Here's a view of Banking ordinance assented by President to tackle banks' NPA crisis

The draft published on Gazette of India said, “Whereas the stressed assets in the banking system have reached unacceptably high levels and urgent measures are required for their resolution.”

An ordinance to further amend the Banking Regulation Act was signed by President Pranab Mukherjee on Friday in a move to tackle Indian banks' long hanging 'stressed assets' (NPA) issue .

On Wednesday, the cabinet approved the amendment in the Banking Regulation Act. The draft was presented to President for approval on Friday.

The draft published on Gazette of India said, “Whereas the stressed assets in the banking system have reached unacceptably high levels and urgent measures are required for their resolution.”

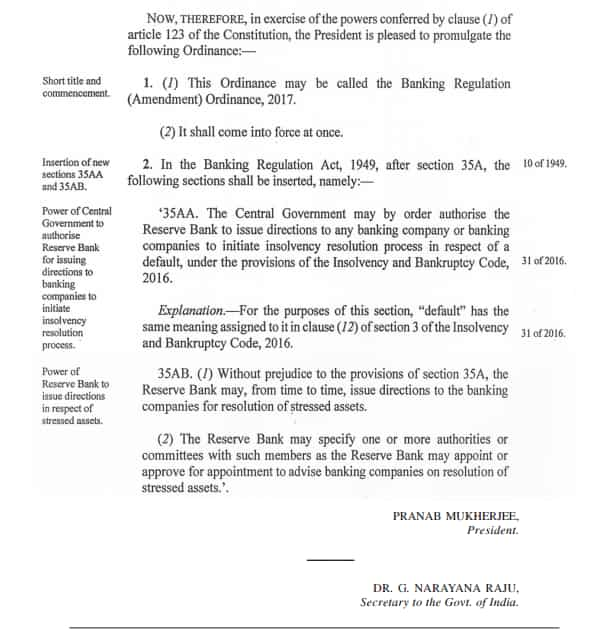

The new ordinance passed by Mukherjee shall be called as Banking Regulation (Amendment) Ordinance, 2017.

New rules in the Banking Regulation Act 1949 section 35A was amended, under which it gave more power to the Reserve Bank of India (RBI) in resolving banks stressed assets crisis.

As per the new rules, under Section 35AA - the central bank is entitled to issue directions to any banking company or banking companies to initiate insolvency resolution process in respect of a default under the provisions of the Insolvency and Bankruptcy Code.

Another reform was made in Section 35AB where the central bank from time to time, issue directions to the banking companies for resolution of stressed assets.

RBI may further appoint one or more committees to advise banks on resolution of stressed assets.

As on September 2016, the stressed assets under banking system stood at Rs 6.7 lakh crore. As per the Economic Survey, gross NPAs climbed to almost 12% of gross advances for public sector banks at end-September 2016.

There are at least fifteen more state-run banks with gross NPAs above 10% which include UCO Bank (17.19%), United Bank of India (14.29%), Punjab National Bank (13.75%), Central Bank (13.52% ) and Bank of India (13.38% ) and Indian Overseas Bank with 20.48% Gross NPAs).

Due to bad loans problem, not only the entire banking universe but also India's economic growth has been in danger.

Viral Acharya, Reserve Bank of India (RBI)'s Deputy governor, while maintaining a neutral stance on Indian economy from accomodative said, "There is a need for speedy and efficient resolution of stressed assets as it probably could help in restoring the utilisation capacity in this sector while further creating healthy investment in the system and at the same time would also support banks to again start lending in the same sectors again."

Finance Minster Arun Jaitely will be briefing about the ordinance passed in the act later on Friday.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

04:22 PM IST

Pranab Mukherjee: The president who could never be prime minister

Pranab Mukherjee: The president who could never be prime minister Scholar par excellence, towering statesman who always blessed me: PM Modi pays tribute to Pranab Mukherjee

Scholar par excellence, towering statesman who always blessed me: PM Modi pays tribute to Pranab Mukherjee Ex-President Pranab Mukherjee awarded Bharat Ratna

Ex-President Pranab Mukherjee awarded Bharat Ratna Bharat Ratna for Pranab Mukherjee, Nanaji Deshmukh and Bhupen Hazarika

Bharat Ratna for Pranab Mukherjee, Nanaji Deshmukh and Bhupen Hazarika President hands over free LPG connection under Ujwala scheme

President hands over free LPG connection under Ujwala scheme