Equity indices open 1.5% down; Sensex tanks 440 points

The shares of Tata Steel will be in focus as the company will be announcing its financial results for the quarter ended on June 30.

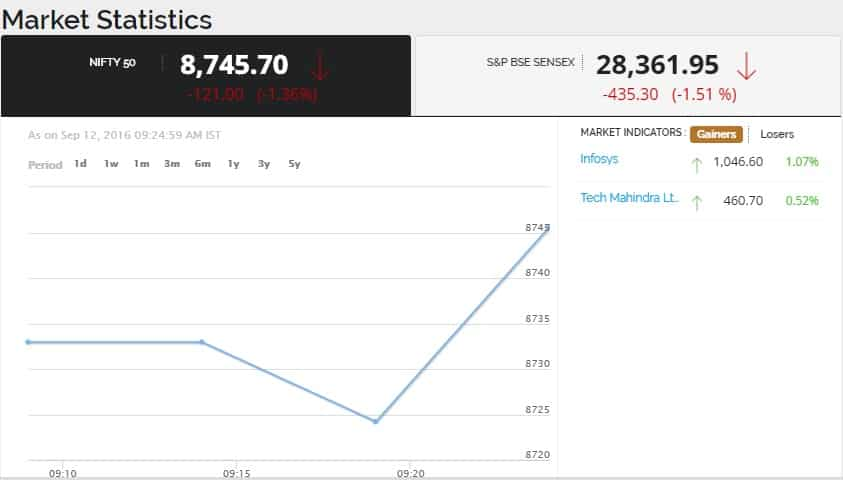

Indian equity markets on Monday opened in red as it slipped over 1.5% on the back of weak global cues.

At 0921 hours BSE Sensex was trading at 28,364.64, down 442.56 points, or 1.54%. While, NSE Nifty was trading at 8,732.20, down 134.50 points, or 1.52%.

On 30-share benchmark, among top gainers were only Infosys (0.70%) and Tata Consultancy Services (0.13%). Among losers were ICICI Bank (-3.16%), Hero MotoCorp (-2.86%), State Bank of India (-2.75%), Axis Bank (-2.67%) and Adani Ports (-2.54%).

All the sectors on BSE were trading down except IT sector (32.12 points). Among sectors, biggest losers were Banking (-541.20 points) and Auto (-498.43 points).

The Indian rupee opened lower by 20 paise at 66.88 per dollar versus previous close on Friday at 66.68.

The shares of Tata Steel will be in focus as the company will be announcing its financial results for the quarter ended on June 30. In the morning trade, the shares of the company were trading at Rs 382.90, down 2.94%, or Rs 11.60.

Also, market sentiments was influenced by investors trading cautiously ahead of July IIP data and August CPI data, which is due to be released later today.

As per the Reuters poll, the median forecast of 27 economists pegs CPI at 5.50% for August, down from 6.07% in July.

On global front, Asian shares skidded with investors rattled by rising bond yields and talk the Federal Reserve might be serious about lifting US interest rates as early as next week, a Reuters report said.

MSCI`s broadest index of Asia-Pacific shares outside Japan fell 1.9%, pulling away from a 13-month peak. It was the largest daily drop since the frenzy caused by Britain`s vote in late June to leave the European Union, the report added.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

09:58 AM IST

Final Trade: Sensex tumbles 1,200 points, Nifty slips below 23,600; IT stocks cushion the fall

Final Trade: Sensex tumbles 1,200 points, Nifty slips below 23,600; IT stocks cushion the fall Zomato set to debut in Sensex, replacing JSW Steel

Zomato set to debut in Sensex, replacing JSW Steel Sensex drops 170 points, Nifty below 23,950; oil & gas stocks rebound

Sensex drops 170 points, Nifty below 23,950; oil & gas stocks rebound FIRST TRADE: Equities fall for fifth consecutive day; Nifty holds on to 23,900 levels, Sensex down 208 pts

FIRST TRADE: Equities fall for fifth consecutive day; Nifty holds on to 23,900 levels, Sensex down 208 pts GIFT Nifty futures drop 60 pts; markets to open on a cautious note

GIFT Nifty futures drop 60 pts; markets to open on a cautious note