GST council meeting today: Cars, power to lotteries, here is how it may impact you

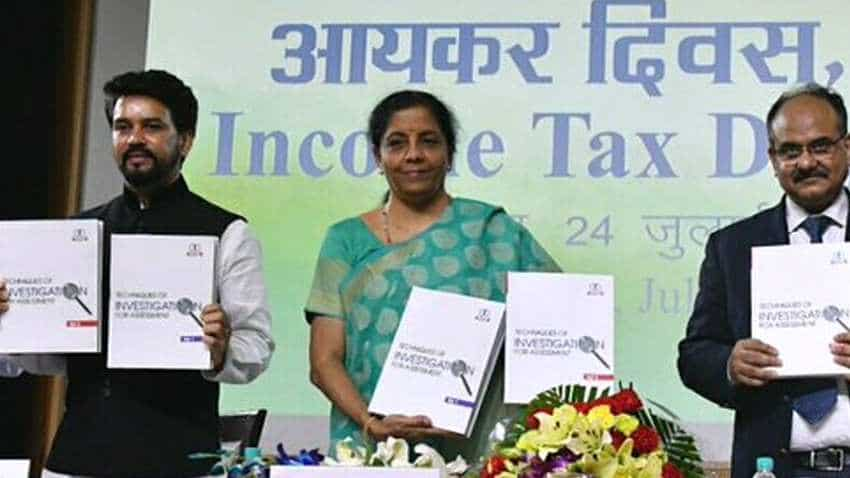

GST council meeting today: The 36th meeting of the Goods and Services Tax (GST) Council led by Finance Minister Nirmala Sitharaman is set to be held today. Notably, for citizens, there may be some big takeaways. Under focus is a decision on lowering tax rates for electric vehicles and this may well change the way everyone drives.

GST council meeting today: The 36th meeting of the Goods and Services Tax (GST) Council led by Finance Minister Nirmala Sitharaman is set to be held today. Notably, for citizens, there may be some big takeaways. Under focus is a decision on lowering tax rates for electric vehicles and this may well change the way everyone drives. The valuation of goods and services in solar power generating systems and wind turbine projects for the purposes of levying GST are also likely to be discussed in the meeting which will be held through video conferencing. The Council, which has state finance ministers as members, in its meeting last month, had referred the issue relating to Goods and Services Tax (GST) concessions on electric vehicle, electric chargers and hiring of electric vehicles, to an officers committee.

Earlier Centre had asked the Council to slash GST rates to 5 per cent from 12 per cent. The government had asked the same to push domestic manufacturing of e-vehicles. GST rate for petrol and diesel cars and hybrid vehicles is already at the highest bracket of 28 per cent plus cess.

Watch Zee Business LIVE TV Streaming online -

Apart from this, the Council will also discuss the tax structure for solar power projects. The Delhi High Court had asked the GST council to take a relook at the taxation structure following industry petition. Earlier this year, the government had said that for the purpose of taxing solar power projects, 70 per cent of contract value would be treated as goods -- taxable at 5 per cent, and balance 30 per cent as services -- taxable at 18 per cent. Meanwhile, the solar industry has been demanding a different ratio for splitting goods and services for levying GST.

GST Rates on Lotteries

Another key issue that could be discussed during the meeting is taxation of lotteries. In the previous meeting, the Council had decided to seek legal opinion of the Attorney General for levying GST. The GST rate on lottery falls under two brackets - 12 per cent on lottery run by the state government and 28 per cent on lotteries authorised by the state government.

The last meeting of the GST Council was held on June 21 where the last date for filing of GST returns for FY 2017-18 was extended by two months to August 2019.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

10:39 AM IST

Maharashtra will play key role in achieving India's $5 trillion economy goal: Minister Aditi Tatkare

Maharashtra will play key role in achieving India's $5 trillion economy goal: Minister Aditi Tatkare India's GDP growth to pick up in third quarter compared to first half of FY25: ICRA report

India's GDP growth to pick up in third quarter compared to first half of FY25: ICRA report GST collection grows 9% to Rs 1.87 lakh crore in October

GST collection grows 9% to Rs 1.87 lakh crore in October IMF says India's GDP growth to moderate to 7% in 2024 and 6.5% in 2025

IMF says India's GDP growth to moderate to 7% in 2024 and 6.5% in 2025  India poised to be third largest global economy by 2030, rising population presents challenges: S&P

India poised to be third largest global economy by 2030, rising population presents challenges: S&P