Demonetisation: Can normalcy return in the next two months?

SBI believes that introduction of Rs 500 currency notes in large numbers will fill the much needed vacuum of serving as the medium of exchange in between Rs 100 and Rs 2000 rupee notes.

Prime Minister Narendra Modi had asked the people of India to give him 50 days to solve the problems of long queues that demonetisation process brought with itself.

However, it was soon realised that the issue is going to take much longer than that to resolve. With the December 30, 2016 deadline fast approaching, can situation normalise over the next two months?

Economic research unit of State Bank of India (SBI) said, "Our results indicate that 50% and 75% of the total value of extinguished notes can be supplied by Dec-end and Jan-end respectively, given the current phase of frantic printing. ”

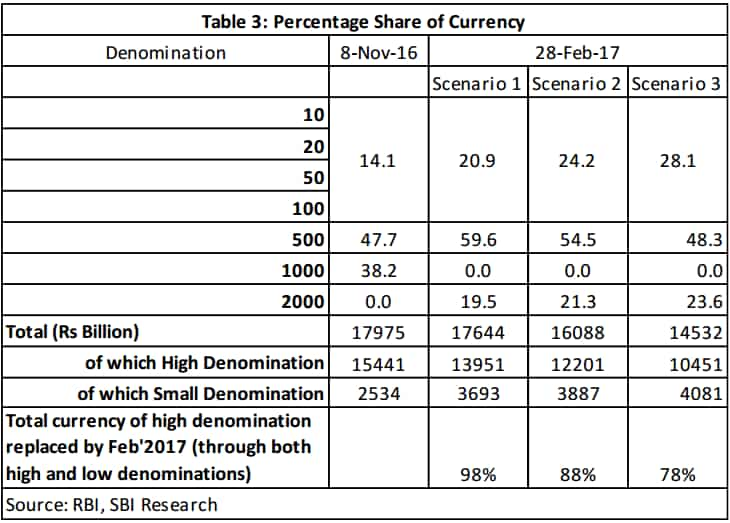

They added, “By the end of February, 78%- 88% of the currency could be back in the system under the best case scenario in terms of an optimal currency distribution (more small denomination notes). Clearly, it seems that within next 2 months things would be pretty close to normal. Interestingly, this number can go up-to 98% if we disregard the currency composition.”

As per last reports from Reserve Bank of India (RBI), over Rs 13 lakh crore have been deposited in banks and withdrawals of over Rs 4 lakh crore have been made.

SBI believes that introduction of Rs 500 currency notes in large numbers will fill the much needed vacuum of serving as the medium of exchange in between Rs 100 and Rs 2000 rupee notes.

“This is currently the largest operational hurdle, but we are convinced that such notes will come back in plenty into the system beginning December onwards, if we look at the current printing trends,” added SBI.

From November 10 – December 10, 2016, RBI printed 2180 crore notes of various denominations worth Rs 4,61,000 crore. Data supplied by RBI stated that from the total about 2010 crore notes were of small denominations worth Rs 1,15,900 crore, which indicates that the remaining amount of Rs 3,45,100 crore (1700 crore pieces) involved high denomination notes.

Following are the scenarios, SBI expects will support in cash crunch by February 2017.

The three scenarios show that RBI has to print more of Rs 500 notes to tide over this cash crunch situation at the earliest.

SBI said, "The best thing, however, is that with at least a 7% jump in small denomination currency share in overall currency post demonetization it would enable use of money more as a medium of exchange and thereby get accounted rather than as a store of value."

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

02:32 PM IST

Beware! Your bank ATM will shut down soon! Know when, why and how

Beware! Your bank ATM will shut down soon! Know when, why and how Exclusive! On ATM cash crisis, 2600 entities under scanner; govt targets those responsible

Exclusive! On ATM cash crisis, 2600 entities under scanner; govt targets those responsible Till when will ATM cash crunch last? SBI Chairman Rajnish Kumar gives deadline

Till when will ATM cash crunch last? SBI Chairman Rajnish Kumar gives deadline  ATM cash crunch: This is whom govt is blaming for currency crisis

ATM cash crunch: This is whom govt is blaming for currency crisis ATM currency crisis: What is to blame? Huge withdrawals in Telangana, Andhra, Karnataka

ATM currency crisis: What is to blame? Huge withdrawals in Telangana, Andhra, Karnataka