Indian Ultra High Net Worth Individuals expected to increase investment allocation in Gold in 2019: Knight Frank Report

According to Attitude Survey conducted by Knight Frank, 14% of Indian Ultra High Net Worth Individuals (UHNWIs) are likely to increase their investment to the Gold asset class in 2019, 3% higher compared to the year 2018.

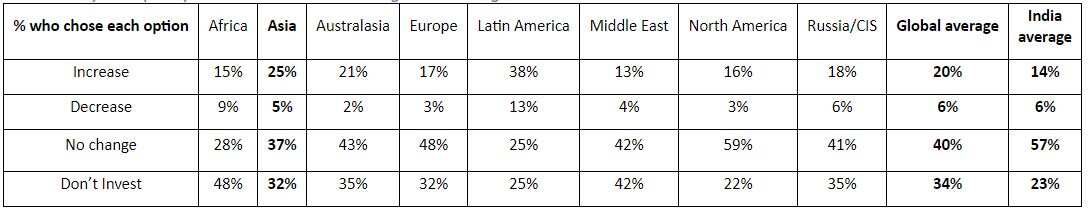

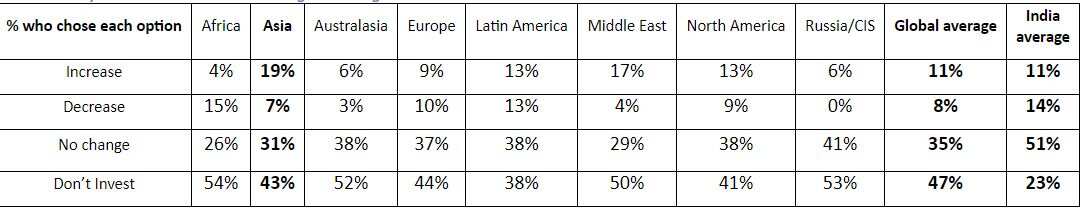

According to Attitude Survey conducted by Knight Frank, 14% of Indian Ultra High Net Worth Individuals (UHNWIs) are likely to increase their investment to the Gold asset class in 2019, 3% higher compared to the year 2018. Globally, 20% of survey respondents said that they are going to increase allocation to Gold in 2019, a higher percentage when compared with 11% citing to have increased allocation in 2018. The positive attitude of UHNWIs towards investments in the asset class has also gone up in Asia with 25% expecting an increase when compared to 19% who cited an increase in allocation in 2019. Knight Frank conducted the survey to map the investment sentiment of UHNWIs towards Gold as an asset class in 2019.

Globally, bullion led by gold has always been considered a safe investment and in countries with a cultural affinity towards the yellow metal, we are seeing a renewal of interest in remaining investment in this asset class. Like all investments gold also witnesses volatility but has remained largely stable with an upward bias for long periods of time. While India is one of the largest consumers of gold, it has usually been in the form of ornaments for retail purpose. However, in recent times, we have seen investors purchase gold and bonds and expect the trend to grow further. With the optimistic outlook towards investments in the asset class, on the auspicious occasion of Akshaya Tritiya, we expect a number ultra-rich in India to purchase gold both for investment and consumption purpose,” says Shishir Baijal, Chairman & Managing Director, Knight Frank India.

Q. On average, what proportion of your clients' investment portfolios is allocated to Gold?

Q. How do you expect your clients' allocation to gold to change in 2019?

Key Inferences of the Attitude Survey:

1. Asset allocation to Gold: Indian UHNWIs have a higher allocation towards Gold in their investment portfolio (4%) than the global average (2%) and Asia average (3%)

2. Expected change in allocation to Gold in 2019: 14% of Indian UHNWIs are expected to increase their allocation (11% in 2018)

3. With 55% UHNWIs from China citing to increase their Gold allocation this year (45% in 2018); the country has been a major influence in improving the global and Asia averages

4. Globally, 20% UHNWIs are expected to increase their allocation (11% in 2018). In Asia, 25% UHNWIs are expected to increase their allocation (19% in 2018)

Q. How did your clients' allocation to goldchange in 2018?

The positive attitude of UHNWIs towards investments in the asset class has also gone up in Asia with 25% expecting an increase when compared to 19% who cited an increase in allocation in 2019. Knight Frank conducted the survey to map the investment sentiment of UHNWIs towards Gold as an asset class in 2019.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Dearness Allowance (DA) Calculations: Is your basic monthly salary Rs 25,500, Rs 35,400, or Rs 53,100? Know how much DA will you get at different rates

Power of Compounding: How long it will take to build Rs 8 crore corpus with Rs 7,000, Rs 11,000 and Rs 16,000 monthly investments

Income Tax Calculations: What will be your tax liability if your salary is Rs 8 lakh, Rs 14 lakh, Rs 20 lakh, and Rs 26 lakh?

Monthly Pension Calculations: Is your basic pension Rs 25,000, Rs 35,000, or Rs 50,000? Know what can be your total pension as per latest DR rates

Fixed Deposit Rates for 1 Lakh Investment: Compare SBI, PNB, HDFC, ICICI, and Post Office 3-year FD returns

07:20 PM IST

Instruments wherein High Net Worth Individuals (HNIs) and Ultra HNIs want to park their money - Expert reveals

Instruments wherein High Net Worth Individuals (HNIs) and Ultra HNIs want to park their money - Expert reveals 28% Indian ultra high net worth individuals expect wealth creation will be easy in 2019: Survey

28% Indian ultra high net worth individuals expect wealth creation will be easy in 2019: Survey  Mumbai ranks 21st in the ‘City Wealth Index’ ahead of Toronto, Washington DC, Moscow

Mumbai ranks 21st in the ‘City Wealth Index’ ahead of Toronto, Washington DC, Moscow