Market crash haunting you? Take shelter in these 10 dividend-yielding stocks

The Sensex has shaved off over 3000 points so far from its peak hit on January 29 after the re-introduction of long-term capital gains (LTCG) tax in Budget 2018, and amid pressure in public sector banking stocks post the alleged financial fraud in Punjab National Bank (PNB).

The bears do not appear to be giving up soon with analysts expecting a prolonged correction in the market at least in 2018. The Sensex has shaved off over 3000 points so far from its peak hit on January 29 after the re-introduction of long-term capital gains (LTCG) tax in Budget 2018, and amid pressure in public sector banking stocks post the alleged financial fraud in Punjab National Bank (PNB). Spectre of an interest rate hike by Reserve Bank of India (RBI) on the back of rising inflation, and globally, US President Donald Trump’s ‘trade war’ comments, surge in oil prices and fears of heightened pace of rate hikes by US Federal Reserve also weighed on the indices.

However, market never falls short of opportunities. Analysts believe at a time when market is going through a correction, looking for some hefty dividend-paying companies with good fundamentals could turn out to be a rewarding option for investors.

“As markets are somewhat under the weather, and as we are in the middle of fourth quarter of the financial year (Q4FY18), it’s good time to look at dividend-yielding stocks,” said brokerage Centrum Broking in a research note.

Which are the sound dividend paying companies? Before we come to that, let’s understand all about dividends in detail:

What is dividend and dividend yield?

When board of directors of a company decides to distribute a portion of company’s earnings among its shareholders, this portion is called dividend. Dividend could be allocated in the form of cash payments, as shares of stock, or other properties. It is usually paid in cash and is given against the face value of the stock. Face value is the original cost of the stock shown on the certificate. Indian firms usually fix at Rs 10.

Investors track the value of dividend yield (expressed in percentage) over a course of a period to discover company’s dividend history. Dividend yield is derived by dividing the annual dividend per share (DPS) with the current market price of the company. To calculate the dividend per share, one must divide company’s declared annual dividend by the face value of a share.

For example: Coal India had declared an equity dividend of 199 per cent for the year ending March 2017. Dividend per share, then, would amount to Rs 19.9 i.e. by dividing the 199 by face value of Rs 10. At the current share price of Rs 306.45, this results in a dividend yield of 6.49 per cent i.e. dividend per share/current market price.

Based on the historic evidence, PSUs have been high dividend payers to address the fiscal deficit concerns of the government against the shortfall in tax collection. Some of the stocks such as Coal India have seen huge dividend pay-outs over the years. Fourth quarter of the financial year traditionally provides maximum activity in terms of PSU dividends.

Why to invest in dividend stocks?

i) Dividend income is tax free: The average interest rate on fixed deposits is 6-7 per cent. There are enough stocks with the similar rate of dividend yield. The interest on bank fixed deposits is taxable whereas the dividend from equity is completely exempt from tax except when the dividend income in a financial year exceeds Rs 10 lakh.

In that context, post-tax dividend yields of some of the stocks is way higher than the post-tax interest yield on bank fixed deposits. So, investors can consider some of the high dividend yield stocks to bring in regular inflows.

ii) A dividend catch-up expected in 2018: There was a huge drop in dividend payment by RBI to government for the financial year ending June 30, 2017. The central bank halved its dividend payout to the government to Rs 30,659 crore for the fiscal year ended June 2017 as compared to Rs 65,876 crore in the previous year. That said, brokerage Centrum Broking believes there may be dividend catch-up needed from the other profit-making PSUs. Meanwhile, the government has fixed Rs 80,000 crore divestment target for FY19, meeting which would require profit-making PSUs to share some profit.

iii) Dividend yield vs stock price: With the recent market correction, the stock prices of some of the PSUs have seen rough treatment, resulting in possibility of healthy dividend yields as dividend yield is inversely proportional to stock price. Stocks such as IL&FS Investment Managers, NMDC, Power Finance, REC and NTPC etc are down up to 40 per cent year to date.

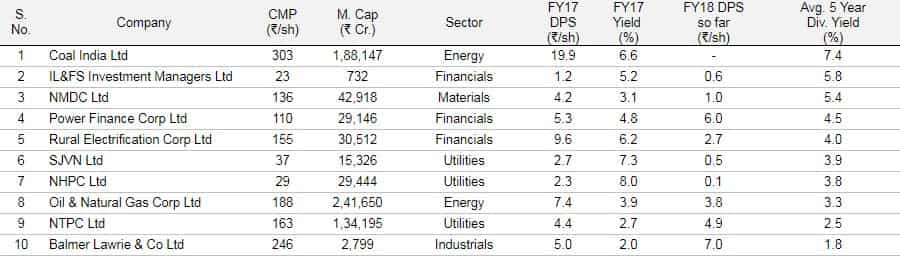

10 stocks to focus in the context of dividend

*CMP as on March 5, 2018

Source: Centrum Broking

Centrum Broking sees maximum potential for healthy dividends in Coal India, IL&FS Investment Managers, NMDC, Rural Electrification Corp (REC) and Oil & Natural Gas Corp (ONGC).

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

10:25 AM IST

Final Trade: Sensex tumbles 1,200 points, Nifty slips below 23,600; IT stocks cushion the fall

Final Trade: Sensex tumbles 1,200 points, Nifty slips below 23,600; IT stocks cushion the fall Zomato set to debut in Sensex, replacing JSW Steel

Zomato set to debut in Sensex, replacing JSW Steel Sensex drops 170 points, Nifty below 23,950; oil & gas stocks rebound

Sensex drops 170 points, Nifty below 23,950; oil & gas stocks rebound FIRST TRADE: Equities fall for fifth consecutive day; Nifty holds on to 23,900 levels, Sensex down 208 pts

FIRST TRADE: Equities fall for fifth consecutive day; Nifty holds on to 23,900 levels, Sensex down 208 pts GIFT Nifty futures drop 60 pts; markets to open on a cautious note

GIFT Nifty futures drop 60 pts; markets to open on a cautious note