Demonetisation: Steady activation of debit cards to boost ATM volumes for PSBs

Post demonetisation, Indian banks especially public banks are expected to see growth in the ATM volumes led by steady activation of debit cards.

With the continuation in demonetisation process, Indian banks, especially public banks are expected to see growth in the ATM volumes led by steady activation of debit cards.

During the month of November 2016, when demonetisation took place, somewhat 85% ATMs were re-calibrated for the new currency.

As per data released by Minister of State for Finance Santosh Kumar Gangwar in Lok Sabha stated that, a total 179,614 ATMs have been re-calibrated till November 30,2016.

Analyst of Kotak Institutional Equities expects, public sector banks (PSBs) to see massive rise in ATM volume in comparison with private banks post demonetisation.

For a PSU, onsite ATM is about 80% of their overall branch network but in case for a private banks this are lower at 35% as of September 30, 2016.

A data from Kotak revealed, from an ATM ownership perspective, the share of public banks has increased, especially since FY2013. Public banks have a total of 1.4 millon ATMs as of 2QFY17, which represents a share of 72% as compared to 0.44 million for new private banks, which holds 23% share.

Kotak believes potential for onsite ATM growth to be highest in PSU Banks. Till FY16, public banks grew by 15% to 78,693 onsite ATMs, from 68,382 ATMs in FY15. On the other, private banks saw just 2340 rise in onsite ATMs to 22,757 in FY16 compared to 20,417 of FY15.

The largest public sector lender – SBI has the highest share in ATMs at 30%. While, ICICI Bank, Axis Bank and HDFC Bank have approximately an equal share of 7% each. Other PSUs like – Bank of Baroda, Bank of India, Central Bank and Punjab National Bank has also recorded increase in ATM in the range of 3-5%.

Kotak said, “We note that most banks are being actively monitored by the government on their ATM deployment. We see a gradual increase in penetration outside urban/metro market in recent quarters.”

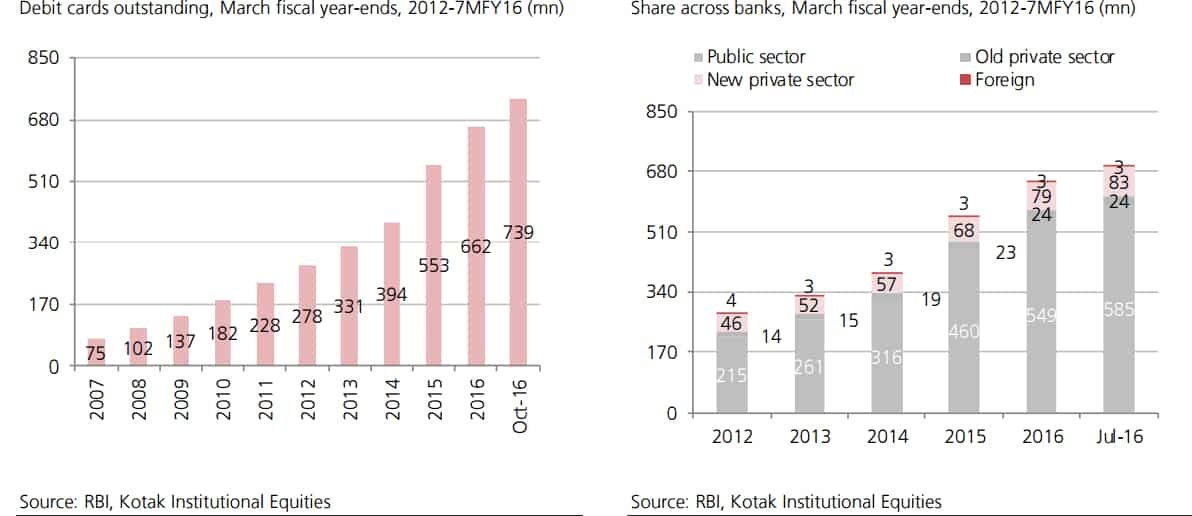

Along with the presence of ATMs today, banks are pushing more on issuing debit cards to the depositors. Since FY2007, the total number of debit cards issued has grown 7 times or 28% CAGR (compounding annual growth rate), for which Kotak feels is an important step towards moving towards an inexpensive medium of transaction.

Public sector banks have 83% share of debit cards issued. SBI takes the lead with 29% of market share followed by PNB at 7%. Among private banks - ICICI Bank, HDFC Bank and Axis Bank have a share of 3-5% of the total debit card issued.

Further, Jhan Dhan schemes is also expected to boost public banks. They account about 27% of the debit cards in PSBs.

Lastly Kotak said, " If we include the earlier scheme of zero-balance-accounts or no-frill-accounts, the figure could be higher for public banks. We see this is as progress in financial inclusion while the adoption of ATM is a positive for public banks as it eases capacity constraints."

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

10:39 AM IST

Hidden charges on SBI ATM cards: Is your money disappearing quietly?

Hidden charges on SBI ATM cards: Is your money disappearing quietly? Bank of Baroda's BOBCARD introduces EMI facility on UPI Payments - Here's how it works

Bank of Baroda's BOBCARD introduces EMI facility on UPI Payments - Here's how it works SBI, ICICI, Axis Bank Cards, and Mutual Funds: 5 key personal finance-related changes to look for in April

SBI, ICICI, Axis Bank Cards, and Mutual Funds: 5 key personal finance-related changes to look for in April  SBI Debit Card Charges: From April 1, brace for a Rs 75 hike in fees; catch latest details here

SBI Debit Card Charges: From April 1, brace for a Rs 75 hike in fees; catch latest details here RBI proposes customers should have option to choose card network

RBI proposes customers should have option to choose card network