM Modi announced demonetisation.

Just five days after November 8 saw an influx of Rs 18,500 crore in these said accounts.

This prompted speculation that a lot of black money is finding its way into these accounts to avert detection. PM Modi, during an address, told holders of these accounts to not return the money to the people who lured them into depositing this ill-gotten wealth in their legitimate accounts for a fee.

In mid-November, the Government said that these PMJDY accounts will be probed for misuse. RBI placed a withdrawal limit of Rs 10,000 per month from these accounts.

It said, “Fully KYC compliant account holders can withdraw up to Rs 10,000 from their account in a month. The bank managers may allow further withdrawal beyond Rs 10,000 within the current applicable limits only after ascertaining the genuineness of such withdrawals and duly documenting the same on the bank’s records."

Currently, the total number of accounts opened under PMJDY stand at 25.98 crore as on December 14, 2016. This is an increase from 25.82 crore accounts that were opened till Deecmber 7, 2016.

The total number of accounts with zero balance too has increased from 5,92,96,799 to 6,03,28,417.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

11:58 AM IST

23% Jan Dhan accounts still without balance; deposit surge abates

23% Jan Dhan accounts still without balance; deposit surge abates Jan Dhan inflows decline after govt alert on converting black money

Jan Dhan inflows decline after govt alert on converting black money Will find way to let poor retain Jan Dhan deposits: PM Modi

Will find way to let poor retain Jan Dhan deposits: PM Modi Govt looking into sudden spurt in Jan Dhan account deposits

Govt looking into sudden spurt in Jan Dhan account deposits Demonetisation aftermath: Jan Dhan accounts being used to convert black money

Demonetisation aftermath: Jan Dhan accounts being used to convert black money