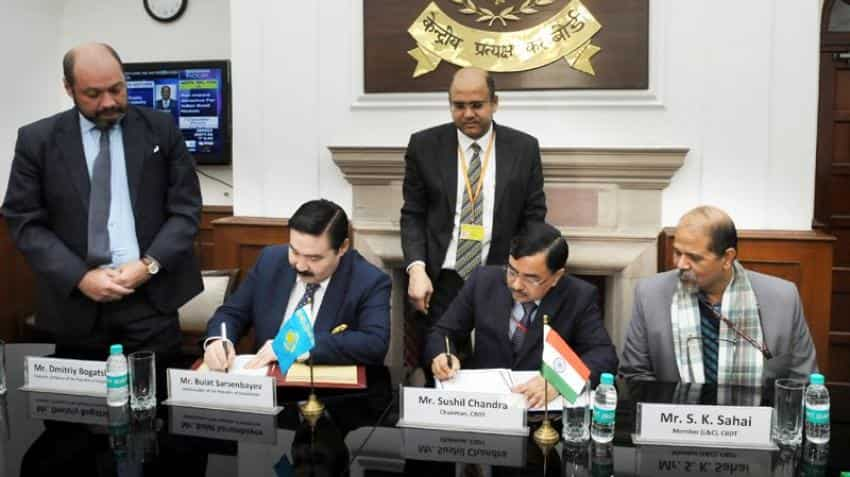

India, Kazakhstan sign an agreement to amend old bilateral tax treaty

India and Kazakhstan on Friday signed an agreement to amend the two-decade old bilateral tax treaty under which information exchanged between the two can be shared with other law enforcement agencies.

The protocol to amend the existing Double Taxation Avoidance Convention (DTAC) between the two countries provides internationally-accepted standards for effective exchange of information on tax matters, an official statement said.

ALSO READ: Tax treaties India signed in 2016 to curb black money

"The information received from Kazakhstan for tax purposes can be shared with other law enforcement agencies with authorisation of the competent authority of Kazakhstan and vice versa," it added.

The initial DTAC between India and Kazakhstan was signed on December 9, 1996, for avoidance of double taxation and prevention of evasion with respect to taxes on income.

The revised tax treaty will provide for a Limitation of Benefits clause to prevent misuse of DTAC. It would help allow application of domestic law and measures against tax avoidance or evasion.

The protocol inserts specific provisions to facilitate easing of economic double taxation in transfer pricing cases.

"This is a taxpayer-friendly measure and is in line with India's commitment under the Base Erosion and Profit Shifting (BEPS) Action Plan to meet the minimum standard of providing Mutual Agreement Procedure (MAP) access in transfer pricing cases," the statement read.

The protocol also includes service permanent establishment (PE) provisions with a threshold and also provides that the profits to be attributed to PE will be determined on the basis of apportionment of total profits of the enterprise.

ALSO READ: Here are 6 benefits of India-Cyprus double taxation treaty

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

02:40 PM IST

India-Cyprus double taxation treaty: What is Grandfather clause?

India-Cyprus double taxation treaty: What is Grandfather clause? India-Singapore Tax Treaty: 'Reasonable burial' to black money route, says FM Arun Jaitley

India-Singapore Tax Treaty: 'Reasonable burial' to black money route, says FM Arun Jaitley  India to tax capital gains of Singapore investors in amended treaty

India to tax capital gains of Singapore investors in amended treaty Six key things to know about India-Mauritius tax treaty

Six key things to know about India-Mauritius tax treaty Here are 6 benefits of India-Cyprus double taxation treaty

Here are 6 benefits of India-Cyprus double taxation treaty