Did RBI consciously stop printing Rs 2000 currency notes?

If we look the RBI' annual report data closely, it indicates that the central bank printed heavily Rs 500 denominations but slowed down on Rs 2,000 denominations.

As demonetisation drive has already completed a year now, reports coming in hint at RBI's conscious move to stop printing the 2000 denomination notes/or printing in smaller numbers.

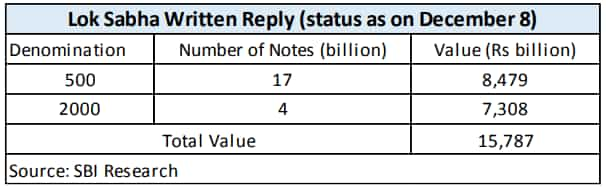

In a recent written reply to Lok Sabha, Union Finance Ministry stated that as many as 16,957 million pieces of Rs 500 notes and 3,654 million pieces of Rs 2000 notes were printed by the Reserve Bank of India as on December 8, 2017.

Total value of such notes together translates nearly Rs 15.79 lakh crore with Rs 500 currency notes valuing up to Rs 8.48 lakh crore and Rs 2,000 notes costing up to Rs 7.31 lakh crore.

If we look the RBI' annual report data closely, it indicates that the central bank printed heavily Rs 500 denominations but slowed down on Rs 2,000 denominations.

In RBI's annual report for FY17, till March 2017, the central bank printed 5,882 million pieces of Rs 500 currency notes and 3,285 million pieces of Rs 2000 currency notes, valuing Rs 2.94 lakh crore and Rs 6.57 lakh crore respectively.

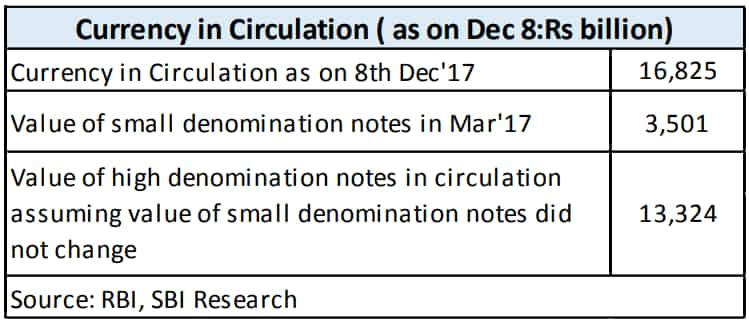

It was observed that RBI cumulatively printed nearly Rs 3.50 lakh crore small denomination currencies up to March 2017. And if we compare this data with Ministry of Finance, it shows that between April 2017 and December 8, 2017, RBI printed 11,118 million pieces of Rs 500 and just 715 million pieces of Rs 2000 notes.

Explaining it, SBI Ecoflash said, “This implies that the value of high denomination notes was equivalent to Rs 13,324 billion as on December 8 after we net out the small denomination notes from the currency in circulation on Dec 8.”

“This means that the residual amount of high currency notes (Rs 15,787 billion –Rs 13,324 billion) of Rs 2463 billion may have been printed by the RBI but not supplied in the market,” said the report authored by Soumya Kanti Ghosh, group chief economic adviser, SBI.

“It is safe to assume that Rs 2,463 billion may be on the lower side as the RBI must have printed notes of small denomination in the interregnum (Rs 50 and Rs 200),” the SBI report added.

If RBI printed more of small denomination notes that would mean it touched 35% in value terms of currency in circulation.

For Rs 2,000 notes, the report explains that considering this Specified Bank Note (SBN) led to challenges in transactions, therefore, RBI may have either consciously stopped printing the 2000 denomination notes / or printing in smaller numbers after initially it was printed in ample amount to normalise the liquidity situation.

RBI faced challenges while printing the high denomination notes, so much so that it's surplus to government more than halved to Rs 30,659 crore in FY17 compared to Rs 65,880 crore in FY16.

The SBI data highlighted that approximate cost of printing each note of new Rs 500 currency would have cost RBI in the range of Rs 2.87 to Rs 3.09 and for Rs 2,000 notes between Rs 3.54 to Rs 3.77. Till March 2017, RBI paid between Rs 3,690 crore for printing Rs 500 notes and Rs 3,980 crore for Rs 2000 notes.

So one reason can be of halting Rs 2,000 notes, due to its cost charges. But for now, we are still away from reaching the remonetisation level.

India's currency-in-circulation in value terms have reached to Rs 16.83 lakh crore as on December 8, 2017, compared to Rs 13.35 lakh crore in March 2017 and Rs 17.98 lakh crore on November 4, 2016.

It may be noted that RBI printed in heavy amount high denomination notes between January and March 2017, and has slowed printing from April 2017 till date.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

05:12 PM IST

Impact of Rs 2,000 notes withdrawal: Currency-in-circulation growth dips to 3.7% in Feburary

Impact of Rs 2,000 notes withdrawal: Currency-in-circulation growth dips to 3.7% in Feburary Petrol pumps in Kolkata see 10-times spike in payments in Rs 2,000 currency notes

Petrol pumps in Kolkata see 10-times spike in payments in Rs 2,000 currency notes Rs 2,000 notes withdrawn from circulation: Don't panic, this is NOT demonetisation

Rs 2,000 notes withdrawn from circulation: Don't panic, this is NOT demonetisation Rs 2000 Note India Latest News: Confusion cleared! Check update from Modi government

Rs 2000 Note India Latest News: Confusion cleared! Check update from Modi government Rs 2000 Notes ATMs News: No confusion now! Nirmala Sitharaman clears the air - Check what she said

Rs 2000 Notes ATMs News: No confusion now! Nirmala Sitharaman clears the air - Check what she said