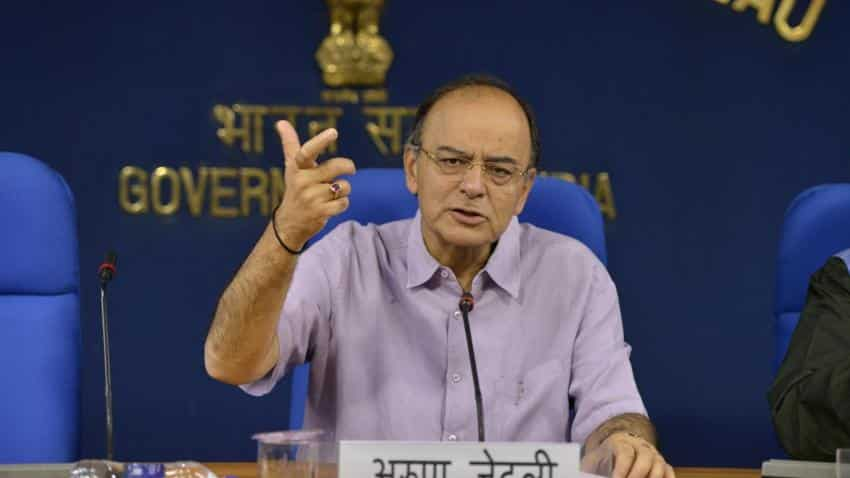

Demonetisation led to 'great movement' towards digitisation: Jaitley

Union Finance Minister Arun Jaitley today said the government was aware that demonetisation would cause a cash crunch in India but had envisaged long-term advantages like "great and substantial" movement towards digitisation of the economy.

"We were conscious of the fact that the demonetisation, to the extent that it causes a cash crunch made temporarily for a quarter or two impact on us adversely. But there were some long-term advantages which were envisaged," Jaitley told Bloomberg TV in an interview aired here.

Asked whether demonetisation has been a success, he said the first significant advantages that has taken place is that there is a "great and a substantial movement" towards digitisation of the economy.

"The use of cash relatively comes down, the use of other mode of payments increases. The second is, there is a substantial number of assesses who have been added," Jaitley said.

He also said that he anticipates a substantial increase in the tax base.

"I think the new normal has been established in India and a message is loud and clear that it's no longer safe to deal substantially in cash," said the finance minister.

Responding to a question, Jaitley said he does believe that India has carried on a large number of structural reforms in the last few years.

"With the kind of structural reforms which are setting in, the kind of public expenditure and the foreign direct investment we are getting in, I do expect the growth to turn around and improve this year," he said.

"I do believe that the net effect of demonetisation, that is the invigoration of the informal economy with the formal one. The GST is likely to set by the first of July this year," he said, hoping that with a good monsoon being forecasted this year, the growth would increase.

"The one important challenge that we have is with regard to a private sector investment, we do believe that the global curve is also turning, go turning slowly. Domestic consumption is improving. And hopefully, if we are able over the next one year or so, address the problem of the Indian banking system itself. We will again pick up significant growth," Jaitley said.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

09:54 AM IST

Rs 7,755 crore worth of withdrawn Rs 2,000 banknotes still in circulation

Rs 7,755 crore worth of withdrawn Rs 2,000 banknotes still in circulation 2,000-rupee note: A barrage of memes on social media as RBI presses 'exit' on 2,000 currency bill

2,000-rupee note: A barrage of memes on social media as RBI presses 'exit' on 2,000 currency bill Bye bye, Rs 2,000 banknote! 10 things to know about the bill that has been in circulation for 6 years

Bye bye, Rs 2,000 banknote! 10 things to know about the bill that has been in circulation for 6 years Finance Minister Nirmala Sitharaman says govt hasn't stopped banks from filling Rs 2000 notes in ATMs

Finance Minister Nirmala Sitharaman says govt hasn't stopped banks from filling Rs 2000 notes in ATMs Demonetisation in India: Timeline

Demonetisation in India: Timeline