India GDP: IMF's forecast not surprising; problems way beyond demonetisation, GST

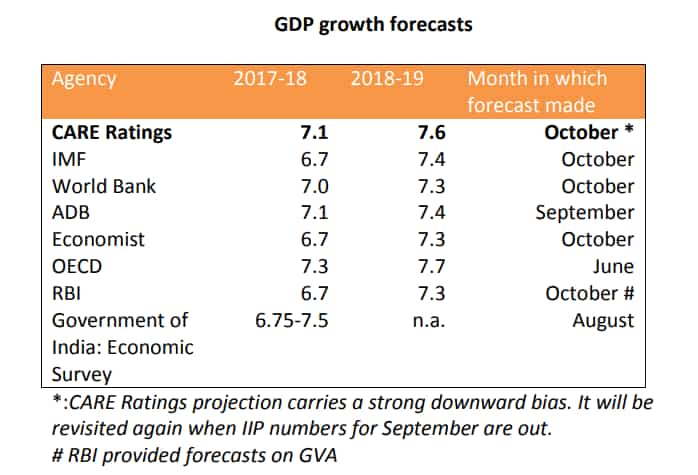

IMF and many economists have forecasted India's GDP growth to range between 6.5% to below 7% for fiscal year 2017-18 (FY18)

After posting three-year low GDP numbers, India has been losing its rank as the fastest growing economy. IMF would be the latest one to slash the country's growth project by 0.5% to 6.7% for 2017-18.

This is slower than the forecast for China which is seen growing at 6.8%.

Aditi Nayar, Senior Economist, ICRA, "IMF reduction in growth forecast does not comes as a surprise, after looking at the Q1FY18 GDP numbers many agencies have cut their growth forecast."

Nayar added even RBI has reduced its GVA forecast and there were many international agencies who have followed the same in past two weeks.

IMF argued that while it expects overall growth in the global economy to recover in 2017, there would be downward pressure exercised by slower growth in USA, UK and India.

IMF, in World Bank's economic outlook report, said,"In India, growth momentum slowed, reflecting the lingering impact of the authorities' currency exchange initiative as well as uncertainty related to the midyear introduction of the country-wide Goods and Services Tax.”

Few reasons as per Nayar were - Q1 numbers which came in below market expectation, issues related to GST transition surpassed expectation in terms of hampering the economy. She said, “GST transitions are not yet sorted out and we are hopeful that last weeks GST council meet - might bring some relief for industries and defence.”

As per Care Ratings, demonetisation move, which was announced on November 08, 2016, affected both demand and supply.

GDP numbers has been slowing down since the start of last fiscal year (FY17). GDP which stood at 9.2% in March 2016 reached to 7.9% in June 2016, 7.5% in September 2016 and 7% by December 2016. This was way before demonetisation and GST flavored out their affect.

This would mean that Indian economy was already slowing down despite GST transition and demonetisation which are only periodical.

Nirmal Bang in its report said, “We expect a strong pick-up in activity in 2HFY18 as the shocks of demonetisation and GST fade away slowly."

Sure these impact will fade away but deeper problems like subdued private investment in India, lower rate of growth in government spending, slowdown in consumption spending and corporate debt overhang which has been hanging in India since past few quarters continue to remain.

Investment recovery hope which was expected to revive in second half of FY18 now shows different picture and growth is unlikely this fiscal.

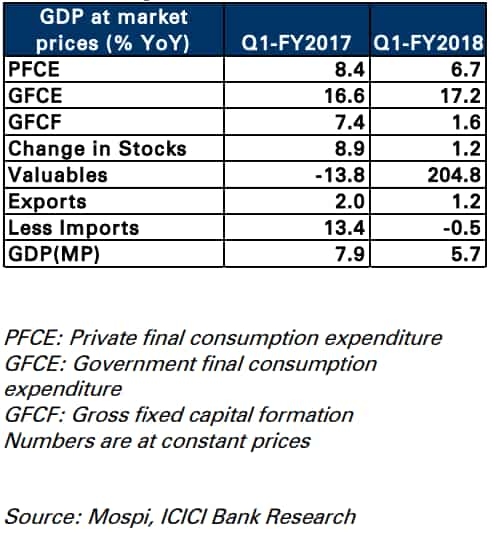

Private Consumption constitutes about 54% of GDP and grew by 7%. Last year for the same quarter, consumption grew at 8%. While governments final consumption expenditure just grew by 0.6% to 17.2% in Q1FY18 versus 16.6% in Q1FY17.

Investment accounts for about 30% of GDP down from 31%. Investment grew by only 1.6% in Q1 FY18 as against 7.4% last year.

Edelweiss added, “GDP growth cannot be sustainable without pickup in investment. As advanced economies begin to expand, global trade cycle picks up, investment demand should kick in. Exports have been growing although the pace has slowed due to strong currency.”

A recent report of India Ratings also mentioned that private sector capital expenditure is likely to grow by Rs 1 lakh crore between FY18 – FY20 due to weak domestic consumption demand, global overcapacity and also negative impact while shifting to GST transmission on working capital.

Analysts at Ind-Ra said, “Although capex by both private and public sector entities, primarily on maintenance, will marginally increase in the near term, a complete turnaround in the investment cycle is unlikely in the next three-four years, until there is high demand visibility and significant deleveraging.”

Stressed sectors, especially infrastructure, metals and power (thermal), steel and telecom owing to high leverage and weak cash flow – have limited ability to incur large-scale, debt funded capex.

In Care's view government to boost economy is expected to simplify and ease labour market regulations and also land acquisition procedures.

For next fiscal analysts are quite optimistic and see India's economy to grow between 7.3% - 7.6% respectively.

Whether the country's economy surprises once again in next fiscal or not – will be keenly watched for now our GDP growth is expected below 7% until above key problems are not tackled soon.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

12:58 PM IST

India's GDP expected to fall below 6.5% in FY25 amid slowdown in GDP growth in second quarter: SBI

India's GDP expected to fall below 6.5% in FY25 amid slowdown in GDP growth in second quarter: SBI $8 trillion of $14 trillion invested in India since 1947 came in last 10 years

$8 trillion of $14 trillion invested in India since 1947 came in last 10 years India's GDP growth likely to slip at 6.5%, maintains 7% estimate for FY25: Icra

India's GDP growth likely to slip at 6.5%, maintains 7% estimate for FY25: Icra IMF says India's GDP growth to moderate to 7% in 2024 and 6.5% in 2025

IMF says India's GDP growth to moderate to 7% in 2024 and 6.5% in 2025  India to clock GDP growth of 7% in FY25: NITI Aayog member

India to clock GDP growth of 7% in FY25: NITI Aayog member