Grab a piece of Bank of Baroda! This is how it will make you rich

Mega size may translate into big profits too, down the line. So, as an investor, here is why you might want to think about grabbing a piece of BoB, because it is set to be a money making magnet going forward.

There is a saying with age comes experience, and it would be quite true for the over 110 year old Bank of Baroda. It has been hiding in the shadows of major lenders like State Bank of India (SBI), HDFC Bank and ICICI Bank for quite some time, but looks like this Gujarat-based bank has grabbed the spotlight now. BoB is just in process of merging two new banks with itself namely, Vijaya Bank, which is an anchor bank and the weaker Dena Bank. But did you know that, as many as 10 banks have already merged under BoB since its inception way back in 1908? With BoB-Vijaya-Dena Bank merger, India will get its third largest commercial bank having a total business size of Rs 15.4 trillion and loan book size of Rs 6.6 trillion and branch network of 9,511. Mega size may translate into big profits too, down the line. So, as an investor, here is why you might want to think about grabbing a piece of BoB, because it is set to be a money making magnet going forward.

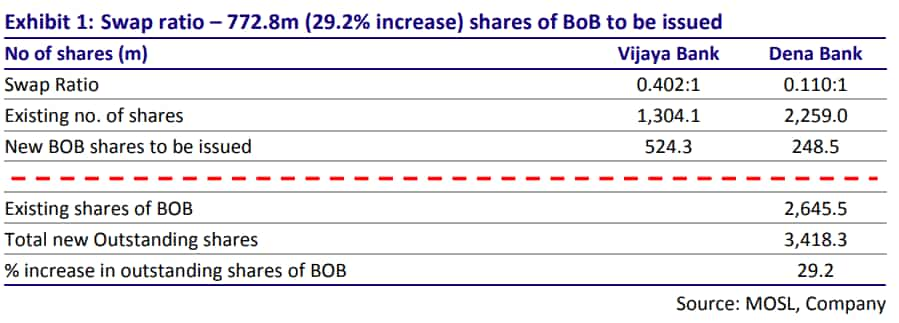

What has happened is that, a fair equity exchange share ratio was approved by BoB on Wednesday for amalgamation of Dena Bank and Vijaya Bank. Under this ratio - 402 equity shares of BoB at Rs 2 each will be swapped for every 1000 equity shares at Rs 10 each of Vijaya Bank. Furthermore, about 110 equity shares of BoB at Rs 2 each will be exchanges by Dena Bank’s 1000 equity shares of Rs 10 each.

This itself proves that BoB will see a rise in it market price, courtesy the mega merger.

Let’s calculate how Bank of Baroda can power a massive rise in its share price.

The equity swap ratio involves - 0.402:1 for BoB and Vijaya, whereas in case of BoB and Dena the ratio stands at 0.110:1.

Currently, the existing number of shares in BoB is about 2,645.5 million, Vijaya Bank has about 1,304.1 million shares and that of Dena Bank has 2,259 million shares, as per Motilal Oswal.

Post equity-swap ratio, BoB is seen to see a rise of 29.2% in terms of outstanding shares. This will boost the stock price of BoB.

Analysts at Elara Capital explain that, Vijaya Bank’s 1,000 equity shares value stands at Rs 51,050 against which its shareholders have been awarded Bank of Baroda’s equity shares worth Rs 47,939, translating into a loss of 6%.

Likewise, 1,000 shares of the Dena bank, value stands at Rs 17,900, and on swap, they receive Bank of Baroda’s equity shares worth Rs 13,118, translating into a loss of 27%.

Details of equity exchange swap ratio will go ahead after February 07, 2019, as a Grievance Redressal Committee headed by a retired judge of Mumbai High Court, has been set up to address the concerns of shareholders.

While the equity swap ratio will already be a boon to BoB share price, many analysts have also given a buy rating on this bank.

Alpesh Mehta and Yash Agarwal analysts at Motilal Oswal said, “BOB has shown early signs of turnaround in recent quarters, and management's focus on cleaning up the balance sheet and improving provisioning coverage has further laid the foundation for sustainable growth. “

In the duo’s view, “Such a large-scale merger will present its own set of challenges in the near term, but the recovery in the NPL cycle, credit growth and the prospects of adequate capital infusion from the government will aid smoother integration and help in returning to normal operations. The purging of bad loans over the past few years has considerably improved transparency levels, and thus, will preempt any post-merger shocks for BOB. The favorable swap ratios have resulted in 8.2%/2.2% increase in BV/ABV for BOB.”

Following which, Motilal Oswal has maintained a Buy Rating with an unchanged price target of Rs 140 per piece on BoB.

Analysts at Antique Stock Broking said, “ Post announcement of merger, BoB has underperformed BANKNIFTY by ~15% as integration of state-owned bank is not an easy task and could delay the RoE normalization. Now with overhang of merger and SWAP ratio over, integration and long-term leadership path would be keenly watched. Reasonable valuation and strong fundamentals of BoB (standalone) drive our BUY rating and we maintain our target price of INR145.”

Coming back to today’s market price, BoB has already jumped by nearly 2% on BSE after touching an intraday high of Rs 121.40 per piece. However, at around 1212 hours, the bank is trading at Rs 121.15 per piece up by 1.47%.

As an investor, it needs to be noted that, this would be a great time to buy BoB when it currently trading at lower level as in coming months the valuation can give an hefty short term gains. Also, it is noteworthy, that BoB has already earmarked an all-time high of Rs 176 per piece on BSE, hence, the potential in this 11 decades year old bank is commendable.

Post merger, the branch count of the combined entity will increase to 9,511 (second largest amongst all banks). The employee base, too, will rise to 86,473, as against 94,907 for the second largest lender – HDFC Bank.

Therefore, a piece of BoB on stock exchanges would definitely be a wise decision.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

01:08 PM IST

India likely to attract $20-25 billion FPI inflows in FY25, recent outflow temporary: Bank of Baroda

India likely to attract $20-25 billion FPI inflows in FY25, recent outflow temporary: Bank of Baroda NBCC arm gets Rs 65 crore work order in Bengaluru from Bank of Baroda

NBCC arm gets Rs 65 crore work order in Bengaluru from Bank of Baroda SBI 5-year FD vs Bank of Baroda 5-year FD: What will senior and general citizens get on Rs 8 lakh investment in each FD

SBI 5-year FD vs Bank of Baroda 5-year FD: What will senior and general citizens get on Rs 8 lakh investment in each FD Bank of Baroda Q2 FY25 Results Preview: PSU lender likely to register 3% rise in profit; interest income may expand 9%

Bank of Baroda Q2 FY25 Results Preview: PSU lender likely to register 3% rise in profit; interest income may expand 9% Bank of Baroda to sell Oman operation to Bank Dhofar

Bank of Baroda to sell Oman operation to Bank Dhofar