GST rollout: Get ready to file GSTR-1 from next month; here are the steps

The Excel template, comprising eight worksheets, is part of GSTN’s approach to make tax compliance easy and convenient for taxpayers and also reduce the time of compliance.

Goods and Service Tax (GST) has been smoothly rolled out starting from July 1. With this implementation, now the taxpayers will need to file eight returns monthly and one annual return and one quarterly basis.

This will include forms which are separate returns for a taxpayer registered under the composition scheme, taxpayer registered as an Input Service Distributor, a person liable to deduct or collect the tax (TDS/TCS).

The most common used return will be GSTR 1, 2,3, 4 & 9. GSTR 1, GSTR 2 and GSTR 3 is required to be filed on monthly basis, GSTR 4 is required to be filed on a quarterly basis whereas GSTR 9 should be filed on an annual basis.

ALSO READ: GST rollout: All you need to know about monthly, quarterly, annually tax return filing

GST Network (GSTN) on Friday launched an offline Excel-based format for traders and businesses to upload sales data on the GST portal, a PTI report said. The Excel template, comprising eight worksheets, is part of GSTN’s approach to make tax compliance easy and convenient for taxpayers and also reduce the time of compliance.

As per the GST law, a return of all sales or trade made in a month have to be filed online by the 10th of the following month.

This Excel template can be downloaded from the GST common portal (www.gst.gov.in), and can be used by taxpayers to collate all invoice related data on a regular basis, the report had mentioned.

ALSO READ: Are you ready to file 37 tax returns under GST regime? All your questions answered

In the excel sheet, the businesses would have to give details of transaction, like supply invoices issued to registered taxpayers, export invoice details, consolidated details of supplies to consumers, credit/debit note details to registered/unregistered taxpayers and details of documents issued.

According to the GST law, every registered taxable person is required to submit the details of outward supplies in the GSTR-1. This return is required to be filed within 10 days from the end of the tax period, or the transaction month (in simple words).

GSTR-1 has a total of 12 headings. However, the taxable person need not worry as most of these will be prefilled.

Here are 12 section headings under GSTR-1:

1. Name of the taxpayer

2. Gross turnover of the taxpayer in the previous FY

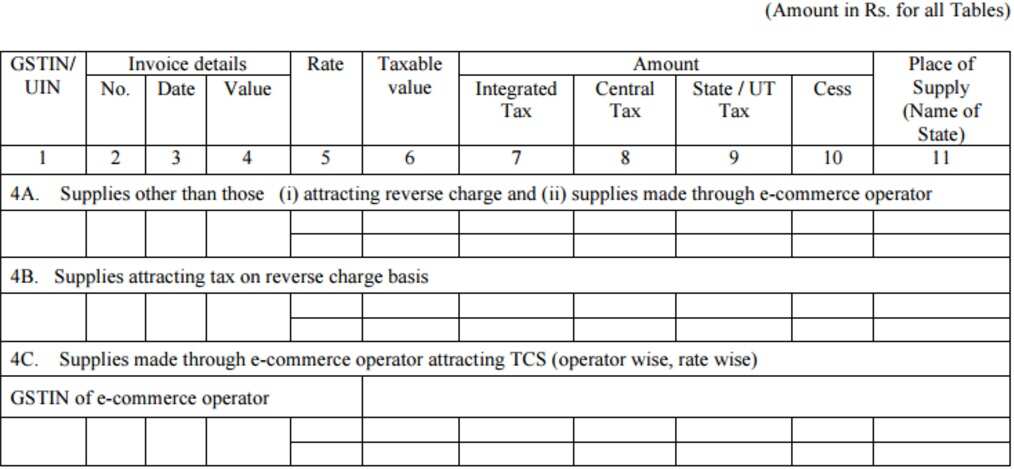

3. Taxable outward supplies made to registered persons (including UIN-holders) other than supplies covered by Table 6

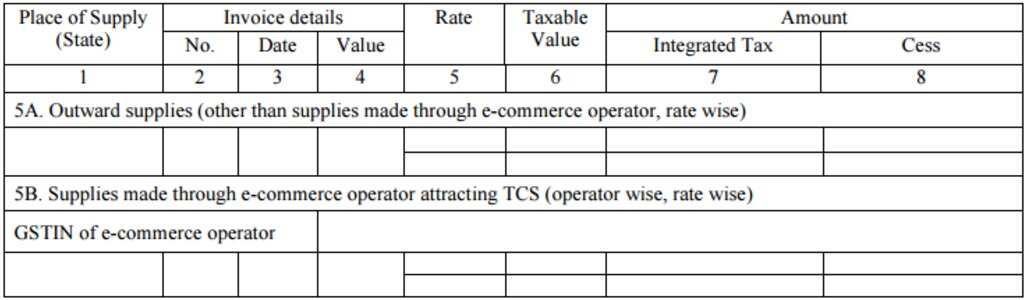

4. Taxable outward inter-state supplies to unregistered persons where the invoice value is more than Rs 2.5 lakh

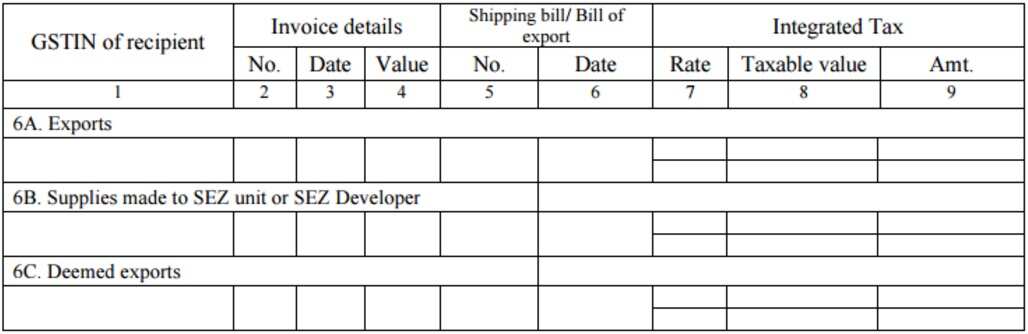

5. Zero-rated supplies and deemed exports

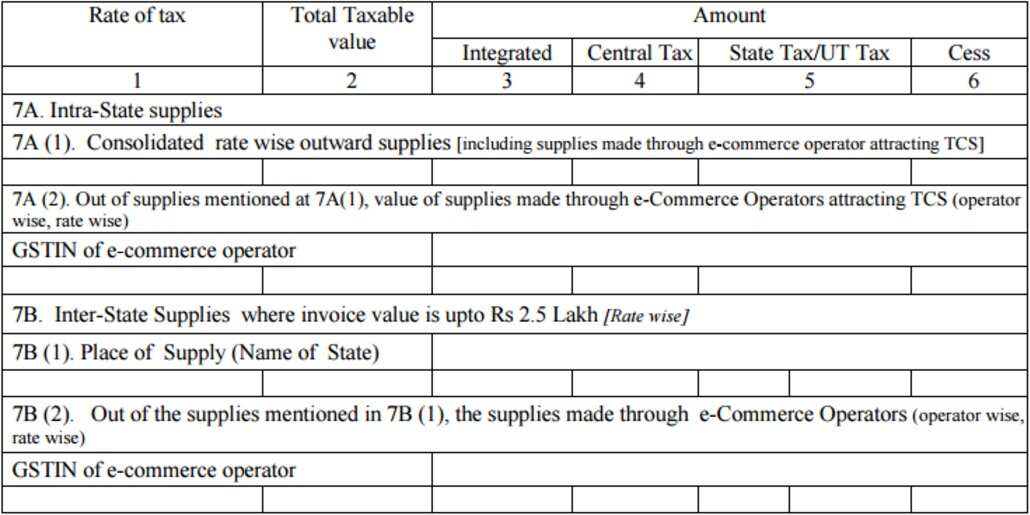

6. Taxable supplies (net of debit notes and credit notes) to unregistered persons other than the supplies covered in Table 5

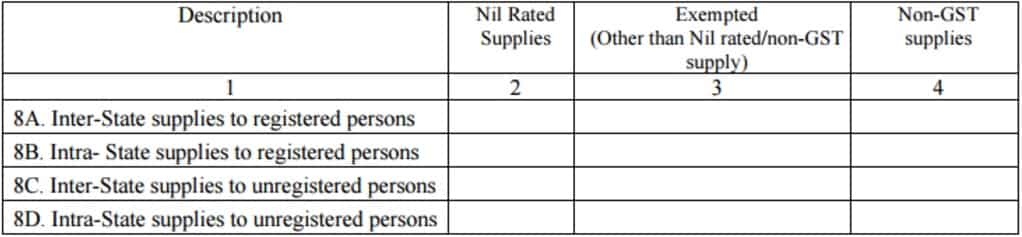

7. Nil-rated, exempt and non-GST outward supplies

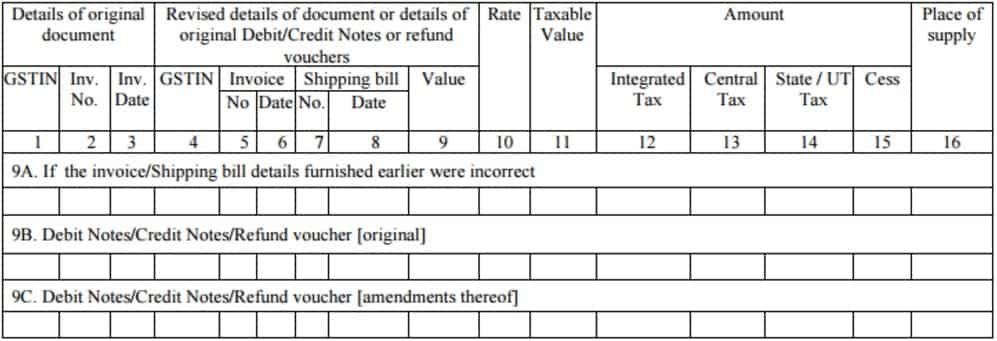

8. Amendments to taxable outward supply details

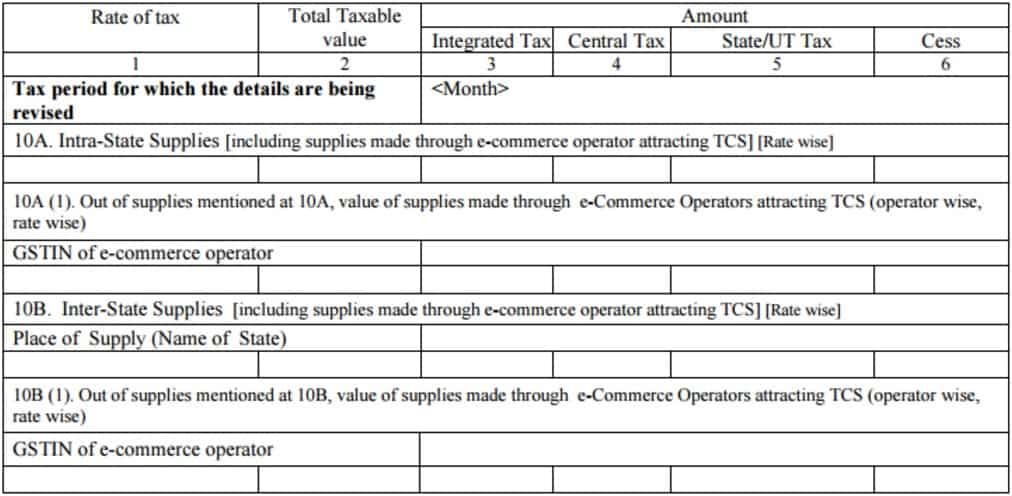

9. Amendments to taxable outward supplies to unregistered persons

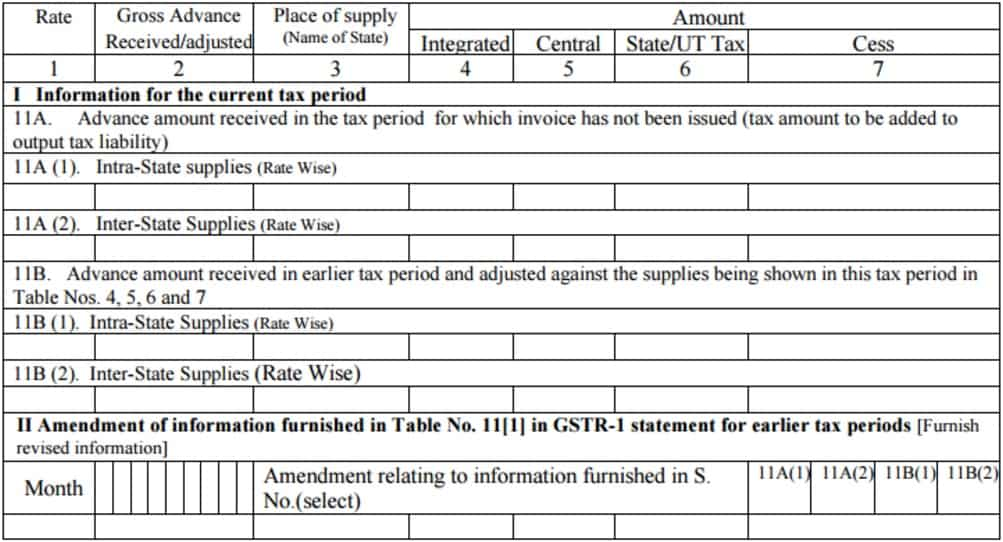

10. Consolidated statement of advances received/advance

11. Harmonized System of Nomenclature for goods-wise summary of outward supplies

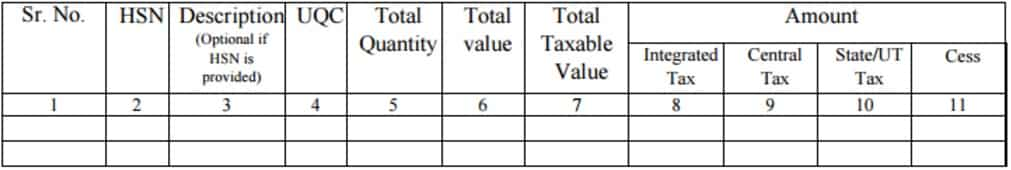

Here the taxable person will consolidate all his supplies across HSN codes. This section will also reflect high-level information on supplies made and IGST, CGST and SGST collected against it.

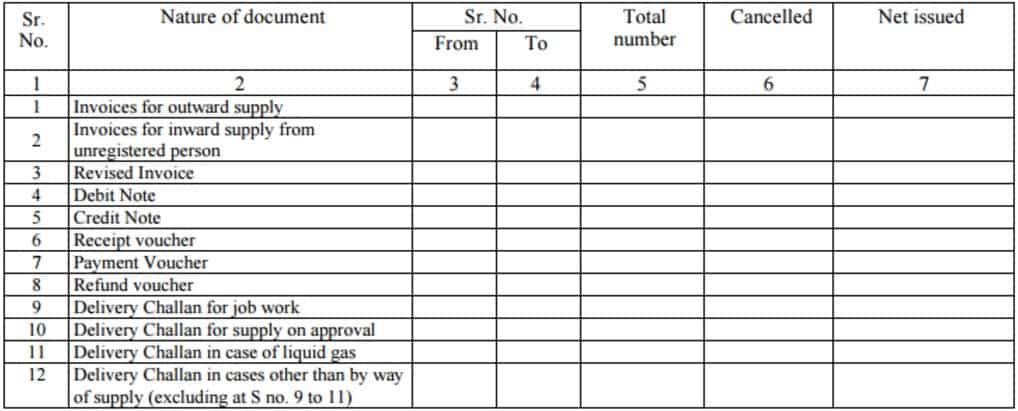

12. Documents issued during the tax period

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

LIC Saral Pension Plan: How to get Rs 64,000 annual pension on Rs 10 lakh one-time investment in this annuity scheme that everyone is talking about

Gratuity Calculation: What will be your gratuity on Rs 45,000 last-drawn basic salary for 6 years & 9 months of service?

Rs 1,500 Monthly SIP for 20 Years vs Rs 15,000 Monthly SIP for 5 Years: Know which one can give you higher returns in long term

Income Tax Calculations: What will be your tax liability if your salary is Rs 8.25 lakh, Rs 14.50 lakh, Rs 20.75 lakh, or Rs 26.10 lakh? See calculations

8th Pay Commission Pension Calculations: Can basic pension be more than Rs 2.75 lakh in new Pay Commission? See how it may be possible

SBI Revamped Gold Deposit Scheme: Do you keep your gold in bank locker? You can also earn interest on it through this SBI scheme

Monthly Pension Calculations: Is your basic pension Rs 26,000, Rs 38,000, or Rs 47,000? Know what can be your total pension as per latest DR rates

03:47 PM IST

Average tax under GST dips from 15.8% to 11.3%: FM Nirmala Sitharaman

Average tax under GST dips from 15.8% to 11.3%: FM Nirmala Sitharaman Gems, jewellery industry urges govt to reduce GST to 1.25% on bullion, ornaments

Gems, jewellery industry urges govt to reduce GST to 1.25% on bullion, ornaments  GST Council to soon take decision on rates, number of slabs: FM Nirmala Sitharaman

GST Council to soon take decision on rates, number of slabs: FM Nirmala Sitharaman GST mop-up rises 12 per cent to Rs 1.96 lakh crore in January

GST mop-up rises 12 per cent to Rs 1.96 lakh crore in January  Beware! Fraudsters issuing fake summons related to GST; here is how to stay safe

Beware! Fraudsters issuing fake summons related to GST; here is how to stay safe