Happy New Year 2019! Good news! RBI Financial Stability Report out; Banks back on track

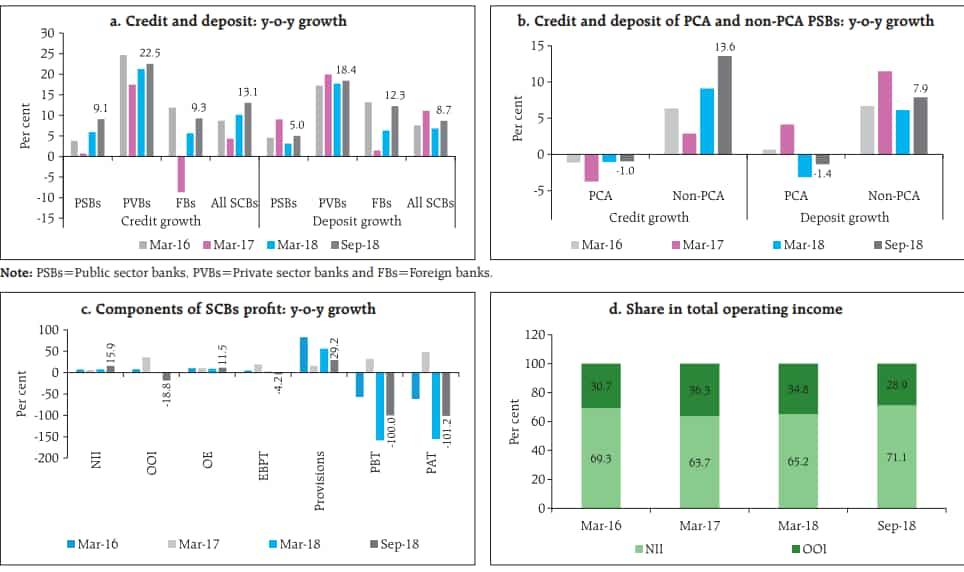

RBI says, "SCBs’ credit growth on a year-on-year (y-o-y) basis improved across bank groups between March and September 2018, largely driven by the private sector banks (from 21.3 per cent in March 2018 to 22.5 per cent in September 2018)."

In the December 2018 Financial Stability Report, the Reserve Bank of India (RBI) acknowledged the rising performance of banks as on September, 2018. The report shows that signs of improvement have been witnessed in terms of both credit growth and deposits. While that has been highlighted, RBI's latest report also reveals that the nightmares of lenders under Prompt Corrective Action (PCA) continue to haunt them.

What is now known is that credit growth of Scheduled Commercial Banks (SCB) improved to 13.1% in September, 2018, which is courtesy of private banks.

RBI says, "SCBs’ credit growth on a year-on-year (y-o-y) basis improved across bank groups between March and September 2018, largely driven by the private sector banks (from 21.3 per cent in March 2018 to 22.5 per cent in September 2018)."

Not only this, even private banks deposit growth also reflected strong performance with growth rate of 18.4%.

On the other hand, performance of public sector banks (PSBs) improved, however, yet remained in single digits.

PSBs witnessed an overall credit growth of 9.1% in September 2018 quarter compared to 5.9% in March 2018. Meanwhile, their deposits stood at 5% in September versus 3.2% of March 2018 quarter.

However, this was not the case of PSBs under PCA framework. RBI said, "there has been a further widening between PCA and non-PCA PSBs."

Non-PCA PSBs credit growth improved from 9.1% in March, 2018 to 13.6% in September, 2018. Deposits came in at 7.9% in the latest period as against 6.1% by end of March 2018.

Witnessing opposite trend, PCA-PSBs registered negative growth in both credit and deposits, said RBI.

RBI added, "In terms of quality, incremental credit portfolio of PCA-PSBs shows a declining conversion rate to non-performing assets (NPA) in FY 2017-18 compared to FY 2016-17, although the rate still remains significantly large vis-à-vis other financial intermediaries."

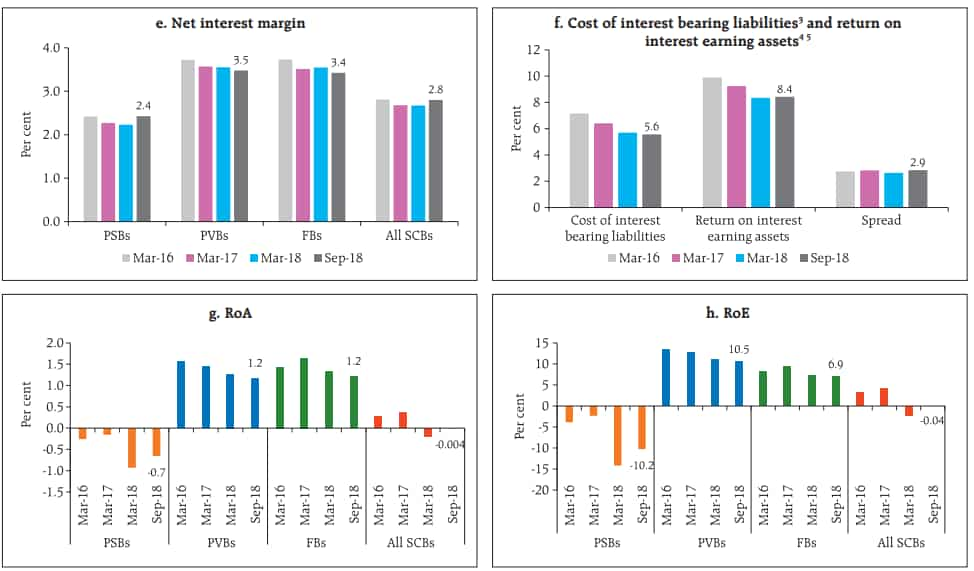

Further, RBI's data highlighted that, SCBs’ net interest income (NII) growth improved in September 2018 as compared to March 2018, while there was decline in other operating income (OOI). This, along with higher growth in operating expenses (OE), pulled down the earnings before provisions and tax (EBPT). However, growth in provisions was lower between March and September 2018.

Interestingly, net interest margins (NIM) of SCBs have improved mainly due to PSBs.

Higher growth in NII improved in the PSBs, though they were still lower than PVBs and FBs.

In case of profitability ratios of SCBs, as per RBI that continued to be impacted.

Individually, in a sample of 55 SCBs, 24 banks were able to improve their return on asset (RoA) in September 2018 as compared to March 2018.

On the other hand, private sector banks, which were able to maintain their profitability till recently, have experienced decline in their profitability ratios. The RoA of 8 out of 19 PVBs in the sample improved in September 2018 as compared to March 2018.

In regards to MSMEs, RBI carried an analysis of portfolio of Micro, Small and Medium Enterprises (MSMEs) which showed that, the performance of PSBs in the MSME segment trails that of other intermediaries (private banks and non-banking financial companies (NBFC)), both in terms of inherent as well as realised credit risk.

Finally, the data mentions that, the liquidity coverage ratio (LCR), intended to build banks’ short-term resilience to potential liquidity disruptions, improved for PSBs and PVBs in September 2018. PSBs are able to maintain better LCR than the PVBs .

From the above one can see that the worst case scenario is over for PSBs especially the ones who are not included in PCA framework. This comes as a good news as earnings may see some jump in upcoming quarters.

Spells good news for investors as well as customers, going forward into new year 2019.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

08:04 PM IST

RBI Financial Stability Report: Breather in asset quality for banks in these sectors

RBI Financial Stability Report: Breather in asset quality for banks in these sectors RBI Financial Stability Report: Surprise! Banks asset quality improves; gross NPAs down

RBI Financial Stability Report: Surprise! Banks asset quality improves; gross NPAs down