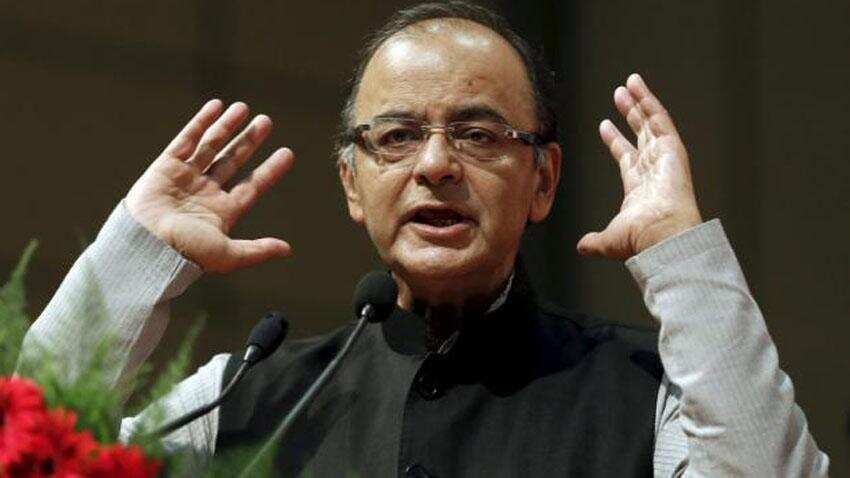

Defaulters won't be allowed to sleep well: Arun Jaitley

Jaitley, who was on a six-day visit to Japan to attract investments, said the losses were because of provisioning to cover for bad debt.

Amid 10 state-run lenders suffering losses of over Rs 15,000 crore in the March quarter, Finance Minister Arun Jaitley has promised greater capital support to banks while warning that defaulters cannot be allowed to "sleep well", leaving all the worry to bankers.

He also rejected suggestions that huge losses being posted by public sector banks (PSBs) were like "skeletons tumbling out", saying non-performing assets (NPAs) were mostly due to business-related losses in certain sectors, rather than due to frauds, and one must "distinguish between chalk and cheese".

Jaitley, who was on a six-day visit to Japan to attract investments, said the losses were because of provisioning to cover for bad debt and most of the banks including State Bank of India (SBI) and Punjab National Bank (PNB) had good profits at operational level.

"Look at the balance sheets of these banks. Punjab National Bank (PNB) operationally had a good profit, SBI had a good profit. It is the provisioning which makes it look like a loss," the Finance Minister told PTI.

Stating that non-performing assets (NPAs) or bad loans have always been there, Jaitley said, "Whether you keep it below the carpet or you bring it into the balance sheet... I think a transparent balance sheet is the best way of doing business and that's what the banks are today doing.

"I am very clear, the government will fully strengthen the banks and fully support the banks where it is needed. I have declared a figure in the Budget, but I am willing to look at a higher figure if that is necessary." On measures being taken to empower the banks, he said bankruptcy law is one empowerment while the strategic debt restructuring (SDR) mechanism of Reserve Bank of India (RBI) is also there.

"What we are doing to several other recovery laws the Securitisation, Debt Recovery Tribunal (DRT) itself is an empowerment. Therefore, you cannot indefinitely have a situation where people who owe money sleep well and bankers have to worry. I think the people who owe these monies will also have to act," he said.

Asserting that all NPAs are not bank frauds, he said there may be some improper loans but there were a large volume of loans resulting from business losses or on account of sectoral losses.

"The loans were rightly given, sectors haven't done well. So to say that these are all skeletons stumbling out (is not correct). A business loss is not a skeleton. A skeleton is something which is done as a scam or a scandal and therefore we must be careful to distinguish between chalk and cheese as far as the banking NPAs are concerned," he said.

The Finance Minister said once the problem climaxes and the sectoral results start turning over, the situation would change.

Citing the example of PNB, he said the bank last year made a Rs 12,000 crore operational profit, which is not a low level of profit, but it declared loss because of NPA provisioning. "So it is the balance sheet provisioning which has led to that situation."

These NPA loans were not given recently, Jaitley added.

"These are old loans which relates to sectors which have been under stress. Those sectoral problems have been addressed significantly. In many of those sectors, the balance sheet has started changing and therefore, slowly it must relate to the banks itself and reflect on their balance sheet," he said.

Against the backdrop of mounting bad loans and record losses of public sector banks, Jaitley will hold a quarterly performance review on Monday with the heads of PSBs and Financial Institutions.

He would "review the overall performance of public sector banks (PSBs) during the financial year 2015-16 as well as with regard to the flow of credit to agriculture, insurance and MSE sectors among others", the Finance Ministry said in a statement.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

05:42 PM IST

PNB reports Rs 5,367 crore fourth quarter loss as bad loans surge

PNB reports Rs 5,367 crore fourth quarter loss as bad loans surge Public sector bankers wary of writing down bad loans: Arvind Subramanian

Public sector bankers wary of writing down bad loans: Arvind Subramanian IDBI reports Rs 1,736 crore net loss as bad loans touch 11%

IDBI reports Rs 1,736 crore net loss as bad loans touch 11% Bank of India Q4 net loss widens to Rs 3,587 crore as bad loans mount

Bank of India Q4 net loss widens to Rs 3,587 crore as bad loans mount