From Aadhaar linkage to farm loans upto Rs 3 lakh; Here's what Interest Subvention Scheme 2017-18 is about

RBI introduced various measures in the Interest Subvention Scheme for Short Term Crop Loans during the year 2017-18. The aim is to provide agriculture credit at affordable rate.

Key Highlights:

- Interest subvention scheme implemented by RBI and NABARD

- RBI advises banks to link Aadhaar of farmers while giving crop loans

- Short-term crop loans up to Rs 3 lakh will be charged at interest rate of 7% p.a

In a move to make available agriculture credit at affordable rate, the Reserve Bank of India (RBI) on August 17, introduced various measures in the Interest Subvention Scheme for the year 2017-18.

RBI said, “To ensure hassle-free benefits to farmers under Interest Subvention Scheme, the banks are advised to make Aadhar linkage mandatory for availing short-term crop loans in 2017-18.”

Further, under the scheme, short term crop loans upto Rs 3 lakh will be provided at an interest rate of 7% per annum in FY18 to the farmers, with an interest subvention of 2% per annum to lending institutions like Public Sector Banks (PSBs), private banks on use of their own resources.

Calculation of interest subvention of 2% on crop loan would be from date of its disbursement/ drawal up to the date of actual repayment of the crop loan by the farmer or up to the due date of the loan fixed by the banks whichever is earlier, subject to a maximum period of one year.

Additional interest subvention of 3% per annum has also been provided to such of those farmers who will make timely repayment of loans. Also farmers paying promptly as above would get short term crop loans at 4% per annum during the fiscal.

To discourage distress sale and to encourage them to store their produce in warehouses, the benefit of interest subvention will be available to small and marginal farmers having Kisan Credit Card for a further period of up to six months post the harvest of the crop at the same rate as available to crop loan.

In case of farmers affected by natural calamities, an interest subvention of 2 percent per annum will be made available to banks for the first year on the restructured loan amount.

Such restructured loans will attract normal rate of interest from the second year onwards.

All banks are asked to send their eligible pending audited claims of 2015-16 latest by August 31, 2017.

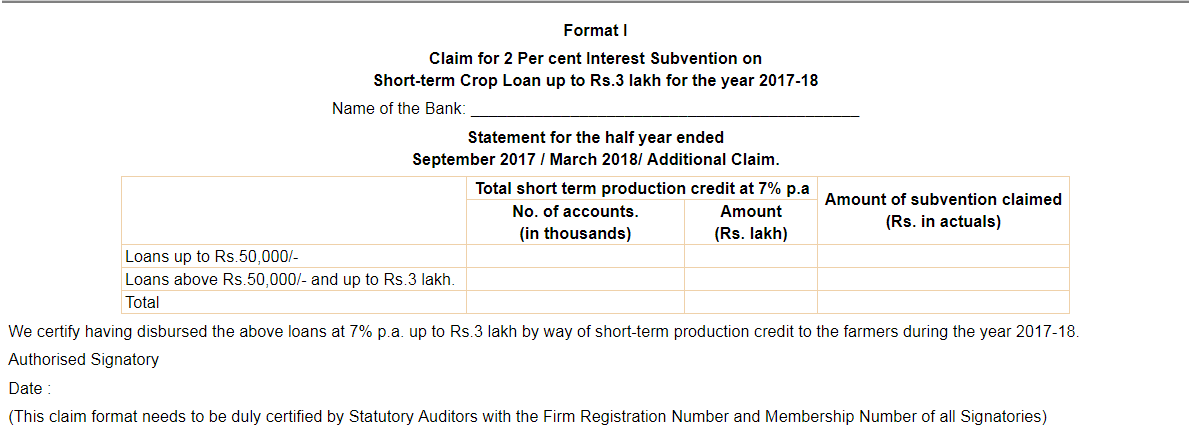

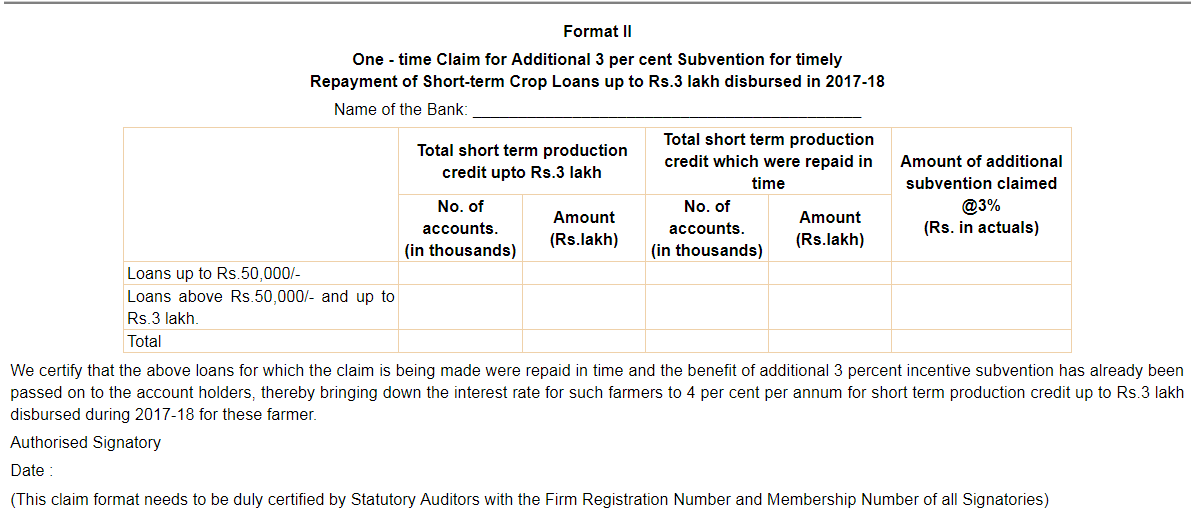

Here's an overview of the Formats for banks claiming the interest subvention.

Interest Subvention at 2% per annum.

Interest Subvention of 3% per annum.

Interest Subvention of 3% per annum.

On June 14, 2017, Union Cabinet chaired by PM Narendra Modi said, "Objective of the scheme is to make available at ground level, agricultural credit for short term crop loans at an affordable rate to give a boost to agricultural productivity and production in the country.”

Interest subvention scheme will continue for one year and it will be only implemented by the Reserve Bank of India and NABARD.

ALSO READ:Cabinet approves interest subvention on short-term crop loans; Here's are its features

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

01:55 PM IST

Electricity distribution companies continue to remain a burden on state finances: RBI

Electricity distribution companies continue to remain a burden on state finances: RBI Rupee hits all-time low; RBI intervenes to curb further losses

Rupee hits all-time low; RBI intervenes to curb further losses Rupee slumps to record closing low of 84.88 vs dollar

Rupee slumps to record closing low of 84.88 vs dollar Bank stocks rally up to 2% after RBI cuts CRR to 4%

Bank stocks rally up to 2% after RBI cuts CRR to 4% RBI raises retail inflation estimate for FY25 to 4.8% amid rising food prices

RBI raises retail inflation estimate for FY25 to 4.8% amid rising food prices