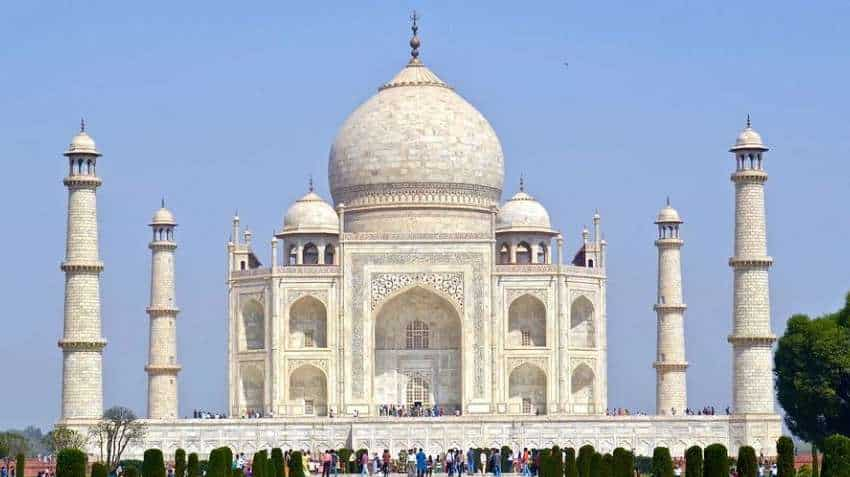

First-of-its-kind action! Archaeological Survey of India gets water, property tax notices for Taj Mahal

The ASI in Agra said the monuments are exempted from such taxes, but Municipal Commissioner Nikhil Tikaram Funde said notices have been issued to several buildings and those eligible will be given the relief.

The Archaeological Survey of India has been asked to pay a water tax of nearly Rs 2 crore, and a property tax of about Rs 1.5 lakh for the Taj Mahal, along with a Rs 5-crore service tax for the Agra Fort, in an apparent first-of-its-kind action by local authorities.

The ASI in Agra said the monuments are exempted from such taxes, but Municipal Commissioner Nikhil Tikaram Funde said notices have been issued to several buildings and those eligible will be given the relief.

The Agra Municipal Corporation's notices ask the ASI to pay a water tax of Rs 1.94 crore and a property of Rs 1.47 lakh for the Taj Mahal, and Rs 1.40 lakh as property tax for another monument, the tomb of Itmad-ud-Daulah.

The notices were issued for the financial years 2021-22 and 2022-23, and the ASI has been asked to pay up within the next 15 days.

In-addition, the Agra Cantonment Board has sent out a notice to the ASI to recover a service tax of Rs 5 crore for the Agra Fort, an official said.

Agra Circle ASI official protested the action by the municipality.

"The Taj Mahal, tomb of Itmad-ud-Daulah and the Agra Fort are national monuments that are exempted from such taxes," said ASI's Agra Circle Superintending Archeologist Rajkumar Patel.

He said the ASI takes care of about 4,000 monuments in the country and has not made any such payment before.

"It is the first time in my knowledge, and as per records, that the Archaeological Survey of India (ASI) has received notices of Water Tax from the Jal Kal Vibhag part of Agra Municipal Corporation (AMC) and Property Tax from the Agra Municipal Corporation for the national monuments Taj Mahal and the tomb of Itmad-ud-Daulah."

"We received a water tax notice of Rs 1.94 crore for the premises of Taj Mahal and nearby areas that are not mentioned clearly, but it is mainly for the Taj Mahal premises. Property tax of Rs 1.47 lakhs for the East Gate of Taj Mahal and Rs 1.40 lakh for the tomb of Itmad-ud-Daulah for property tax have been issued."

"In addition, we have also got a notice from the Agra Cantonment Board regarding a service tax of about Rs 5 crore for the Agra Fort. It is also a World Heritage Site and it is exempted from taxes. We have replied to them and mentioned that in the GST regime it is clearly notified that no service tax will be applicable on monuments."

Agra Municipal Commissioner Funde said, "The notice was issued to the ASI for the Taj Mahal and the tomb of Itmad-ud-Daulah after the first time assessment process of buildings through the Geographic Information Survey (GIS)."

The Agra Municipal Corporation (AMC) issues notices to every building whether it is a national, government, private or religious place, he said.

"If after that these buildings are eligible for tax exemption, we exempt them from tax," he said. "The same procedure will be followed with the Taj Mahal and the tomb of Itmad-ud-Daulah."

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

04:30 PM IST

Wedding Diaries by Hilton – A show studded with stars & celebrations at DoubleTree by Hilton Agra

Wedding Diaries by Hilton – A show studded with stars & celebrations at DoubleTree by Hilton Agra Taj Mahal to open for night viewing on during Sharad Purnima: Check dates, timings and ticket price

Taj Mahal to open for night viewing on during Sharad Purnima: Check dates, timings and ticket price  Elon Musk, mother Maye Musk remember Taj Mahal; Twitter users want Tesla cars in India

Elon Musk, mother Maye Musk remember Taj Mahal; Twitter users want Tesla cars in India Taj Mahal reopens: 5000 visitors to be allowed on day 1, masks mandatory

Taj Mahal reopens: 5000 visitors to be allowed on day 1, masks mandatory  Taj Mahal, Agra Fort to re-open from September 21 even as COVID-19 cases continue to grow

Taj Mahal, Agra Fort to re-open from September 21 even as COVID-19 cases continue to grow