Govt won’t benefit much from low market borrowings, say economists

Economists pointed out that low government borrowing means softening bond yields. However, this has been more than offset by the high inflation and consequent policy rate hikes by the RBI.

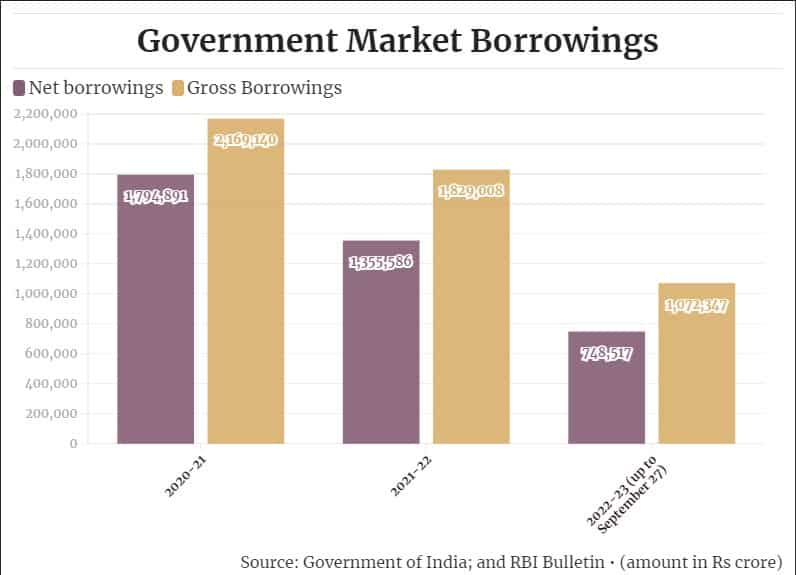

The Government Market Borrowings have come down considerably for both the state government and the central government in FY 2022-23 (up to September 27) shows the recent data released in the bulletin of the Reserve Bank of India (RBI). Between 2020-21 and this year, both the net borrowings and gross borrowings have come down by more than 50 percent shows the recent RBI data. The borrowings have been lower in the first half of the fiscal primarily on account of strong revenue inflows which states received in Q4 of last fiscal, but the total amount has increased from pre covid time, according to economists and analysts.

In the Union Budget 2022-23, gross and net market borrowings were placed at Rs. 14.95 lakh crore and Rs. 11.19 lakh crore, respectively.

Factors contributing to lower borrowings

Some of the major factors that contributed to the lowering of the borrowings include gross g-sec issuance and nominal GDP growth. Both these factors lead to better tax collection that helped the government to move towards its target of lowering borrowings, said economists.

The nominal GDP growth in the FY23 budget is 11.1per cent. However, due to high inflation, it is expected to be 16.8per cent. This simply means much higher tax collection than budgeted. The data so far shows that this indeed is the case. FY23 has budgeted direct tax collection at INR 14.09 trillion.

“As the direct tax collection in FY23 is expected to exceed budgeted estimate by INR 3-3.5 trillion and the expenditure ( including fertilizer subsidy and free food grain scheme) is unlikely to increase proportionately, the government is borrowing less than the budgeted amount,” added Dr. Sunil Sinha, Sr. Director and Principal Economist, India Ratings and Research.

Alongside this, The government’s total gross liabilities in Q1 FY23 increased to Rs 145.72 lakh crore from Rs 139.58 crore at the end of March 2022. The marginal downward revision was a positive surprise and likely reflects a buoyant tax collection trend.

“Post the pandemic formal sector growth has been much stronger which has resulted in a sharp pick-up in tax collection. Indeed, we estimate that net tax collection is likely to exceed Budget Estimates by Rs 2tn, led by a strong tax collection trend in direct and indirect taxes. This will counter some of the fiscal slippage risks but not all of them. We estimate expenditure could exceed Budget Estimate by INR2.7tn, led by higher subsidy expenditure (fertilizer, food and LPG subsidy),” said Gaura Sengupta, IDFC First Bank.

According to economists, the extra borrowing requirement can be covered by issuing more t-bills and drawing down on cash balances.

Low borrowing but high borrowing cost

Economists pointed out that low government borrowing means softening bond yields. However, this has been more than offset by the high inflation and consequent policy rate hikes by the RBI.

“Despite lower borrowing, the cost of government borrowing has not changed much. This also means the benefit of lower government borrowing is not benefiting other capital market participants as well, especially concerning the borrowing cost,” added Sinha.

Alongside, economists also cautioned that there is a growing risk of extra g-sec borrowing. As a percentage of GDP, various economists expect the Centre fiscal deficit to be at a Budget Estimate of 6.4per cent, with nominal GDP growth expected to be higher.

Compensating the lower borrowing

While the government has lowered the overall market borrowings, they are likely to take certain other measures to compensate for the same.

“Since the borrowings are low as of date, the state fiscal deficit levels will also be on the lower side. States also benefited partially from the 50-year interest-free loans provided by the central government as part of the Special assistance scheme for capital expenditures,” added Anuj Sethi, Senior Director, of CRISIL Ratings.

On the internals, the tax revenues will be much more than budget projection on account of greater compliance and a high double-digit nominal growth rate, asserted economists. “We estimate around Rs 3tn higher than budgeted tax collections for FY23 even after adjusting for Rs 1tn shortfall due to cut in excise on fuel. This should help the govt. offset the excess spending on food and fuel subsidy and thus overall fiscal deficit should be in line with budget projections,” said Ashhish Vaidya, Managing Director & Head - Treasury & Markets, DBS Bank India

Considering the buoyant tax collections, economists believe that the government will not need to contract capital expenditure and that augurs well for the economy. The government is also expanding PLI schemes to more sectors and this should reflect better export performance over the medium term.

No sigh of relief

Despite lower borrowings this quarter, economists cautioned that the borrowings are likely to spike again in the upcoming quarters.

“The overall government borrowings show moderation due to lower borrowings by the state government in H1 FY23 on account of better fiscal positions. Transfer of tax devolution by the center, uncertainty over borrowings limits, an overhang of extra borrowings in the previous year all supported the better cash position of states in the first half of the year,” added Sakshi Gupta, principal economist, HDFC Bank.

Thus, going forward, state borrowings are likely to pick up as the GST compensation cess has come to an end and states spending both on revenue and Capex continue to rise. Moreover, the concern persists as the government borrowing (both central and state) continued to be high as compared to the pre covid time.

The government might struggle to get back to the borrowing amount as low as pre covid time due to increased social spending, lower collection in small saving schemes, and absorption of off-balance sheet borrowing of govt owned companies like FCI into the central govt deficit.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

08:01 PM IST