Lok Sabha passes amendment in Bankruptcy code

IBC was introduced in 2016, with an aim to find a time-bound resolution on companies that have become insolvent and to protect the interest of creditors.

The much-awaited Insolvency & Bankruptcy Code (Amendment) Bill which will tighten norms on willful defaulters, was passed by Lok Sabha.

Amendment in IBC, excludes willful defaulters and existing promoters from bidding to purchase stressed asset of companies, which are under going insolvency proceedings.

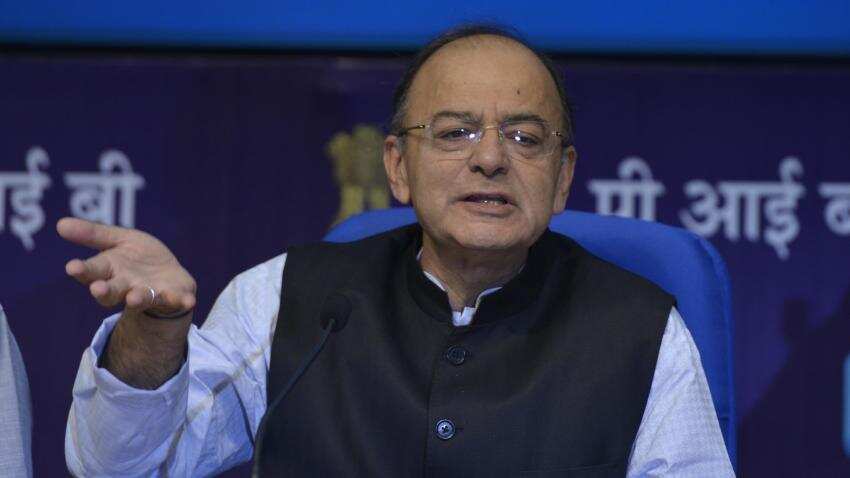

Union Finance Minister Arun Jaitley during the discussion on IBC, said, "The government cannot allow loan defaulters to merrily walk back by just paying a fraction of the amount due."

Responding to a question raised by Premachandran, Jaitley said, "The ordinance is necessary, because this act itself provides a 180 days time period in which a resolution is needed to be completed."

Jaitley said,"There are 12 cases referred by the Reserve Bank of India, but there are cases which either the promoters themselves have gone and presented a resolution plan. There are cases where creditors have filed application. So there are numerous cases pending and the law will be applied to all of them."

Sharing my response in the Lok Sabha with respect to discussions on the Insolvency and Bankruptcy Code (Amendment) Bill 2017, December 29, 2017 https://t.co/3hTR6wPaiF

— Arun Jaitley (@arunjaitley) December 29, 2017

He explained because the time period is 180 days, and above mentioned cases are resolution that are already at advanced stage. One-year experience shows, that an ineligibility criteria has to be introduced.

Need for IBC criteria, as per Jaitley was because there were promoters who have defaulted, some promoters have been declared insolvent, some promoters have been debarred by Sebi, some of them excluded under Companies Act, while some are willful defaulters.

Therefore, Jaitley said IBC was needed to ensure that defaulting promoters are not able to regain control of their companies after the resolution process, leaving only the creditors poorer.

IBC was introduced in 2016, with an aim to find a time-bound resolution on companies that have become insolvent and to protect the interest of creditors.

According to PRS Legislative Research, the Bill prohibits certain persons from submitting a resolution plan in case of defaults.

These include: (i) wilful defaulters, (ii) promoters or management of the company if it has an outstanding non-performing debt for over a year, and (iii) disqualified directors, among others.

Further, it bars the sale of property of a defaulter to such persons during liquidation. Click Here to get an overview of the entire IBC bill passed by Lok Sabha.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

02:18 PM IST

Govt may offer pre-pack insolvency resolution plan even for large corporates

Govt may offer pre-pack insolvency resolution plan even for large corporates Claims worth Rs 3.13 lakh cr under insolvency proceedings

Claims worth Rs 3.13 lakh cr under insolvency proceedings Looking at new growth opportunities in Indian economy: ICICI

Looking at new growth opportunities in Indian economy: ICICI Government should go slow on public sector bank mergers: Raghuram Rajan

Government should go slow on public sector bank mergers: Raghuram Rajan RBI might take up NPAs worth Rs 8 lakh crore for resolution by 2019: Assocham

RBI might take up NPAs worth Rs 8 lakh crore for resolution by 2019: Assocham