Equitas Holdings' Rs 2,200 crore-IPO price reasonable: Experts

The company is the first to enter the capital market for raising an IPO for the current financial year.

Equitas Holdings' Rs 2,200 crore-IPO, the first by a small finance bank, opened on April 5 has managed to attract bids for 94.8 lakh shares against 13.91 crore shares on offer as on Tuesday afternoon. Brokerage firms and experts have recommended investors to subscribe the issue.

Retail investors have subscribed for 92.15 lakh shares as against 6.93 crore shares on offer. The company's issue closes on April 7, Thursday.

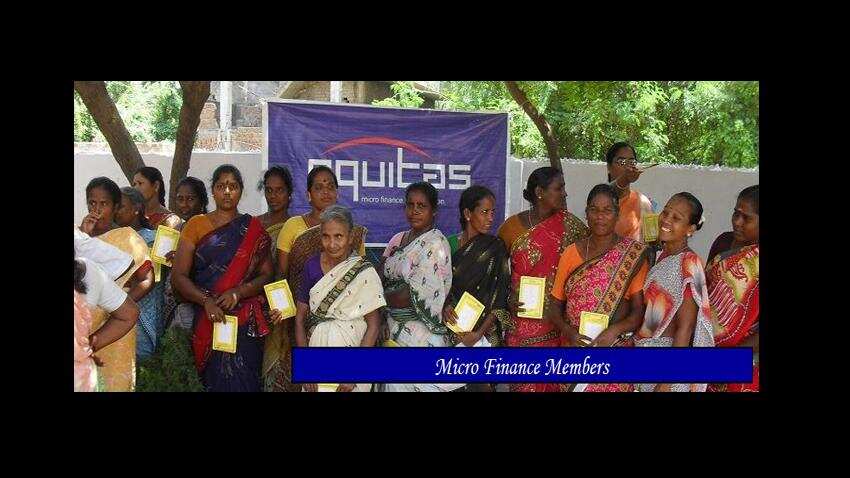

Equitas Holdings is a Non-Banking Financial Company (NBFC) founded in 2007 and has been in the business for two decades. It serves individuals and micro and small enterprises (MSEs) that are underserved by formal financing channels. Motilal Oswal, in its research note dated April 1 said, "Equitas is a well-established player and has a strong management team that can deliver business scalability."

The company is one of the 10 recipients of small finance bank (SFB) licenses issued by the Reserve Bank of India (RBI).

India is home to 21% of the world's unbanked adults and there are approximately 57.70 million small business units, mostly individual proprietorships, which operate manufacturing, trading or services activities. The company has developed an understanding of this segment and caters to individual and medium and small enterprise (MSE) customer segment that is underserved by formal financing channels. The report further said, "Return on Equity (RoE) (sub-10%) is likely to be subdued in initial years due to dilution and the initial cost of setting up banking operations."

The company's IPO price band is in the range of Rs 109 to Rs 110 and India Infoline Holdings Ltd (IIFL), another brokerage, sees the pricing as 'reasonable'.

Franklin Moraes and Rajiv Mehta of IIFL, in research note dated April 2, said, " We believe that pricing is reasonable given that it is lower than well run private sector banks and it also seems to sufficiently capture the likely compression in Return on Assets (RoA) over the next couple of years due to required investments."

Conversion to Small Finance Banks (SFBs) involves multiple challenges such as complying with shareholding norms, revamping the branch network, ability to manage liabilities and statutory requirements. According to IIFL Equitas, it will be able to navigate through the challenge successfully and evolve as a profitable small finance bank (SFB).

"Given impressive execution track‐record, strong reach and substantial customer base of Equitas, we believe it should be able to navigate the challenge successfully and evolve as a profitable small finance bank (SFB) after three-four years. Long‐term investors can subscribe in the Long‐term investors can subscribe in the IPO," added the two analysts from IIFL.

Anand Rathi Share and Stock Brokers sees healthy growth for the Equitas Holdings' micro-finance and home finance business in the coming years and advise investors to participate in the IPO.

"The company has been growing healthily at compounded annual growth rate (CAGR) 64% over last four years. Given the growth opportunity in microfinance and its entry into home finance business, the growth in the coming years is expected to be healthy. The valuation for FY16 earnings is approximate 23x which could fall down to 17x in the current financial year," said Ridhi Mehta of Anand Rathi Share and Stock Brokers in a research note on April 2.

"This valuation is also comparable to SKS Microfinance which has the same valuation though bigger in size in microfinance. We, therefore, recommend investors to participate in the IPO with 'Long Term Subscribe',” Mehta added.

Monarch Networth Capital has also echoed similar views on Equitas Holdings' valuations and it recommends investors to subscribe to the IPO issue mainly because of its experienced management team, increase in valuations in the longer term, among others.

"In our view, the stock is available at reasonable valuations," said Jyoti Khatri of Monarch Networth Capital in a note on April 1.

However, experts are also quick to point at the subdued Return on Equity (RoE) that the company might offer.

Motilal Oswal report said, "Return on Equity (RoE) (sub-10%) is likely to be subdued in initial years due to dilution and the initial cost of setting up banking operations. However, it has strong growth potential and can deliver +2% Return on Assets (RoA). At Rs 110 stock is valued at 1.88x trailing post money book."

"Given the niche customer segments they operate in, the profitability of small finance banks will be higher than that of conventional banks but lower than established NBFCs. However, for technical reasons, their RoEs will be suppressed over FY17-19," said Digant Haria of Antique Stock Broking in a research report on March 30.

Haria also said, "For a well-established player like Equitas, valuations at 1.7x post money book are reasonable, especially considering the fact that it can deliver strong growth and RoAs in excess of 2% post FY18."

Cholamandalam Securities, too, echoed the sentiment and in an April 1 report said, "We believe the post issue valuation at 1.8X P/BV looks reasonable considering the track record of the company, its future prospects post conversion to a small finance bank (SFB) and the synergies it could create by leveraging its existing large customer base and diverse product offering. Hence, we give out a subscribe recommendation on the IPO of Equitas Holding."

Experts are unanimous that Equitas Holdings' IPO subscription is reasonable and recommend investors to subscribe to it for the longer-term.

"Their business operations involve a large number of small transactions, mostly in cash, across hundreds of rural and urban locations. They have implemented standardised terms for their financing products, as well as standardised operating procedures for customer acquisition, customer engagement, account management and cash collection," Axis Capital said in a research note in April this year.

"They typically have separate teams for customer origination, disbursement, and collection aimed at improving operating efficiencies, productivity, and risk management," it said.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

03:54 PM IST

Zomato set to debut in Sensex, replacing JSW Steel

Zomato set to debut in Sensex, replacing JSW Steel Hamps Bio shares debut at 90% premium on BSE SME platform

Hamps Bio shares debut at 90% premium on BSE SME platform Traders' Diary: Buy, sell or hold strategy on Piramal Pharma, Vedanta, Thermax, Indus Tower, and other top stocks today

Traders' Diary: Buy, sell or hold strategy on Piramal Pharma, Vedanta, Thermax, Indus Tower, and other top stocks today Swiggy shares rise nearly 2% after Axis Capital initiates ‘buy’ rating

Swiggy shares rise nearly 2% after Axis Capital initiates ‘buy’ rating GIFT Nifty futures down 100 points; markets to track Fed meeting, Chinese data

GIFT Nifty futures down 100 points; markets to track Fed meeting, Chinese data