Late, but not too late! From Rallis India to Dhanuka Agritech, Monsoon makes these 5 stocks best bets on D-Street

The Monsoon has finally started with a bang especially in states like Maharashtra, Gujarat, Odisha and Uttar Pradesh and it has put in perspective certain stocks.

Yes, the monsoon has been late across India, however, some regions still waiting and hoping for the rain gods to be merciful. In the last couple of days, heavy rains in major states has played well in favor of a few stocks related to agrochemicals. As per data compiled by Skymet Weather, the southwest monsoon has now advanced into various parts of Gujarat, Rajasthan, Madhya Pradesh and Uttar Pradesh. Now, it is passing through the cities of Dwarka, Deesa, Udaipur, Kota, Gwalior, Shahjahanpur, Najibabad, and Mandi. India's financial hub Mumbai city has already crossed 500mm mark rains in last three days. With that, experts at Antique Stock Broking, after interaction with agrochemical dealers, mentioned that the late monsoon has pushed sales forward to Q2FY20, however, operating profit is now expected to improve.

Manish Mahawar, Himanshu Binani and Prateek Jain, analyst at Antique Stock Broking said, “Our interaction with agrochemical dealers and channel partners indicate that domestic industry is likely to grow at mid single digit YoY in 1QFY20 as sales have been pushed forward to Q2 on account of slower start of the monsoons. However, EBITDA margin is likely to improve led by a) price hikes taken in the recent past coupled with b) lower base effect.”

During 1QFY20, subpar performance of agrochemicals industry, as per the trio will be led by 1) delayed start to south west monsoons leading to delay in sowing by 10-15days 2) adverse climatic situations like drought in Maharashtra and some southern states impacting crop area 3) low agro-commodity prices.

However, the trio also added, good rainfall in the last couple of days on a pan India basis has narrowed down the gap. Several weather forecasting agencies expect good rainfall in the remaining period for the month.

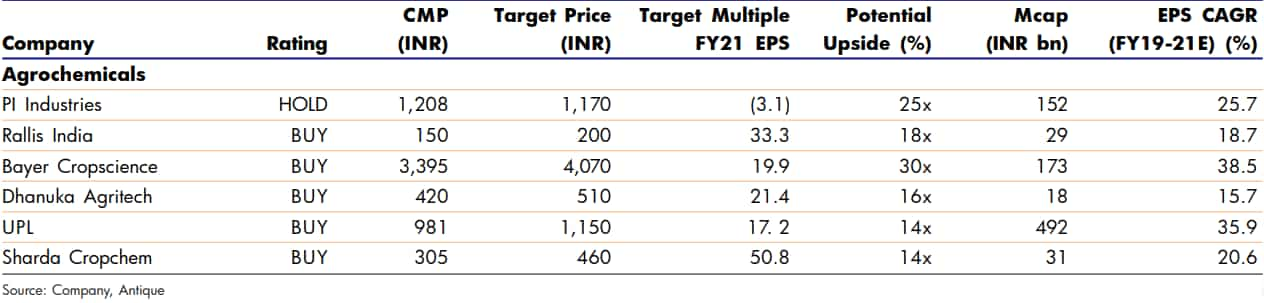

These stocks are best pick during monsoon on Dalal Street:

According to Antique’s analyst, “We expect agrochemical sector revenue growth of 8.6% YoY in 1QFY20 primarily driven by superior exports.”

The trio says, “We believe that export focused players like PI Industries, UPL, Sharda Cropchem are likely to report better growth as compared to the pure domestic focused players like Dhanuka Agritech, Bayer Cropscience and Rallis India.

We expect EBITDA to grow 10.4% YoY (up 30bps YoY) primarily led by superior margin improvement of Dhanuka agritech (up 220bps YoY led by several one-off related items), Rallis India (up 270 bps YoY led by better operating leverage) and Sharda crop chem (up 200 bps YoY on account of unfavorable currency impact in the base quarter).

Bayer Crop is likely to witness a 300 bps YoY contraction in margins due to better gross margins (up 400 bps YoY) in the base year due to favorable change in product mix.”

During next 48-72 hours, Skymet states that, the persisting Well Marked Low will move west-northwestward and will result in Monsoon’s advancement over the leftover regions of Gujarat, Madhya Pradesh, more areas of Rajasthan, Himachal Pradesh, Jammu and Kashmir, rest of Uttar Pradesh, Uttarakhand and some parts of Haryana, Chandigarh and Delhi.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

09:56 PM IST

146 roads blocked in Himachal amid heavy rains, Met sounds yellow alert

146 roads blocked in Himachal amid heavy rains, Met sounds yellow alert West Bengal Rainfall Forecast: IMD predicts heavy downpour in sub-Himalayan districts

West Bengal Rainfall Forecast: IMD predicts heavy downpour in sub-Himalayan districts  Rajasthan Rains Update: Heavy showers recorded in Tonk, Pali, Bundi, Bhilwar districts; see latest IMD data

Rajasthan Rains Update: Heavy showers recorded in Tonk, Pali, Bundi, Bhilwar districts; see latest IMD data Weather Update: Weather office IMD forecasts heavy rains in parts of Andhra Pradesh for three days

Weather Update: Weather office IMD forecasts heavy rains in parts of Andhra Pradesh for three days  Heavy rains continue to batter Kerala

Heavy rains continue to batter Kerala