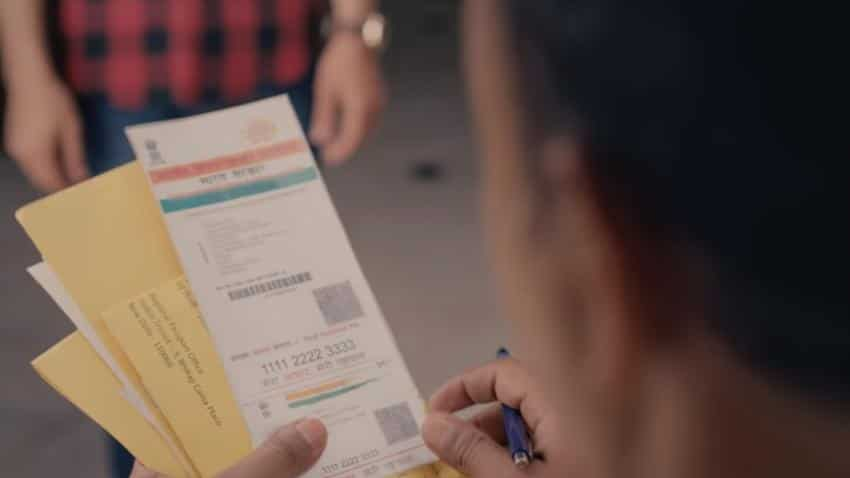

High Court allows woman to file Income Tax returns without Aadhaar card

The Madras High Court today allowed a woman to file her income tax returns without quoting Aadhaar number or Aadhaar enrolment number.

Justice T S Sivagnanam passed the interim order on a plea by Preethi Mohan.

She had moved the court relying upon a Supreme Court decision in Binoy Viswam Vs Union of India case, in which it had imposed a partial stay on the operation of Section 139AA of the Income Tax Act, which mandates linkage of Aadhaar with I-T returns.

The counsel for the woman contended that the directions issued by the apex court in the case make it clear that Aadhaar scheme was always meant to be voluntary.

"But despite a partial stay imposed by the apex court, the Income Tax department is acting in a manner directly opposed to the court order and are demanding linkage of Aadhaar," the counsel submitted.

The petitioner also referred to similar petitions allowed by the Kerala High Court permitting people to file returns without quoting Aadhaar number or enrolment number.

Recording the submissions, the judge said, "I am inclined to grant a similar relief, since today being the last day for filing income tax returns. If the returns are filed belatedly and if ultimately, the matter is decided by the Constitution Bench of Supreme Court against the petitioner, then she may be liable to pay interest for belated payment of tax."

"Accordingly, there will be an interim direction to the Income Tax department to permit the petitioner to file her returns for the assessment year 2017-18 either manually or through appropriate e-filing facility without insisting for Aadhaar number," the judge said and posted the matter to December 18 for the I-T department to file its counter- affidavit.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

08:10 AM IST

How to lock/unlock Aadhaar biometrics via UIDAI portal

How to lock/unlock Aadhaar biometrics via UIDAI portal  Deadline to link Aadhaar with ration card extended

Deadline to link Aadhaar with ration card extended Rule Changes from April 1, 2024: NPS, SBI debit cards, FASTag - Get all the details here

Rule Changes from April 1, 2024: NPS, SBI debit cards, FASTag - Get all the details here DPIs like UPI, Aadhaar to propel India towards $8 trillion economy by 2030: Nasscom

DPIs like UPI, Aadhaar to propel India towards $8 trillion economy by 2030: Nasscom Aadhaar address update request rejected? Here's what you can do

Aadhaar address update request rejected? Here's what you can do