GST Suvidha Providers say IT systems not ready for July 1 roll-out

With three weeks to go before the country moves to big bang tax reform, Goods and Services Tax (GST) Suvidha Providers -- key links between taxpayers and the government -- say the IT systems for a July 1 roll-out are not ready.

"All the rules are yet to be notified. Only after the rules are finalised can the IT systems from Goods and Services Tax Network (GSTN) be ready. The GST Suvidha Providers (GSPs) would be ready only after that," Tejas Goenka, Executive Director at Tally Solutions told IANS.

GSPs are expected to help large businesses with complex internal processes to comply with the GST regime. A meeting was held between GSTN officals and suvidha providers on Friday.

Neeraj Hutheesingh, Founder and Director, Cygnet Infotech said that with the roll-out date closing in, "the worst fears of the market are coming true -- lack of IT preparedness. July 1 fails to appeal as a feasible deadline."

All the GSPs shortlisted and licensed by GSTN, he explained, were dependent on the application progam interfaces (APIs) furnished by GSTN network. In all, 34 GSPs have been selected.

GSPs will use the APIs for accounting software, enterprise resource planning (ERP) software, filing software and billing software that will help businesses comply with the new indirect tax regime.

Analyst Pritam Mahure said that the roll-out date of July 1 is not an issue but the problem is that things were undecided even with 20 days remaining. It was hampering testing needs of the Suvidha Providers.

"Significant testing needs to be carried out by the ecosystem. However, GSTN sandbox release does not appear to be geared up for the same. It`s a catch-22 situation. The problem is that everything is still in a fluid sate -- the tax rates, Rules," Mahure told IANS. A sandbox is a virtual space where new software can be tested securely.

"The primary focus is to handle the forms for which the APIs are avaible from GSTN. For the remainder forms, the entire flow is being finalised so that once the APIs for the same are available, we can be ready to offer the (service) to clients," Saket Agarwal, Global CEO, Spice Digital said.

Vinod Tambi, COO, Excellon Software, said: "Many of the aspects of GST such as rates, exemptions, have only been announced a few days back while we are still awaiting some other inputs. Hence July 1 does look like an uphill task."

GSTN has said that the API specifications will be released in staggered manner for all the GSPs so that they can study and analyse the same for making changes in their software developed on old design of returns.

Subsequent to publishing of the specifications, GSTN will also make available live APIs on the sandbox for testing of the codes that the GSPs will modify/develop. The live API will be made available only by June 29.

But the government has maintained a strict stance that July 1 deadline won`t be deferred.

With a view to assessing preparedness in various areas of GST, a joint presentation by officials from the Centre and state tax administration was held in the national capital on June 4.

"In all interactions with trade industry and public, it should be clearly indicated by officers at all levels that the target date of implementation is July 1 only and the implementation of this big reform will not be deferred beyond this date," according to the minutes of the meeting accessed by IANS.

"All officers should keep a check on adverse publicity or criticism of GST and should counteract it promptly," it was noted at the meeting.

West Bengal Finance Minister Amit Mitra, has also been voicing serious doubts about the IT readiness by July 1.

"Entire GST will depend on one IT system of GSTN. The presentation given by them clearly shows that they are not ready and need more time. They have appointed 34 Suvidha providers for the whole country...will that be sufficient?" Mitra had wondered.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

01:50 PM IST

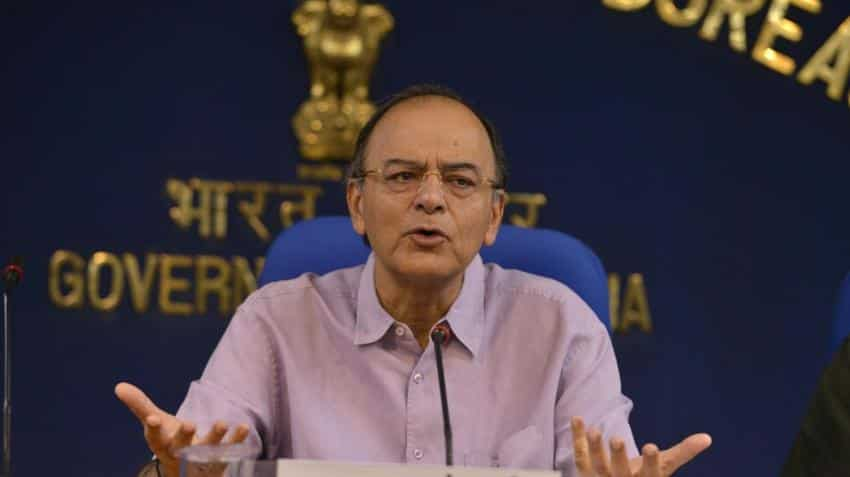

States not in favour of bringing ATF under GST, says finance minister

States not in favour of bringing ATF under GST, says finance minister 55th GST Council Meeting: No GST payable on penal charges levied & collected by banks & NBFCs from borrowers for non-compliance, says Nirmala Sitharaman

55th GST Council Meeting: No GST payable on penal charges levied & collected by banks & NBFCs from borrowers for non-compliance, says Nirmala Sitharaman  GST Council Meeting: Packaged & labelled popcorn with added sugar to attract 18% rate, decision on insurance products deferred

GST Council Meeting: Packaged & labelled popcorn with added sugar to attract 18% rate, decision on insurance products deferred  55th GST Council Meeting: Jet fuel inclusion, lower taxes on insurance policies to be considered

55th GST Council Meeting: Jet fuel inclusion, lower taxes on insurance policies to be considered GoM on GST rate rationalisation yet to submit report, GST Council to take final decision: CBIC

GoM on GST rate rationalisation yet to submit report, GST Council to take final decision: CBIC