Maharashtra's farm loan waiver to worsen its fiscal deficit

Farm loan waivers is expected to hamper Maharashtra's fiscal budget.

Key Highlights:Maharashtra government announces farm loan waiver of Rs 30,000 crore

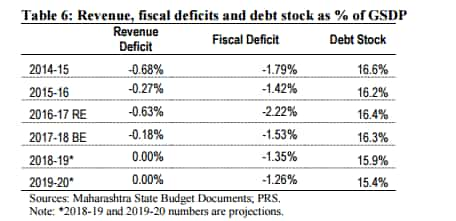

Loan waiver will push Maharashtra's fiscal deficit by 118 basis points

The Rs 30,000 crore farm loan waiver announced by Maharashtra government will burden its fiscal deficit by 2.71%, India Ratings has said.

India Ratings said, “Maharashtra's loan waiver of Rs 30,000 crore will push up states fiscal deficit to 2.71% in FY18 of gross state domestic product (GSDP).”

This would be 118 basis points higher from the budgeted 1.53% for FY18.

Ind-Ra estimates the debt of gross state domestic product will rise to 17.44% against the budgeted 16.26% in FY18. However, its impact will mostly depend on whether the entire loan is absorbed in FY18 or is made partially over a period of three to four years.

Also, the state had budgeted debt stock of Rs 4,12,992 crore for FY18, with loan waiver in picture this could go up to Rs 4,42,992 crore for the year.

Agriculture sector saw a volatile growth in the last four years in Maharashtra. The sector saw negative growth of 11.2% and 4.6% in 2014-15 and 2015-16 respectively. However, the sector is estimated to see 12.5% growth in 2016-17 owing in increased rainfall.

Ind-ra added, “The loan waiver is likely to reduce the fiscal space for the government to undertake higher capital expenditure over the medium-term, thus affecting its medium-term growth prospects.”

Maharashtra is the second state to announce loan waiver, UP Chief Minister Yogi Adityanath has made loan waiver of Rs 36,359 crore to 2.5 crore small and marginal farmers.

ALSO READ: Is farm loan waiver in Uttar Pradesh the right thing to do?

Demand for loan waiver has been also raised from governments of Andhra Pradesh and Telangana state.

Andhra Pradesh and Telangana's total agricultural loans was at around Rs 1.4 lakh crore which is about 19% of the country’s total agricultural loans outstanding.

"More importantly, as these schemes seem to have yielded electoral gains, similar announcements could be made in other states as well. The most vulnerable would be states in which elections are nearing, " said Ind-Ra.

ALSO READ: Farm loan waiver could reach Rs 2.6 lakh crore by 2019, report claims

BofA Merrill Lynch Global Research, in its report said, “We expect almost all states to write- off about $40 billion (Rs 2.6 lakh crore) of farm loans in the run up to 2019 general elections following the ruling BJP's UP and Maharashtra governments' waivers.”

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

01:49 PM IST

Farm loan waivers kill credit culture, says former RBI Governor Raghuram Rajan

Farm loan waivers kill credit culture, says former RBI Governor Raghuram Rajan Congress to offer comprehensive farm loan waiver, may cost Rs 2 lakh crore

Congress to offer comprehensive farm loan waiver, may cost Rs 2 lakh crore What is Jai Kisan Rin Mukti Yojana? MP CM Kamal Nath launches Rs 50,000 cr farm loan waiver scheme

What is Jai Kisan Rin Mukti Yojana? MP CM Kamal Nath launches Rs 50,000 cr farm loan waiver scheme Aadhaar enrollment boosts MGNREGA, cuts delayed payments to low of Rs 67,956 cr in FY18

Aadhaar enrollment boosts MGNREGA, cuts delayed payments to low of Rs 67,956 cr in FY18  Poll-bound Rajasthan announces farm loan waiver, tax relief in 2018 budget

Poll-bound Rajasthan announces farm loan waiver, tax relief in 2018 budget