11 lakh PANs deactivated: Is your PAN active? Here's how you can find it

PAN which is a key identifier of taxable entity and aggregator of all financial transactions are being detected by the IT-department.

Key Highlights;

- 11,44,211 PANs identified and de-activated in cases where there multiple PANs

- 1,566 PANs were detected because they were 'Fake'

- Aadhaar has become mandatory at the time of application of PAN

Over 11 lakh permanent account numbers (PAN) were deactivated by Income Tax Department because they were found to be fake or duplicate.

According to Santosh Kumar Gangwar, Minister of State for Finance, as on July 27, 2017, a total of 11,44,211 PANs identified and deleted or de-activated in cases where multiple PANs were found allotted to one person.

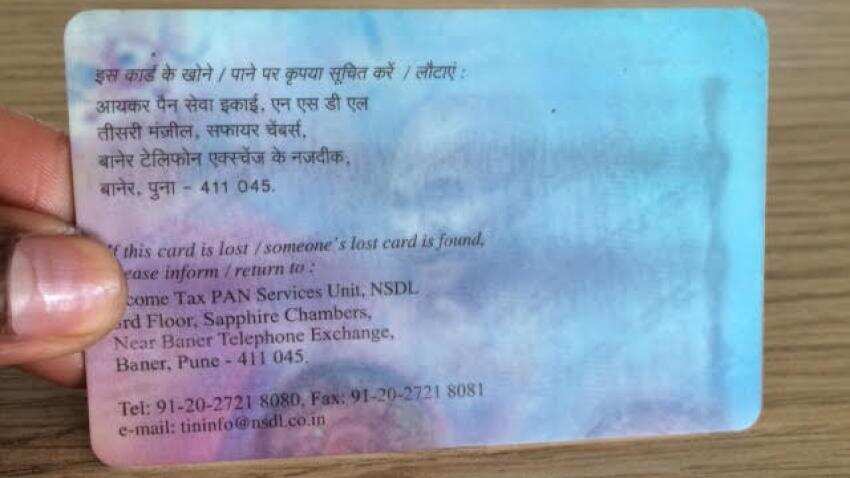

Permanent Account Number (PAN) is the key identifier of taxable entity and aggregator of all financial transactions undertaken by one person.

Gangwar, in a written reply to a question in Rajya Sabha said, “In this regard, the PAN service provider carries out onsite verification of PAN applications to verify identity and addresses of the applicant and share the report of such verification to the concerned Assessing Officer. On receipt of such report the assessing officer also conducts enquires and mark the PAN as "Fake".”

Check PAN online

First, log into the income tax India website https://incometaxindiaefiling.gov.in.

On the left panel, find a tab called “Know Your PAN”.

Fill in your personal information like name, status, gender, date of birth and mobile number.

You will get a One Time Password (OTP) on your registered mobile umber. Fill in the OTP and just click on the validate button.

If your PAN card is valid – the site will show as “Active”.

In case if there are multiple PAN numbers with similar details – an alert page will appear saying “There are multiple records for this query. Please provide additional information”asking in more details.

If information of allotment of more than one PAN is received, the facility to delete or de-activate the PAN is available with the Assessing Officer through application software.

Between 2004 - 2007, an exercise for de-duplication of PAN was conducted in the IT-department to identify probable duplicate PANs, which were consequently deleted or de-activated by the concerned assessing officers after examinations.

The process of detecting and deleting the PAN card took place right after when the Government of India has made the 12-digit biometric Aadhaar or the enrolment ID a must source at the time of application of PAN.

Aadhaar has become mandatory for applying a new PAN card from July 01, 2017.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

05:02 PM IST

ITR filing: Keep these 4 documents safe if you want tax exemption on HRA; check details

ITR filing: Keep these 4 documents safe if you want tax exemption on HRA; check details Rule Changes from April 1, 2024: NPS, SBI debit cards, FASTag - Get all the details here

Rule Changes from April 1, 2024: NPS, SBI debit cards, FASTag - Get all the details here Explained: What does a Permanent Account Number (PAN) tell about an individual?

Explained: What does a Permanent Account Number (PAN) tell about an individual? PAN-Aadhaar linking: What tax authorities' latest clarification means for you & how to use e-pay tax tab

PAN-Aadhaar linking: What tax authorities' latest clarification means for you & how to use e-pay tax tab TODAY IS LAST DAY to link PAN with Aadhaar; here's a step-by-step guide to do it online

TODAY IS LAST DAY to link PAN with Aadhaar; here's a step-by-step guide to do it online