GST rate cuts: Investors tap stocks of these companies, boost them up from 2% to 10%; here’s why

The reason behind the rise of these stocks is because the council has trim down GST rates for about 100 items including FMCG and electronics ones.

The recent announcement by the GST council during their 28th meeting is boding well for somewhat six stocks on domestic equity indices today. The reason behind the rise of these stocks is because the council has trim down GST rates for about 100 items including FMCG and electronics ones. Thereby the move is taken very positively among investors as it would mean the prices would come down for their purchase product in coming days.

Here’s the list of the company that have risen on stock exchanges.

Share price of Dixon Technologies was trading at Rs 2,930 per piece above Rs 132.90 or 4.75% on BSE at around 1353 hours. The company has gained by as much as 5.98% so far in today’s trading session by touching intraday high of Rs 2,966 per piece.

Then was Voltas share price who were trading at Rs 565.60 per piece higher by Rs 14.10 or 2.56% on BSE. It has grown by 3.49% with intraday high of Rs 570.80 per piece.

Havells India gained tremendously the company was trading at Rs 607 per piece up by Rs 47.50 or 8.49% on BSE. It has surged by nearly 10% by touching intraday high of Rs 613.20 per piece.

Whirlpool of India share price jumped by Rs 48.30 or 3.16% trading at Rs 1,575 per piece. The company has gained by 4% so far today.

Share price of Kansai Nerolac Paints were also not far away as they grew by 2.54% trading at Rs 490 per piece on BSE. The company has gained by nearly 4% on the index today.

Also Asian Paints share price rose by 5% on stock exchanges. However, currently it was trading at Rs 1,411 per piece up by Rs 14.10 or 1.01% on BSE.

Crompton Greaves Consumer Electronics also rose by nearly 4% in today’s session. However, currently they are trading at Rs 237.45 per piece up by 1.39%.

Share price of Ashok Leyland was trading at Rs 108.80 per piece up by 1.26%. The company has gained by nearly 2% on BSE.

Passenger vehicle maker Tata Motors also surged by 2% on today’s trading session on BSE, however, it was currently performing at Rs 256.95 per piece up by 1.40%.

Blue Star was also among the companies who reacted well post GST rate cuts, as the company trading at Rs 669.85 per piece up by 1.96%. It has gained by 4% nearly.

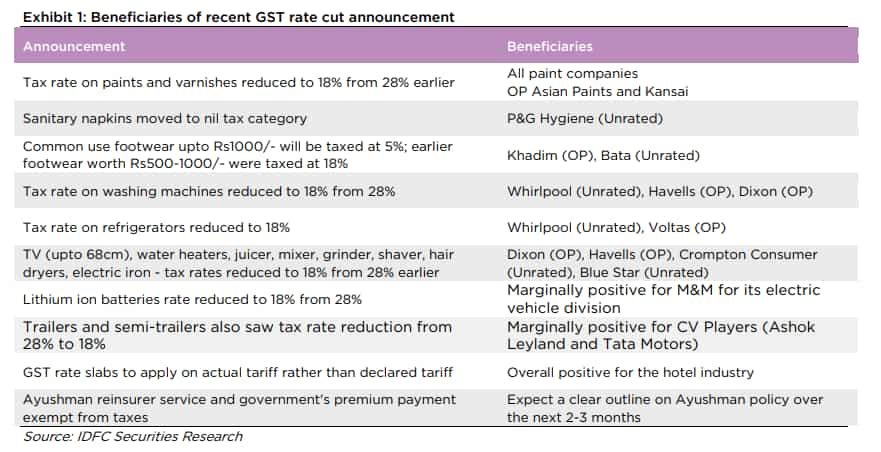

According to IDFC Securities, recently announced GST rate rationalizations (tax rate cuts across categories) bode well for domestic manufacturing (especially consumer goods), SMEs and rural/social sectors.

Analysts at IDFC add, “We also expect a boost to consumption demand in the economy, propelled by a fall in prices across products.”

Consequently, IDFC expects paint companies (Outperformer (OP) on Asian Paints and Kansai), P&G hygiene (Unrated), footwear manufacturers (OP on Khadim), Whirlpool (Unrated), Dixon (OP), Havells (OP), Voltas (OP) and select hotels to be key beneficiaries.

GST rate cuts in items:

28% to 18%

- Paints and varnishes (including enamels and lacquers)

- Glaziers’ putty, grafting putty, resin cements

- Refrigerators, freezers and other refrigerating or freezing equipment including water cooler, milk coolers, refrigerating equipment for leather industry, ice cream freezer etc.

- Washing machines.

- Lithium-ion batteries

- Vacuum cleaners

- Domestic electrical appliances such as food grinders and mixers & food or vegetable juice extractor, shaver, hair clippers etc

- Storage water heaters and immersion heaters, hair dryers, hand dryers, electric smoothing irons etc

- Televisions upto the size of 68 cm

- Special purpose motor vehicles. e.g., crane lorries, fire fighting vehicle, concrete mixer lorries, spraying lorries

- Works trucks [self-propelled, not fitted with lifting or handling equipment] of the type used in factories, warehouses, dock areas or airports for short transport of goods.

- Trailers and semi-trailers.

- Miscellaneous articles such as scent sprays and similar toilet sprays, powder-puffs and pads for the application of cosmetics or toilet preparations.

28% to 12%

Fuel Cell Vehicle. Further, Compensation cess shall also be exempted on fuel cell vehicle.

18%12%/5% to Nil

- Stone/Marble/Wood Deities

- Rakhi [other than that of precious or semi-precious material of chapter 71]

- Sanitary Napkins,

- Coir pith compost

- Sal Leaves siali leaves and their products and Sabai Rope

- PhoolBhariJhadoo [Raw material for Jhadoo]

- Khali dona.

- Circulation and commemorative coins, sold by Security Printing and Minting Corporation of India Ltd [SPMCIL] to Ministry of Finance.

12% to 5%

- Chenille fabrics and other fabrics under heading 5801

- Handloom dari

- Phosphoric acid (fertilizer grade only).

- Knitted cap/topi having retail sale value not exceeding Rs 1000

18% to 12%

- Bamboo flooring

- Brass Kerosene Pressure Stove.

- Hand Operated Rubber Roller

- Zip and Slide Fasteners

18% to 5%

- Ethanol for sale to Oil Marketing Companies for blending with fuel

- Solid bio fuel pellets

18% to 12%

- Handbags including pouches and purses; jewellery box

- Wooden frames for painting, photographs, mirrors etc

- Art ware of cork [including articles of sholapith]

- Stone art ware, stone inlay work

- Ornamental framed mirrors

- Glass statues [other than those of crystal]

- Glass art ware [ incl. pots, jars, votive, cask, cake cover, tulip bottle, vase ]

- Art ware of iron

- Art ware of brass, copper/ copper alloys, electro plated with nickel/silver

- Aluminium art ware

- Handcrafted lamps (including panchloga lamp)

- Worked vegetable or mineral carving, articles thereof, articles of wax, of stearin, of natural gums or natural resins or of modelling pastes etc, (including articles of lac, shellac)

- Ganjifa card

12% to 5%

- Handmade carpets and other handmade textile floor coverings (including namda/gabba)

- Handmade lace

- Hand-woven tapestries

- Hand-made braids and ornamental trimming in the piece

- Toran

The changes would be applicable from 27th July and the impact on stocks in trade reflects a positive picture.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

03:46 PM IST

States not in favour of bringing ATF under GST, says finance minister

States not in favour of bringing ATF under GST, says finance minister 55th GST Council Meeting: No GST payable on penal charges levied & collected by banks & NBFCs from borrowers for non-compliance, says Nirmala Sitharaman

55th GST Council Meeting: No GST payable on penal charges levied & collected by banks & NBFCs from borrowers for non-compliance, says Nirmala Sitharaman  GST Council Meeting: Packaged & labelled popcorn with added sugar to attract 18% rate, decision on insurance products deferred

GST Council Meeting: Packaged & labelled popcorn with added sugar to attract 18% rate, decision on insurance products deferred  55th GST Council Meeting: Jet fuel inclusion, lower taxes on insurance policies to be considered

55th GST Council Meeting: Jet fuel inclusion, lower taxes on insurance policies to be considered GoM on GST rate rationalisation yet to submit report, GST Council to take final decision: CBIC

GoM on GST rate rationalisation yet to submit report, GST Council to take final decision: CBIC