GST structure for airlines: What's in store for economy, business class and lease rentals

GST tax slabs have turn out to lower in economic class tickets, while higher in business class tickets. However, analysts feels migration to GST would be largely neutral for airline sectors.

Key Highlights:

- Economic class tickets under GST tax slab of 5%

- Business class tickets under GST tax slab of 12%

- Airlines will pay GST of 5% for lease rentals

With airlines in India doing brisk business over the past few years on the back of rising incomes and cheaper air tickets due to low oil prices, Goods and Services Tax (GST) is likely to impact air travel.

If you are a frequent flier, you will witness effects of GST tax rates on your airfares henceforth.

GST tax structure in airlines

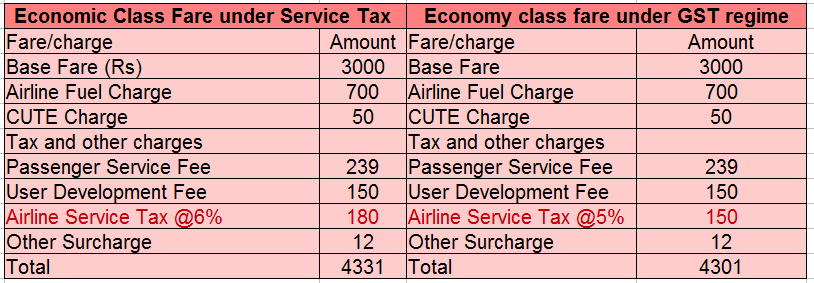

GST council has lowered the tax rate in economy class flight ticket to 5% from previous service tax of 6%.

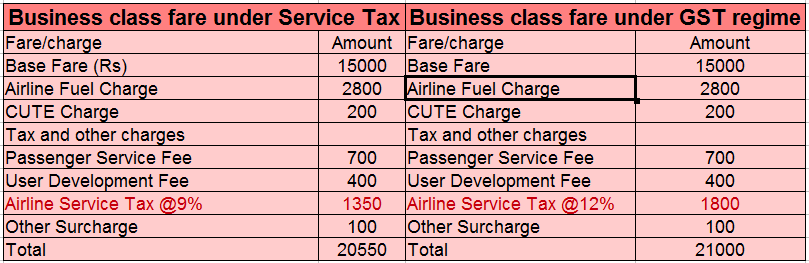

However, it increased business class tickets at a GST tax slab of 12% versus previous service tax of 9%.

Moreover, airlines can only claim input tax credit (ITC) on input services for the economy class, while in case of business class they can claim ITC for spare parts, food items and other inputs excluding cost on aviation fuel turbine (ATF) as it falls under purview of GST.

The government has also levied a GST of 5% on lease rentals paid by airlines.

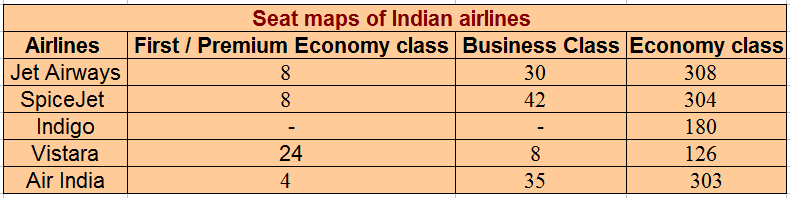

A major portion of the airline's revenue is generated from economy class as this segment offers higher amount of seats.

In India, airlines like Jet Airways, SpiceJet, Vistara and state-owned Air India offer business class seats.

Ashish Shah and Jiten Rushi, analysts at IDFC Securities believe that migration to the GST regime would be largely neutral for the airline sector.

In ICRA's view, these rates changes are not material, and should not have any major impact on the air passenger growth. However, the lowering of tax rate on economy class travel is line with the focus of the Ministry of Civil Aviation to make flying affordable for masses.

Ashutosh Somani and Nitin Agarwala, analysts at JM Financial expect economy tickets to benefit by 1% (6% to 5%). However, tickets other than economy to be costlier by 3% (9% to 12%).”

As per ClearTax, increase in business fare would be minimum and will probably not enough to deter business travellers from their travel plans.

While these airlines can use input credits to offset the tax liability - which arises from procurement of goods and service.

PricewaterhouseCoopers (pwc), in its earlier report said, “The carrier would need to have invoice-wise details of services rendered to passengers so as to pass the input tax credit of the GST charged to such business entities. Given the ecosystem of the GST Network for passing credit, carriers would need to upload details of tickets sold to B2B customers on the GST Network."

Airlines like Air India, Vistara and Jet Airways have already sent out communications informing their passengers that GSTIN details need to be submitted in order to avail the benefits.

ALSO READ: GST benefits: Companies need to provide info to airlines for biz class tickets

Jet Airways said, “All guests traveling for business and who wish to claim the GST benefit for their travel will be required to complete a one-time registration on our website and enter the relevant details at the time of booking.”

It added, “Guests who have provided their GST details will receive an invoice, which will allow them to claim the GST paid for the ticket.”

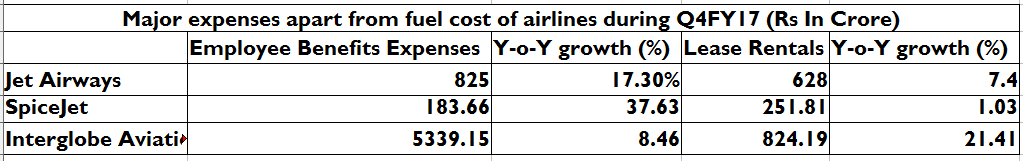

One of the key concern could be higher cost the airlines would pay in lease rentals. For airlines operating in India, ATF, lease rentals, maintenance and employee benefit expenses account for over 70% of their cost.

Before GST, cross border aircraft leases carried out by scheduled airlines were not required to pay customs duty, central excise and VAT.

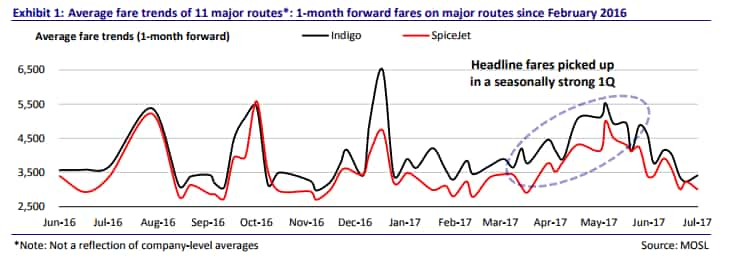

Airlines are already showing fare uptick in the first quarter of financial year 2017-18 (Q1FY18) supported by sequentially lower ATF prices and strong Indian Rupee.

In 1QFY18, ATF price declined by 5% on quarter-on-quarter (QoQ) (from Rs 55.4 per litre in 4QFY17) and increased 16% YoY (from Rs 45.4 per litre in 1QFY17) to Rs 52.7 per litre.

ALSO READ: Airliners last quarter results show that your flight ticket prices may rise

Motilal Oswal in its report said, “INR appreciation along with lower ATF prices and increased air ticket fares should result in sequentially higher profitability for airlines."

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

PPF vs SIP: With Rs 12,000 monthly investment for 30 years; which can create highest retirement corpus

Power of Compounding: At 12% expected annualised return, how soon can Rs 8,000, Rs 9,000, Rs 10,000 monthly SIPs build Rs 5 crore corpus?

Power of Compounding: How can you create Rs 5 crore, 6 crore, 7 crore corpuses if your monthly salary is Rs 20,000?

Top 7 SBI Mutual Funds With Best SIP Returns in 1 Year: Rs 25,252 monthly SIP investment in No. 1 scheme has sprung to Rs 3,74,615; know about others

Highest Senior Citizen FD Rates: Here's what banks like SBI, PNB, BoB, Canara Bank, HDFC Bank and ICICI Bank are providing on 1-year, 3-year, 5-year fixed deposits

11:06 AM IST

Tax officials initiate inspection of M&M records in Chennai

Tax officials initiate inspection of M&M records in Chennai Popcorn sold in movie theatres to attract 5% GST

Popcorn sold in movie theatres to attract 5% GST GST on old used cars only when sale price higher than depreciated value

GST on old used cars only when sale price higher than depreciated value  States not in favour of bringing ATF under GST, says finance minister

States not in favour of bringing ATF under GST, says finance minister 55th GST Council Meeting: No GST payable on penal charges levied & collected by banks & NBFCs from borrowers for non-compliance, says Nirmala Sitharaman

55th GST Council Meeting: No GST payable on penal charges levied & collected by banks & NBFCs from borrowers for non-compliance, says Nirmala Sitharaman