IIP declines for second month in a row; falls by 0.7% in August

The cumulative growth for the period April-August 2016 over the corresponding period of the previous year stands at (-) 0.3%.

Index of Industrial Production (IIP), or factory output, in India in the month of August stood at 175.3, which is 0.7% lower as compared to the level in the month of August 2015., Ministry of Statistics & Programme Implementation said.

The cumulative growth for the period April-August 2016 over the corresponding period of the previous year stands at (-) 0.3%.

Central Statistics Office, in a statement said, " The Indices of Industrial Production for the Mining, Manufacturing and Electricity sectors for the month of August 2016 stands at 113.5, 184.3 and 194.6 respectively, with the corresponding growth rates of (-) 5.6%, (-) 0.3% and 0.1% as compared to August 2015. The cumulative growth in these three sectors during April-August 2016 over the corresponding period of 2015 has been 0.6%, (-) 1.2% and 5.7% respectively".

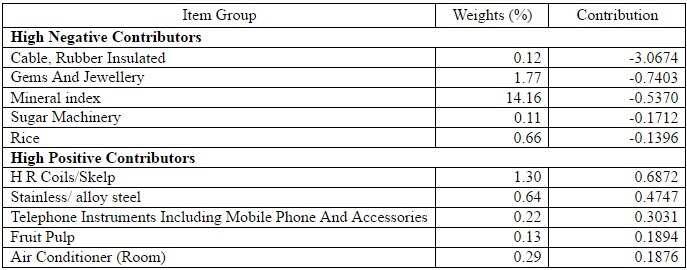

In terms of industries, seven out of the twenty two industry groups in the manufacturing sector have shown negative growth during the month of August 2016 as compared to the corresponding month of the previous year. The industry group ‘Electrical machinery & apparatus n.e.c.’ has shown the highest negative growth of (-) 49.4% followed by (-) 22.4% in ‘Furniture; manufacturing n.e.c.’ and (-) 6.6% in ‘Wearing apparel; dressing and dyeing of fur’. On the other hand, ‘Radio, TV and communication equipment & apparatus’ has shown the highest positive growth of 15.2%, followed by 14.6% in ‘Other transport equipment’ and 12.4% in ‘Basic metals’.

source: tradingeconomics.com

For the month of July, the factory output had declined by 2.4%, after two consecutive months of growth, i.e. in May and June. The General Index for July stood at 176.1. The cumulative growth for the period of April-July 2016 was over the corresponding period of the previous year stood at (-)0.2%.

According to CARE Rating's view, the industrial growth will be around 3% in FY17.

With the record of normal monsoons this year, the inductrial output may pick up in the coming months. As, with the good monsoons, the rural spending is expected to grow on the back of the festive seasons in the ongoing and coming months, CARE Ratings said.

As per the rating agency, the outlook for the factory output will be still constrained on account of the lack of pickup in private investment. However, the government focus on spending will continue to boost growth.

Having similar views like CARE Ratings, FICCI also said that the depressed private investment climate and global economic growth likely to continue to impact the manufacturing sector growth in India.

A. Didar Singh, Secretary General, FICCI, said, "Private investment activity remains sluggish and calls for sustained efforts to address the structural bottlenecks in the economy. Satisfactory monsoons, upcoming festive demand recent cuts in interest rates, have the potential to lift the growth in coming months."

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

07:33 PM IST

Key infra sectors growth rises 6.3% in May against 6.7% in April

Key infra sectors growth rises 6.3% in May against 6.7% in April IIP growth slows marginally to 4.9% in March; grows 5.8% in FY24: Govt Data

IIP growth slows marginally to 4.9% in March; grows 5.8% in FY24: Govt Data Industrial production growth: IIP grows to 4-month high of 5.7% in February on good mining show

Industrial production growth: IIP grows to 4-month high of 5.7% in February on good mining show IIP Data: Industrial production growth rate rises to 16-month high of 11.7% in October

IIP Data: Industrial production growth rate rises to 16-month high of 11.7% in October IIP Data: Industrial production rises 10.3% in August

IIP Data: Industrial production rises 10.3% in August