Key things Modi pointed out on 1-year of demonetisation

About 6,857.82 million notes of Rs 1000 and 17,165.06 million notes of Rs 500 valuing separately Rs 685,782 crore and Rs 858,253 crore respectively were scrapped

November 08,2017, comes as a very special day for Prime Minister Narendra Modi and his government has it marks the one year anniversary of their most controversial move namely Demonetisation or commonly known as notebandi.

Modi in an unscheduled live televised address at 20:00 pm on November 08, 2016 mentioned that we have decided that the five hundred rupee and thousand rupee currency notes presently in use will no longer be a legal tender from midnight tonight. The Rs 500 and Rs 1000 notes hoarded by anti-national and anti-social elements will become just worthless pieces of paper.

About 6,857.82 million notes of Rs 1000 and 17,165.06 million notes of Rs 500 valuing separately Rs 685,782 crore and Rs 858,253 crore respectively were scrapped - which means 86% of India's currency in chest.

Finance Minister Arun Jaitley supporting PM's move have been very vocal about the main objective of demonetisation.

They were to flush out blackmoney, eliminate Fake Indian Currency Notes (FICN), to strike at the root of financing of terrorism and left wing extremism, to convert non-formal economy into a formal economy to expand tax base and employment and to give a big boost to digitalisation of payments to make India a less cash economy.

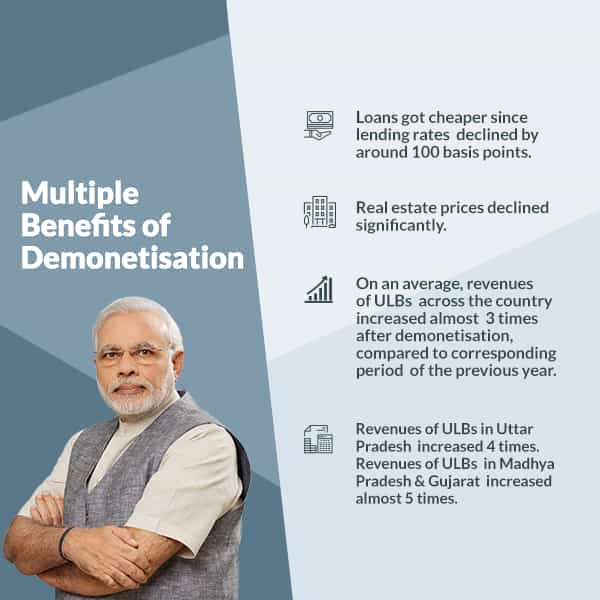

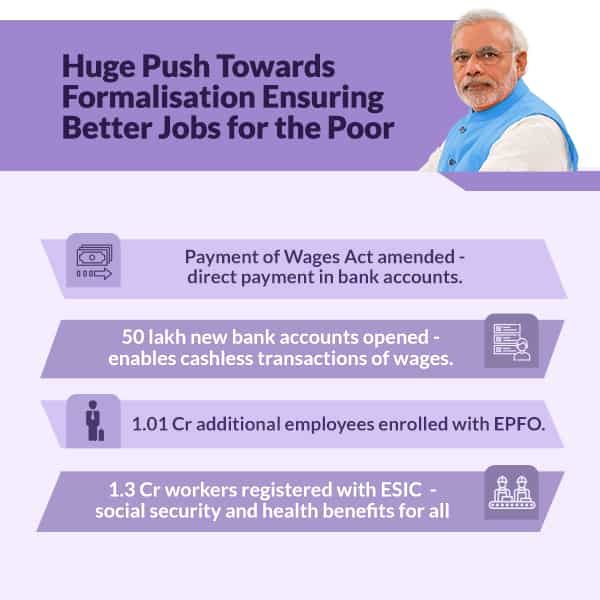

Now that one-year of demonetisation has commenced, Modi on Wednesday went on explaining mutliple benefits of this move in the form of infographics.

Digital Payments:

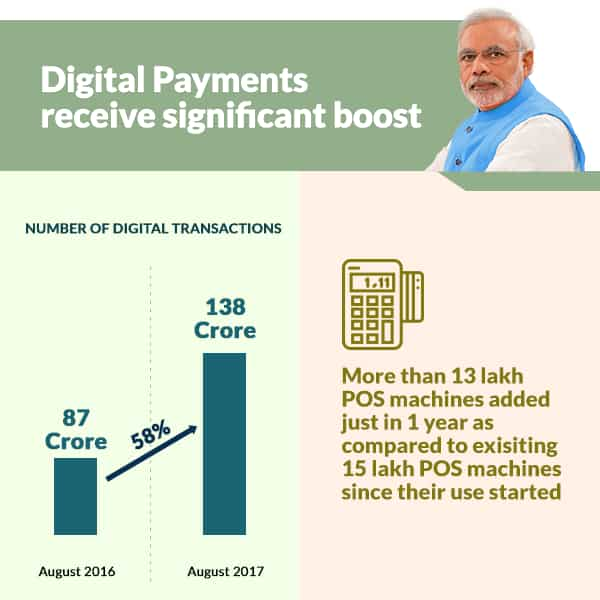

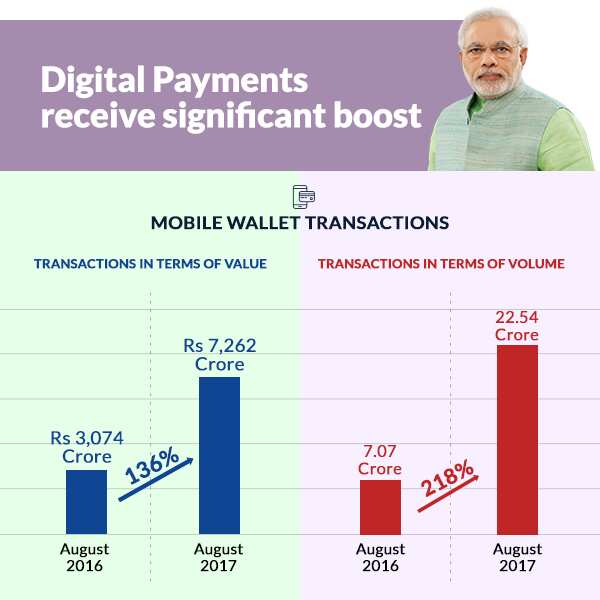

According to Modi's data, digital transaction through mobile wallets, IMPS, debit card and many more saw significant rise in their performance.

Number of digital transaction have risen by 58% to 138 crore by end of August 2017 - compared to 87 crore recorded in the same month of the previous year.

He highlighted that more than 13 lakh POS machine were added in just one-year as compared to existing 15 lakh POS machines since their use started.

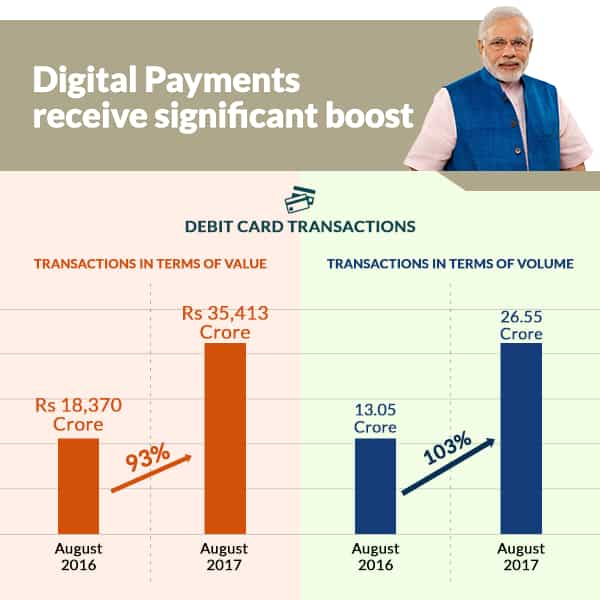

With this debit transaction saw a whopping increase of 103% to 26.55 crore in volume terms by August 2017 versus 13.05 crore volume in August 2016. In value terms, Debit card transaction increased by 93% to Rs 35,413 crore by end of August 2017 compared to Rs 18,370 crore in August 2016.

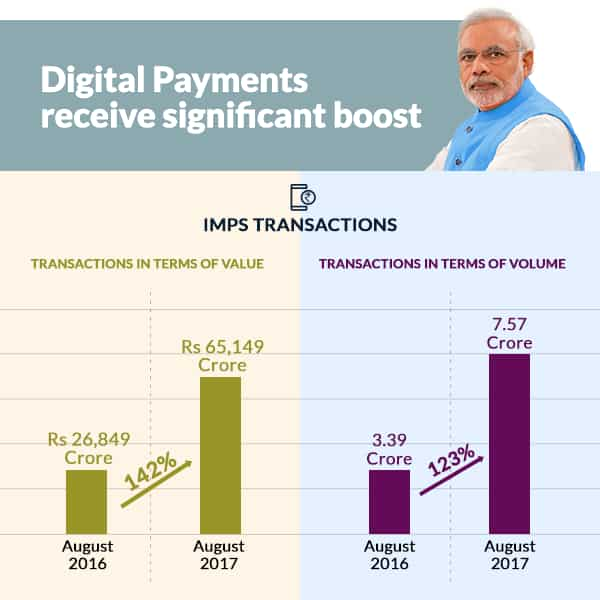

IMPS transaction also saw massive rise to Rs 65,149 crore during this one year - an uptick of 142% from Rs 26,849 crore before demonetisation. In volume terms, this portal saw 123% rise to 7.57 crore post noteban as against 3.39 crore before it was inked.

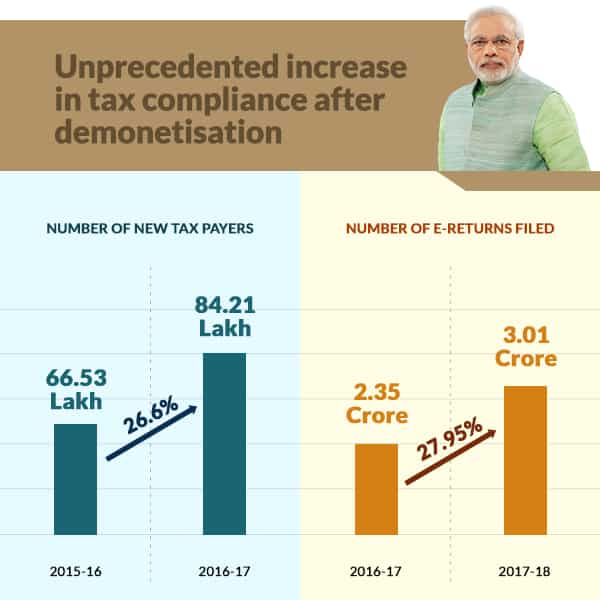

Increase in tax compliance:

By end of FY17 - 84.21 lakh new tax payers entered - which would be 26.6% higher compared to 66.53 lakh tax payers in the previous fiscal. Also e-returned file saw surge of 27.95% to 3.01 crore so far in FY18 compared to 2.35 crore in FY17.

Financial System:

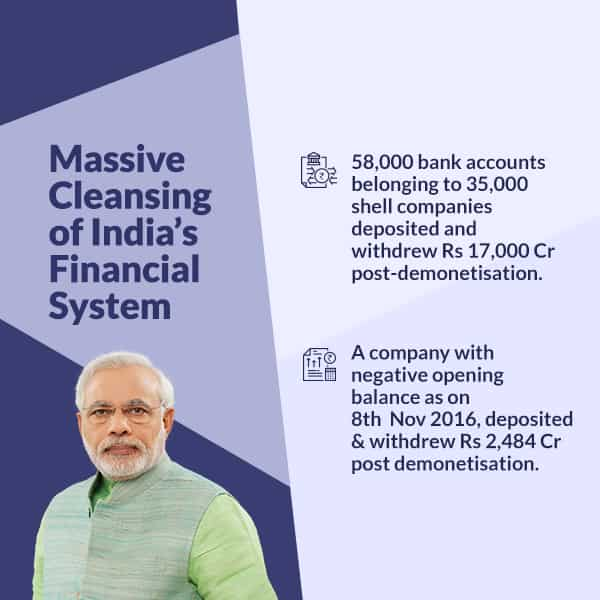

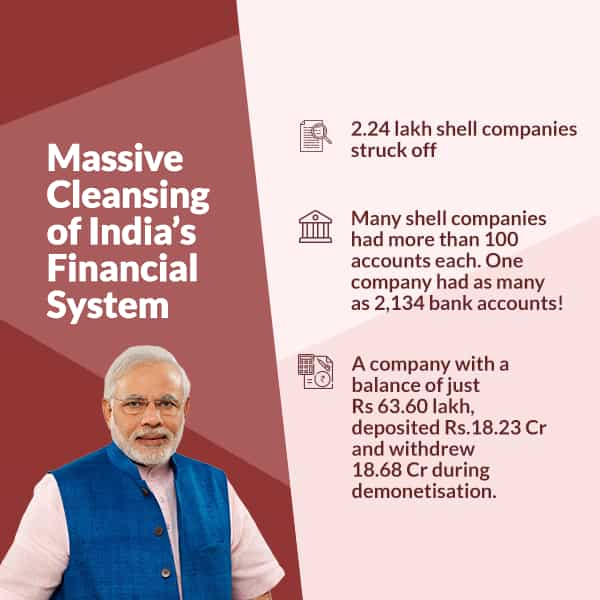

After demonetisation, there have been massive cleaning of shell companies.

58,000 bank accounts belonged to 35,000 shell companies who deposited and withdrew Rs 17,000 crore post demonetisation. One company who had negative balance as on November 08, 2016 - deposited and withdrew about Rs 2,484 crore post noteban.

Unearthing of black money:

Modi highlighted that 0.00011% of India's population deposited almost 33% of total cash in India. Estimated value of banned notes were approximately Rs 12 lakh crore as on September 2017.

He stated without demonetisation the values of high denomination would have been around Rs 18 crore presently. Modi added thus, the high denomination notes have been effectively brought down by about 6 lakh crore - which is 50% of the currency value of denomination in circulation.

Other key things acknowledged by Modi-government were:

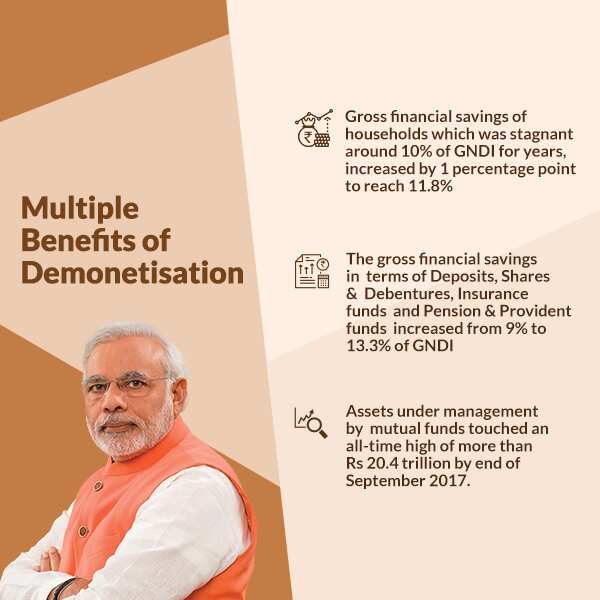

Gross financial savings of households which was stagnant around 10% of GNDI for years - increased by 1% point to reach 11.8%.

Gross financial savings in terms of deposits, shares of debentures, insurance funds and pension & provident funds increased from 9% to 13.3% of GNDI.

Asset under management by mutual funds touched an all-time high of more than Rs 20.4 lakh crore by end of September 2017.

Loans got cheaper since lending rates declined by aruond 100 basis points.

Huge push has also been given towards ensuring better jobs for the poor post demonetisation.

Jaitley on November 07, said, "It would not be wrong to say that country has moved on to a much cleaner, transparent and honest financial system. Benefits of these may not yet be visible to some people. The next generation will view post November, 2016 national economic development with a great sense of pride as it has provided them a fair and honest system to live in."

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

02:09 PM IST

Rs 7,755 crore worth of withdrawn Rs 2,000 banknotes still in circulation

Rs 7,755 crore worth of withdrawn Rs 2,000 banknotes still in circulation 2,000-rupee note: A barrage of memes on social media as RBI presses 'exit' on 2,000 currency bill

2,000-rupee note: A barrage of memes on social media as RBI presses 'exit' on 2,000 currency bill Bye bye, Rs 2,000 banknote! 10 things to know about the bill that has been in circulation for 6 years

Bye bye, Rs 2,000 banknote! 10 things to know about the bill that has been in circulation for 6 years Finance Minister Nirmala Sitharaman says govt hasn't stopped banks from filling Rs 2000 notes in ATMs

Finance Minister Nirmala Sitharaman says govt hasn't stopped banks from filling Rs 2000 notes in ATMs Demonetisation in India: Timeline

Demonetisation in India: Timeline