GST definitely not happening in April, Kerala finance minister says

Goods and Services Tax (GST) implementation is definitely not happening in April, Kerala Finance Minister told reporters in New Delhi at the end of first day of discussions.

Goods and Services Tax (GST) implementation is definitely not happening in April, Kerala Finance Minister Thomas Isaac told reporters in New Delhi at the end of first day of discussions.

Delhi's Deputy Chief Minister Manish Sisodia too seconded the view and said that it is very difficult to meet April 1 deadline for GST. He said that dual control of assesses will be discussed tomorrow.

Isaac further said, "Cess on GST rate will be imposed on items other than demerit, luxury goods to compensate states for revenue loss from GST."

He further said, "Post demonetisation, more than Rs 55,000 crore will be needed to compensate states for revenue loss from GST."

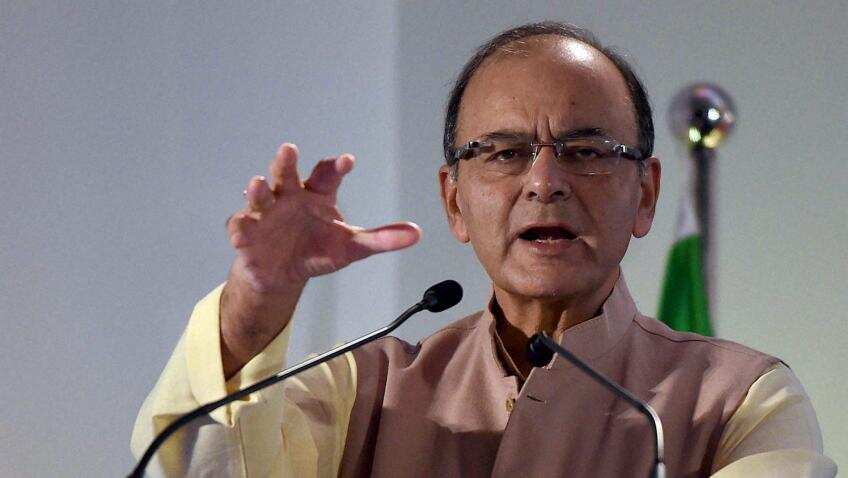

The GST Council was meeting in New Delhi today to discuss the implementation of the new GST regime. The meeting was chaired by Finance Minister Arun Jaitley.

This is the eighth meeting by the GST Council. The first meeting took place on September 22, 2016 and the last one happend on December 23, 2016.

After the last meeting, Jaitley had said, that the Council has made a 'reasonable headway' on supporting legislations and a discussion on Integrated GST law will take place in the next meeting. GST dual control and cross empowerment will also be discussed in this meeting.

In the last meet, the Council had finalised the compensation rules along with the Central Goods and Service Tax (CGST) clauses. CGST, is one of the three categories under Goods and Service Tax (CGST, IGST and SGST) with a concept of one tax one nation. CGST falls under Central Goods and Service Tax Act 2016.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

06:35 PM IST

States not in favour of bringing ATF under GST, says finance minister

States not in favour of bringing ATF under GST, says finance minister 55th GST Council Meeting: No GST payable on penal charges levied & collected by banks & NBFCs from borrowers for non-compliance, says Nirmala Sitharaman

55th GST Council Meeting: No GST payable on penal charges levied & collected by banks & NBFCs from borrowers for non-compliance, says Nirmala Sitharaman  GST Council Meeting: Packaged & labelled popcorn with added sugar to attract 18% rate, decision on insurance products deferred

GST Council Meeting: Packaged & labelled popcorn with added sugar to attract 18% rate, decision on insurance products deferred  55th GST Council Meeting: Jet fuel inclusion, lower taxes on insurance policies to be considered

55th GST Council Meeting: Jet fuel inclusion, lower taxes on insurance policies to be considered GoM on GST rate rationalisation yet to submit report, GST Council to take final decision: CBIC

GoM on GST rate rationalisation yet to submit report, GST Council to take final decision: CBIC