Inflation may overshoot RBI's target for FY18: Experts

Surge in inflation was led by a sharp rise in vegetables inflation, which shot up to a four-year high of 22.5% in Nov’2017 from 7.5% in the preceding month.

India's consumer price index (CPI) which reached at 15-month high indicates that inflation may overshoot the RBI's target for the second half of FY18.

CPI inflation stood at 4.88% in the month of November 2017, up from 3.58% in October 2017, and 3.63% in the same month of the previous year.

source: tradingeconomics.com

Market experts anticipated CPI to be around 4.3% for this month.

Aditi Nayar, principal Economist at ICRA, on November inflation data said, "The uptick in the CPI inflation to a 15-month high in November 2017, was significantly sharper than expected, validating the caution displayed by the Monetary Policy Committee in its recent reviews."

Surge in inflation was led by a sharp rise in vegetables inflation, which shot up to a four-year high of 22.5% in Nov’2017 from 7.5% in the preceding month.

Vegetables contributed 90 basis point to the month-on-month (MoM) rise in the headline inflation number.

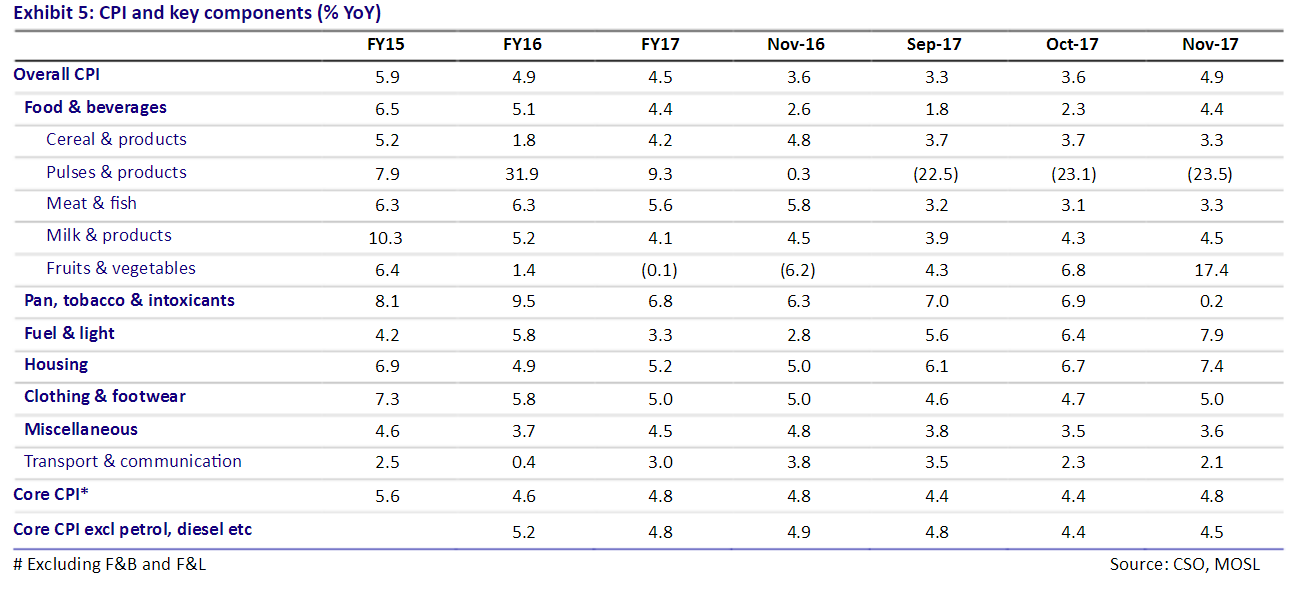

Analysts at Motilal Oswal stated that excluding vegetables, headline inflation stood much lower at 3.6% compared to preceding months.

Food inflation also rose sharply to 4.4% YoY in Nov’2017 (15-month high) from 1.9% in the previous month.

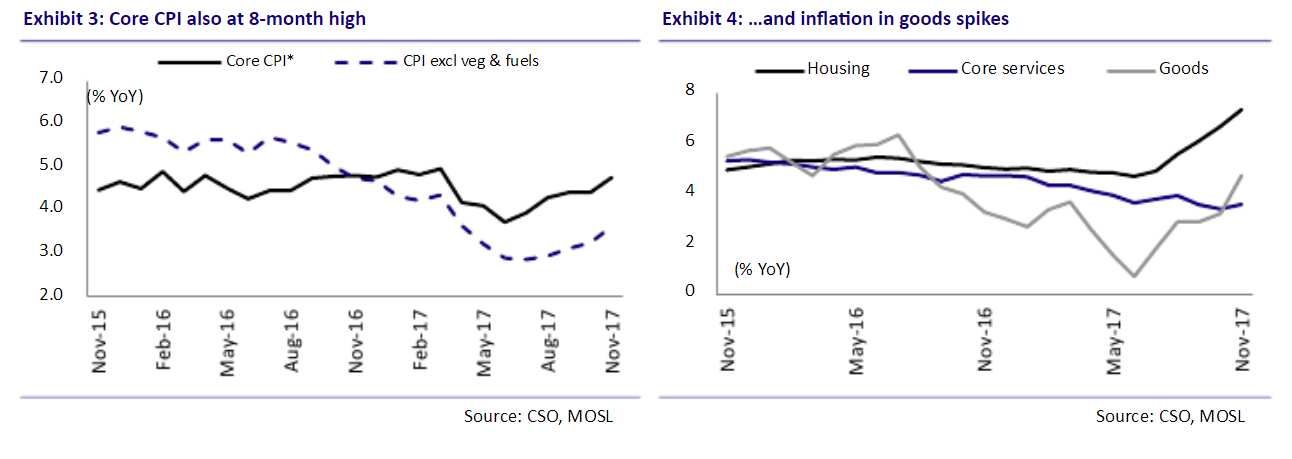

Core inflation (all items excluding ‘food & beverages’ and ‘fuel & light’) rose to an 8-month high of 4.8% in Nov’2017 from 4.4% in October. The core-core inflation (excluding petrol/diesel from core inflation) increased to 4.9% from 4.5% in the previous month.

Motilal report said, “A rise in housing inflation (on account of implementation of 7th CPC House Rent Allowance hikes from August) has led to the pick-up in core inflation over the last four months.”

Dr Soumya Kanti Ghosh, Group Chief Economic Adviser at State Bank of India, however said, "We observed that inflation in Southern states is higher than other parts of the country. This is mainly due to higher rural inflation over urban inflation.”

The SBI expects CPI inflation to breach the 5% mark in the upcoming months of this fiscal.

Dhananjay Sinha and Kruti Shah, analysts at Emkay, said “We expect CPI to increase to 5.2% yoy on an average in Q4FY18 which is much above RBI’s target of 4%.”

As per RBI committee, first, moderation in inflation excluding food and fuel observed in Q1 of 2017-18 has, by and large, reversed. There is a risk that this upward trajectory may continue in the near-term.

RBI said, "The impact of HRA by the Central government is expected to peak in December. The staggered impact of HRA increases by various state governments may push up housing inflation further in 2018, with attendant second order effects."

"Despite recent increase in prices of vegetables, some seasonal moderation is expected in near months as winter arrivals kick in. Prices of pulses have continued to show a downward bias," it added.

RBI expects inflation to range between 4.3-4.7% in Q3 and Q4 of this year, including the HRA effect of up to 35 basis points, with risks evenly balanced.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

07:38 PM IST

India's CPI inflation to ease to 4.7-4.8% in FY25, driven by lower food prices: Report

India's CPI inflation to ease to 4.7-4.8% in FY25, driven by lower food prices: Report CPI inflation worsens to 3.65% in August from 3.03% in previous month

CPI inflation worsens to 3.65% in August from 3.03% in previous month  Telcos' tariff hikes to push up core inflation by 0.2% in FY25: Report

Telcos' tariff hikes to push up core inflation by 0.2% in FY25: Report Consumer inflation at 5.09% in February vs 5.10% in previous month

Consumer inflation at 5.09% in February vs 5.10% in previous month Consumer inflation eases to three-month low of 5.10% in January

Consumer inflation eases to three-month low of 5.10% in January