India's revenue collection jumps 34% in FY 2021-22 over previous year: Ministry of Finance

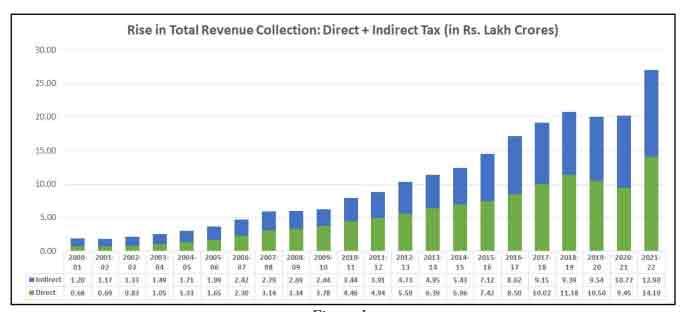

India's tax revenues witnessed a jump of 34% in FY 2021-22 as compared to the previous year.

India's tax revenues witnessed a jump of 34% in FY 2021-22 as compared to the previous year. At Rs 27 Lakh crore this is a record tax collection in a post-pandemic economy, said the Ministry of Finance in a statement.

This figure is almost Rs. 5 lakh crore above the estimates of the Union Budget 2021-22, which stood at Rs. 22.17 lakh crore. This marks a growth of 34% over last year’s revenue collection of Rs. 20.27 lakh crore, led by growth of 49% in direct taxes and supported by 20% growth in indirect taxes.

See Zee Business Live TV Streaming Below:

"As a remarkable testimony to the rapid recovery of the Indian economy following successive waves of COVID-19, India reported revenue collections of Rs. 27.07 lakh crore (as per the pre-actual figures) in the financial year 2021-22. This figure is almost Rs. 5 lakh crore above the estimates of the Union Budget 2021-22," said the Ministry in a statement.

Source: Ministry of Finance

As per the ministry, the major factors which gave a boost to India's revenue collection in FY 2021-22 were due to slew of measures taken by the Prime Minster Narendra Modi led government, such as ease of filing ITR, faceless e-assessment, new AIS & GST reforms boosting compliance & fuelling tax Collection.

There was a decrease in tax collection in 2019-20 and 2020-21 due to the disruption in economic activity in wake of COVID, but the rise in tax collection in the financial year 2021-22 is evidence of a sharp rebound and an economy that is back on track.

The surge in tax revenues has lifted India’s tax-GDP ratio for the year 2021-22 to 11.7%. This includes a direct tax to GDP ratio at 6.1% and indirect tax to GDP ratio at 5.6%.

This significant revenue growth has been propelled by robust economic recovery following the onslaught of the global pandemic, supported by one of the largest immunization programme of the world run by the Government. This was also supplemented with better compliance efforts in taxation.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

07:37 AM IST

India to become 3rd largest economy within next few years: CII President Sanjiv Puri

India to become 3rd largest economy within next few years: CII President Sanjiv Puri Outlook for Indian economy appears bright, but need to keep a watch on global headwinds: FinMin report

Outlook for Indian economy appears bright, but need to keep a watch on global headwinds: FinMin report  Global financial crisis in 2008 wasn't as serious as COVID-19, UPA govt should have handled with sincerity: FM Nirmala Sitharaman

Global financial crisis in 2008 wasn't as serious as COVID-19, UPA govt should have handled with sincerity: FM Nirmala Sitharaman India to become third largest economy in my third term, guarantees PM

India to become third largest economy in my third term, guarantees PM India's economy to grow at 6.8% in current fiscal: CII

India's economy to grow at 6.8% in current fiscal: CII