GST Bill: How will it impact realty, consumer goods, auto, pharma

Sachin Menon, Partner and Head, Indirect tax at KPMG India said, " With the passage of the bill in Rajya Sabha, the action will now shift to the corporate world. Due to the uncertainty on the fate of GST, many of the companies remain unprepared for the implementation of GST. "

The Rajya Sabha, on Wednesday, passed the 122nd Constitutional Amendment. This will pave way for introduction of Goods and Services Tax (GST) Bill in the parliament by November this year.

India Inc is happy that the Bill, in works for the past 13 years, may finally see light of day by April 1, 2017.

Sachin Menon, Partner and Head, Indirect tax at KPMG India said, "With the passage of the bill in Rajya Sabha, the action will now shift to the corporate world. Due to the uncertainty on the fate of GST, many of the companies remain unprepared for the implementation of GST."

What is the roadmap ahead for the sectors now that the bill has passed?

Telecom Sector: The service provided by this sector is been largely utilized by the common man. On overall impact on the sector Sachin Menon said, " As any other service sector the telecom sector will also will have to pay 3 to 5% higher taxes in GST regime. However, in the positive all the non-creditable state taxes become creditable under GST regime would moderate the increased tax burden.”

“The telecom industry will have a challenge to determine as to which state the service is provided so that they deposit the taxes in the right state. The place of supply rules differs from service to service, the IT systems need to be configured to capture the essence of place of supply rules,” added Menon.

Track Telecom sectors market performance on ZeeBusiness:

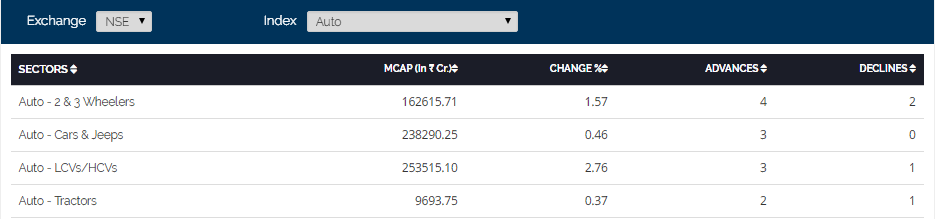

Automobile Sector: Market experts believe this sector is going to highly benefit from the bill. Rajeev Singh, Partner and Head, Automobile Sector, KPMG India said, “GST will have a significant positive impact on the automotive sector.

Currently, all passenger vehicles’ are taxed in four blocks of Excise Duty – 12%, 24%, 27% and 30% and this considered according to length of the vehicle, engine displacement and ground clearance. Also , there is VAT(value-added tax) which ranges from 12.5% to 14.5% and CST (central sales tax) of 2% for those vehicles sold outside their manufacturing place.

On taxes, Rajeev Singh said, “All these taxes are going to be subsumed into a single tax and all passenger vehicles are likely to fall in only two slabs - 18%/20% and 40%. This will result in reduction of cost of cars for the end consumer. Further it will also support OEM’s (original equipment manufacturer) - as the demand new vehicles will go up due higher affordability”

Track Automobile sectors market performance on ZeeBusiness:

Consumer Markets: GST Bill is expected to positively impact the overall value chain of this section.

Rajat Wahi, KPMG India said, A majority of consumer companies are looking to rationalize their supply chain cost. These will benefit from a uniform inter-state GST which will ease the movement of goods across states, encourage business expansion and facilitate easy procurement.

Wahi said, " The manufacturer and retailers are expected to benefit in terms of reducing their supply chain logistics costs by optimising and reducing their warehouses in fewer states, which will support in achieing supply chain optimization and lower costs incurred in logistics and storage. "

The consumer will relish benefit from reduced expenses as the goods are expected to become cheaper owing to companies passing on the cost and efficiency savings to the consumers. Further, input tax credit would enable the businesses to reduce the prices ahead.

Track the Consumer sectors market performance on ZeeBusiness:

Pharmaceutical sector: At present this sector faces multiple taxes at the central, state and municipal levels.

Utkarsh Palnitkar of KPMG India said, “We believe that the GST can mitigate the cascading effect of taxes and other anomalies of the present indirect tax structure in the country; it is also expected to streamline and simplify administrative and compliance-related functions that are crucial for a sound operating environment.”

“The bill may require the pharma industry to review their distribution strategy and re-work/re-design their networks. Most likely, there will be a need to move to a hub-and-spoke model with primary and secondary hubs across states which could also necessitate an overhaul in the way companies choose their warehousing network,” added Palnitkar.

Patnikar also pointed out concerns on the GST rate, he said these rate should be kept at competitive level so that there is no increase in prices of drugs & medicines.

Track Pharma and Healthcare sectors market performance on ZeeBusiness:

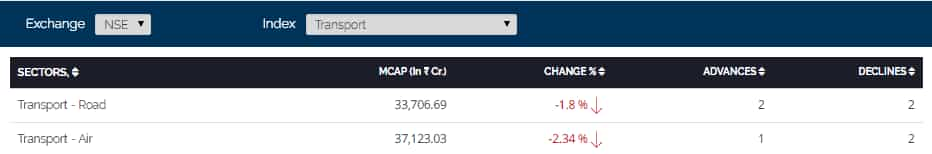

Transport and Logistics: Biswanath Bhattacharya, Government and Healthcare practice, KPMG India said, " The implementation of GST will lead to the reconfiguration of existing logistics networks over time, and thus the creation or development of new or expanded logistics hubs, the locations for which will be driven by commercial and economic efficiency, rather than regulatory considerations.”

Track the Transport and Logistic sector market performance on ZeeBusiness:

Financial Services: The banking sector are currently haunted by stress assets, the GST bill is expected to boost the gross domestic product and the economy of India ahead.

Naresh Makhijani of KMPG said, “Overall the challenges would be around the implementation of a proper IT (income tax) support system and also on various business decisions. The time frame required for adoption by various businesses will depend on the size and complexity of the business,”

“There are some ambiguities in the law as well as practical issues/difficulties in implementation for financial services, which will need to be addressed. Practical issues in determining the ‘place of supply’ for various banking transactions and multifold compliances to be carried out by the Bank considering their Pan India presence needs to be properly represented and discussed with the GST Council to get the same resolved at the earliest,” added Makhijani.

Track the Banking sector market performance on ZeeBusiness:

Other:

On E-commerce sector, Sreedhar Prasad, of KPMG in India said, GST will have a significant impact on the E-Commerce sector both E-Tailing and E-Services/ classifieds.”

Mohit Bahl on retail sector said, It is significantly impacted by GST. The sector is a consumption driven tax and the retail sector is the final touch point with the consumer. The impact is far-ranging, from local retailers to large corporations, each one of them will have to change their business models – where they source from, how they move goods, how they account for transactions, and tweak their IT systems to adapt to the change.”

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

04:33 PM IST

Nifty rallies towards 9,100-mark; Sensex up over 100 points

Nifty rallies towards 9,100-mark; Sensex up over 100 points Cabinet approves GST supplementary and compensation bills

Cabinet approves GST supplementary and compensation bills E-commerce companies to pay up to 1% TCS under GST

E-commerce companies to pay up to 1% TCS under GST Quasi-judicial body likely to curb profiteering post GST

Quasi-judicial body likely to curb profiteering post GST GST Council clears law for compensating states for loss of revenue, says Jaitely

GST Council clears law for compensating states for loss of revenue, says Jaitely