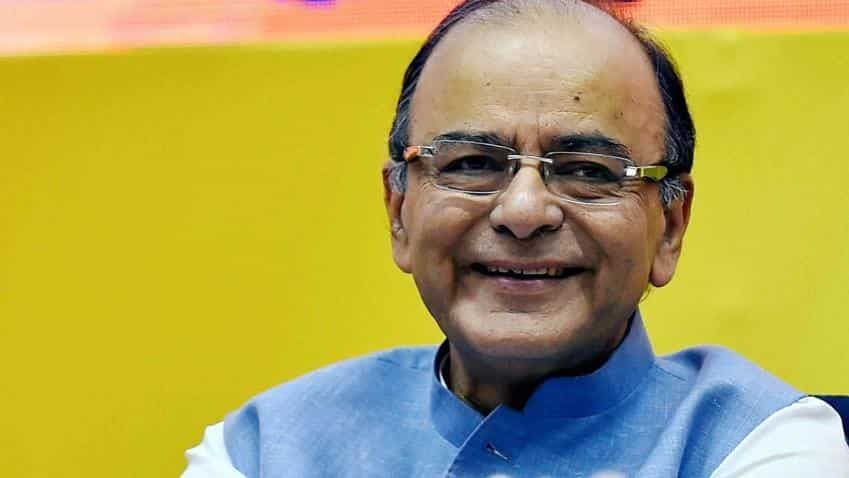

Jaitley to address BRICS seminar on corporate bond market tomorrow

Eyeing deepening of corporate bond market in India, Finance Minister Arun Jaitley will tomorrow address a session on ways to develop it and possibilities of sharing the best practices followed by BRICS countries.

Jaitley will deliver the valedictory address at the one day BRICS Seminar on 'Challenges in Developing the Bond market in BRICS' in Mumbai tomorrow, a finance ministry statement said.

"The seminar will provide a platform to share the best practices from BRICS countries and also explore the global best practices which may be adopted to develop this market," the statement added.

The seminar will be attended by Sebi Chairman U K Sinha, RBI Deputy Governor R Gandhi, Economic Affairs Secretary Shaktikanta Das and experts from BRICS nations, multilateral organisations, financial institutions and the corporate sector.

The BRICS (Brazil, Russia, India, China, South Africa) summit will be held in Goa between October 15-16 and as a lead-up to that, India has initiated a number of events.

Building Responsive, Inclusive and Collective Solutions is the core theme for the BRICS Chairmanship with a special focus on institution-building, implementing past commitments, and exploring innovative solutions in a spirit of continuity with consolidation, the statement said.

"A key agenda is to foster cooperation among BRICS in the development of financial markets. One of the areas which have been identified as a priority is the development of bond markets. The need to develop robust domestic bond markets has been increasingly felt the world over post the global financial crisis," it added.

A deep and vibrant bond market provides governments and corporates with an alternative and cost-effective source of debt funding which is vital for economic growth and stability.

Against this backdrop, DEA is organising this one-day seminar in collaboration with industry chamber CII.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

01:36 PM IST

Govt keen on amalgamation of PSBs to create globally competitive, healthy large banks, says Arun Jaitley

Govt keen on amalgamation of PSBs to create globally competitive, healthy large banks, says Arun Jaitley 'Satyameva Jayate, the truth shall prevail' - Arun Jaitley tweets after CAG report on Rafale deal

'Satyameva Jayate, the truth shall prevail' - Arun Jaitley tweets after CAG report on Rafale deal Budget 2019 speech date, time, major expectations: All you need to know

Budget 2019 speech date, time, major expectations: All you need to know Budget 2019: Real Estate sector expects single window clearance, GST cut on under-construction projects

Budget 2019: Real Estate sector expects single window clearance, GST cut on under-construction projects Upper caste quota will not breach 50 per cent SC cap: Arun Jaitley

Upper caste quota will not breach 50 per cent SC cap: Arun Jaitley