HIGHLIGHTS: RBI Monetary Policy Review February 2019 - From Repo Rate to GDP to Inflation, all you need to know with full PDF

The Reserve Bank of India (RBI) on Thursday announced the sixth bi-monthly monetary policy statement for 2018-19. The three-day policy review meeting by the Monetary Policy Committee (MPC) began in Mumbai on Tuesday.

Following are the highlights of the 6th bi-monthly monetary policy statement of 2018-19 issued today by the Reserve Bank of India:-

- Repo rate reduced by 25 basis points, now at 6.25 from 6.5 per cent. RBI cuts benchmark lending rate by 0.25 per cent to 6.25 per cent.

- As per the RBI's statement, "On the basis of an assessment of the current and evolving macroeconomic situation at its meeting today, the Monetary Policy Committee (MPC) decided to: reduce the policy repo rate under the liquidity adjustment facility (LAF) by 25 basis points from 6.5 per cent to 6.25 per cent with immediate effect."

- RBI has recieved a proposal for an umbrella organisation for urban cooperative banks. RBI has decided on this positively. A decision on the specifics of the umbrella organisation proposal will be taken shortly.

- Monetary policy committee votes 4:2 in favour of rate cut, unanimous on change in stance.

- Export growth on a year-on-year basis was almost flat in November and December 2018, primarily due to a high base effect and weak global demand

- RBI Governor says, "Headline inflation is expected to remain contained below or at its target of 4%. This has opened space for policy action. Investment activity is recovering supported mainly by public spending on infrastructure."

- RBI Governor says, "GDP projection for 2019-20 is 7.4%. The inflation rate is estimated at 3.2-3.4% in the first half of the year 2019-20 and 3.9% in the third quarter of 2019-20."

- RBI has decided enhancement of collateral free agriculture loan from Rs 1 lakh to Rs 1.6 lakhs. This enhancement Rs60,000 has been taken in view of the overall rise in inflation, marginal agriculture input and benefit to small farmers.

WATCH LIVE - FULL VIDEO: Sixth Bi-Monthly Monetary Policy Press Conference 2018-2019, Thursday, February 07, 2019. Governor, Reserve Bank of India’s Press Conference.

Sixth Bi-Monthly Monetary Policy Press Conference 2018-2019, Thursday, February 07, 2019

Governor, Reserve Bank of India’s Press Conference https://t.co/boOY5cGWP1— ReserveBankOfIndia (@RBI) February 7, 2019

- RBI revises down headline inflation estimates to 2.8 pc in March quarter, 3.2-3.4 pc in first half of next fiscal and 3.9 pc in Q3 of FY20.

- 2 MPC members Chetan Ghate and Viral Acharya were for status-quo in rates; decision on changing stance to neutral was unanimous: RBI.

- RBI expects GDP growth to go up to 7.4 pc in FY20, from the FY19 government estimate of 7.2 pc.

- Union budget proposals will boost demand by raising disposable incomes, may take time to play out: RBI.

- RBI revises downwards retail inflation forecast to 2.8 pc for March quarter 2019.

- Reserve Bank of India on Thursday unexpectedly lowered interest rates and shifted its stance to "neutral" from "calibrated tightening" to boost a slowing economy after a sharp fall in the inflation rate.

- The monetary policy committee (MPC) cut the repo rate by 25 basis points to 6.25 percent, as predicted by only 21 of 65 analysts polled by Reuters. Most polled respondents had expected the central bank to only change the stance, to neutral.

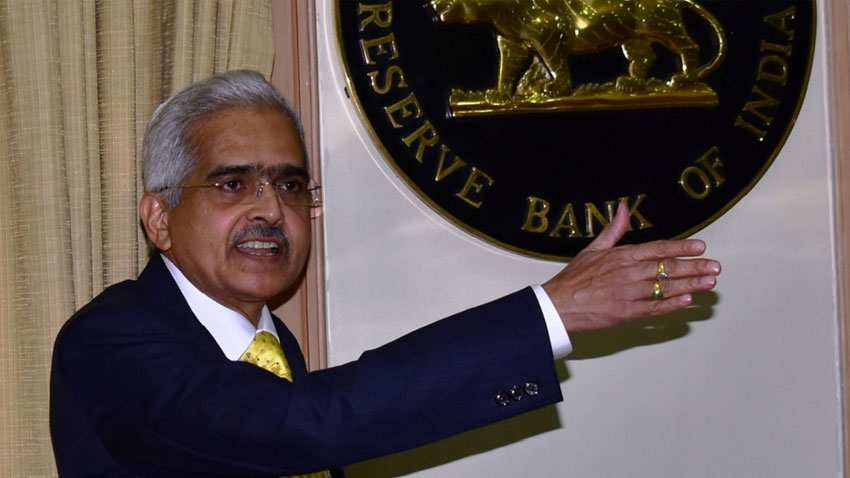

- RBI Governor Shaktikanta Das said, "We are constantly & continuously monitoring the liquidity situation and based on the requirement we will ensure that there is no liquidity scarcity."

- FULL PDF by RBI: Sixth Bi-monthly Monetary Policy Statement, 2018-19 Resolution of the Monetary Policy Committee (MPC) Reserve Bank of India

https://rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=46235

- FULL PDF by RBI: Liquidity Adjustment Facility: Fixed Rate Repo Operations

https://rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=46236

- FULL PDF by RBI: Statement on Developmental and Regulatory Policies

https://rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=46237

- Four of six members of the MPC voted to cut the rates, while all six members voted for a change in the stance.

(Developing story; it is being updated as and when updates are coming in)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Compounding: How soon will monthly SIP of Rs 6,000, Rs 8,000, and Rs 10,000 reach Rs 5 crore corpus target?

SBI Guaranteed Return Scheme: Know how much maturity amount you will get on Rs 2 lakh, 2.5 lakh, 3 lakh, 3.5 lakh and Rs 4 lakh investments under Amrit Vrishti FD scheme

SBI Senior Citizen FD Rate: Here's what State Bank of India giving on 1-year, 3-year, 5-year fixed deposits currently

SBI Senior Citizen Latest FD Rates: What senior citizens can get on Rs 7 lakh, Rs 14 lakh, and Rs 21 lakh investments in Amrit Vrishti, 1-, 3-, and 5-year fixed deposits

12:23 PM IST

RBI, Maldives Monetary Authority sign pact to promote use of local currencies

RBI, Maldives Monetary Authority sign pact to promote use of local currencies RBI cautions public about 'deepfake' video of governor being circulated on social media

RBI cautions public about 'deepfake' video of governor being circulated on social media RBI cancels licence of Vijayawada-based Durga Co-op Urban Bank

RBI cancels licence of Vijayawada-based Durga Co-op Urban Bank  Consumer inflation worsens to 6.21% in October from 5.49% in previous month

Consumer inflation worsens to 6.21% in October from 5.49% in previous month Nearly 98% of Rs 2000 banknotes returned; Rs 6,970 crore worth notes still with public

Nearly 98% of Rs 2000 banknotes returned; Rs 6,970 crore worth notes still with public