GST's new rate structure: Is it momentary or long-term?

Since its inception on July 01, 2017, GST has undergone various revision. The recent one would be 178 items brought down under tax slab of 18%, 12% and 5% from the higher slab of 28% effective from November 15, 2017.

Key Highlights:

- 50 items under GST tax slab of 28%

- GST council in 23rd meeting reduced tax slab of 178 items

- These 178 items has become cheaper from November 15, 2017.

The rate structure decided for Goods and Services Tax (GST) in 23rd meeting of the council chaired by Finance Minister Arun Jaitley has become effective from Wednesday onward. The move has been taken on positive side for both corporates and consumers-end.

Manoj Bahety, Ankit Dangayach and Nilesh Aiya, analysts at Edelweiss Financial Services, said: "We believe, lower GST rate will disincentivise tax evasion and provide a level playing field to tax-compliant organised players. This will accelerate pace of demand shift to organised players and also enhance tax base over the long term."

While analysts at Phillip Capital added, “GST was slashed for a very broad range of consumption items –eating out, shampoos, detergents, tiles – which will benefit consumer-facing companies. These cuts will spur volume growth, as we believe ALL companies will pass on benefits.”

Let's examine by how much would the prices of daily products decline under the new GST tax slab with an example.

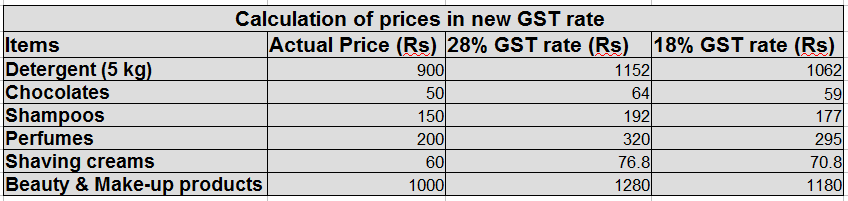

Home-care, skin-related and snacks items like detergents, washing & cleaning preparations, liquid or cream for washing the skin, shampoo, shaving creams perfumes, toilet waters, chewing gums, cocoa butter, chocolates, razors and related products, flour, groats, starch or malt extract waffles and wafers, etc were revised and brought under tax slab of 18% from previous 28%.

With the example, it can be noted that the actual prices of the above mentioned products have come down in range of Rs 5 to Rs 100.

According to Motilal Oswal report, companies like Hindustan Unilever, ITC, Jyoti Laboratories, Godrej Consumer, Colgaye, Nestle, Gillette and GSK Consumer are likely to be the beneficiaries of this change.

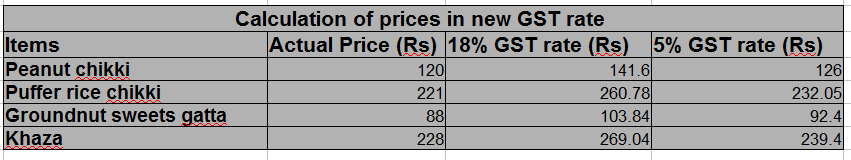

However, Sweet-related products like puffer rice chikki, peanut chikki, sesame chikki, revdi, tilrevdi, khaza, kazauli, groundnut sweets gatta and kuliya, etc have been revised to 5% tax slab compared to 18% rate structure.

If we calculate, these products have seen reduction in their actual prices right from Rs 10 to Rs 50.

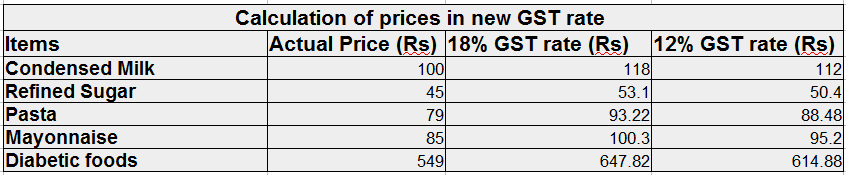

Meanwhile, food-usage items like condensed milk, refined sugar, pasta, mayonnaise, mixed condiments and diabetic foods will now have tax rate of 12% as against 18%.

Under 12% tax slab, the above mentioned items will now see a decline in their prices from Rs 2 to Rs 40.

As per Motilal Oswal report, companies like Parag Milk Foods, Eid Parry, Balrampur Chinni and Shree Renuka apart from Nestle and ITC will reap benefits from this tax slab.

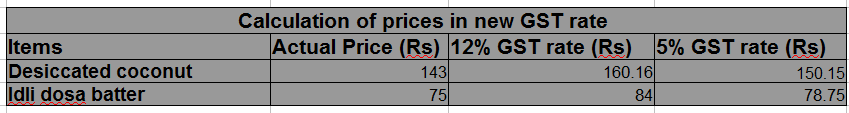

There were changes also made in products like dessicated coconut and idli dosa batter from 12% tax slab to lowest tax rate of 5%. From the example it can noticed that the actual prices of these product have also come down.

Products like guar meal, certain dried vegetables such as sweet potatoes, manaic, unworked coconut shell and fish frozen containers were brought under the zero tax rate from their previous 5%.

Eating out at restaurants has also become cheaper with GST rate for the sector to 5%. All stand-alone restaurants irrespective of air conditioned or otherwise, will charge GST at 5% without Input Tax Credit.

Food parcels (or takeaways) will also attract 5% GST without Input Tax Credit. Restaurants in hotel premises having room tariff of less than Rs 7,500 per unit per day will attract GST of 5% without ITC while the restaurants in hotel premises having room tariff of Rs 7,500 and above per unit per day (even for a single room) will attract GST of 18% with full ITC.

This simply shows that new tax structure of GST will certainly bring prices of products down.

Interestingly, there have been reports mentioning that companies will take at least two-week to pass on the benefits of GST to customers.

As per FMCG experts, the products which have been made after the GST notification (on November 10, 2017) will be the ones to see new tax regime. The companies do not want to mess with MRP of old stocks available in Indian market.

They stated that the prices of new products causes concern for Indian Meteorological Department which is why sachet related products instead of price reduction will see higher quantity.

One shopkeepers said, “The companies hopefully will pass on the benefit of GST on the new products within one or two days times. And once the distributor delivers the products with new MRP sticker than accordingly we will also reduce our prices. However, before November 15, stocks available will be sold on their respective prices there will be no revision in it.”

Well looks like customers will have to wait at least by November-month end to reap the benefit of new GST rates.

However, Sandeep Ashok Gupta, analysts at Motilal Oswal, believes that over a period of time, the government might further consider pruning the list of items in the highest tax bracket.

The reason, Gupta said, “The reduction in rates is estimated to have an impact of Rs 200 billion on government revenue.”

Such would be a worry for the government as it puts near-term pressure on fiscal deficit, which the Centre is committed to achieve at 3.2% for FY18.

Phillip Capital said, “Some critics indicate that tax losses could be even higher. Bond yields have been rising, but their future direction will depend on other factors such as inflation and movement of crude oil.

The decrease in indirect tax rates is likely to have a positive impact on inflation while higher government borrowing and potentially missing fiscal-deficit targets could pose medium-term challenges.”

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

10:41 AM IST

States not in favour of bringing ATF under GST, says finance minister

States not in favour of bringing ATF under GST, says finance minister 55th GST Council Meeting: No GST payable on penal charges levied & collected by banks & NBFCs from borrowers for non-compliance, says Nirmala Sitharaman

55th GST Council Meeting: No GST payable on penal charges levied & collected by banks & NBFCs from borrowers for non-compliance, says Nirmala Sitharaman  GST Council Meeting: Packaged & labelled popcorn with added sugar to attract 18% rate, decision on insurance products deferred

GST Council Meeting: Packaged & labelled popcorn with added sugar to attract 18% rate, decision on insurance products deferred  55th GST Council Meeting: Jet fuel inclusion, lower taxes on insurance policies to be considered

55th GST Council Meeting: Jet fuel inclusion, lower taxes on insurance policies to be considered GoM on GST rate rationalisation yet to submit report, GST Council to take final decision: CBIC

GoM on GST rate rationalisation yet to submit report, GST Council to take final decision: CBIC