Debt issuance in bond market slows

Both issuance in corporate bond market and government securities has been at a slower pace since the start of FY18 this despite bank credit growth travelling history low.

Key Highlight:

- Debt issuance in corporate bond market growth was at 6.8% from April - August 2017

- Bank credit growth at historic low

- G-Sec issuance at Rs 2.94 lakh crore so far in FY18

India Inc has been shifting its fund raising needs from banks to the bond market.

However, its been more than five months now for the fiscal year 2017-18 (FY18) and the growth of corporate bond market and Gsec has also slowed down.

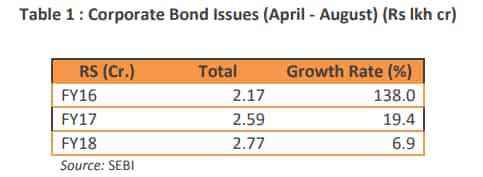

Total issuance in the corporate bond market between April – August 2017 – was at a single-digit growth of 6.8% compared to growth rate of 19.4% in same period of last fiscal (FY17) and 138% in FY16.

However, in value terms the issuance in corporate bond stood at Rs 2.77 lakh crore as against Rs 2.59 lakh crore in FY17 and Rs 2.17 lakh crore – revealing marginal rise.

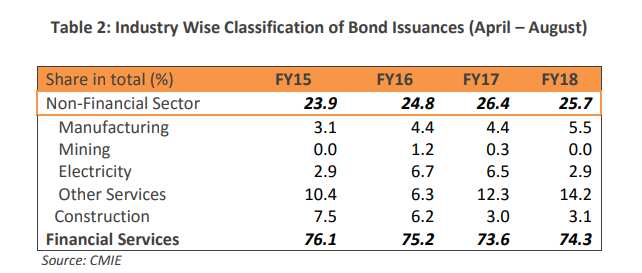

Financial services sector continues to dominate the corporate bond market. If looked closely, financial services performance, which stood at growth rate of 76.1% in FY15, decelerated to 75.2% in FY16 further to 73.6% in FY17 after growing by 0.7% to 74.3% between April – August 2017.

Borrowing from manufacturing and infrastructure too has been relatively low. This corroborates with the economy level data which shows low capacity utilisation in manufacturing and declining private investment in infrastructure.

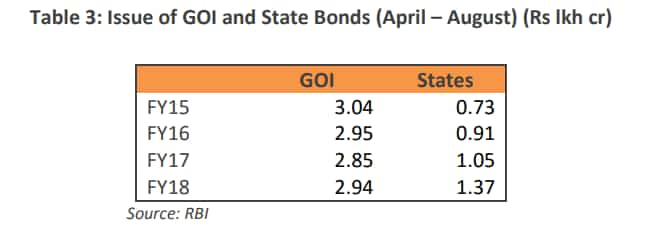

On the other hand, central government’s debt issuance remained largely stable for the period April to August at Rs 3.04 lakh crore in FY15, Rs 2.95 lakh crore in FY16 and Rs 2.85 lakh crore in FY17. In FY18 it was Rs 2.94 lakh crore.

The state issued debt has been growing for the corresponding periods, increasing from Rs 0.73 lalh crore, Rs 0.91 lakh crore, Rs 1.05 lakh crore and Rs 1.37 lakh crore in FY18 so far.

Thus, debt issuance from the bond market especially from the corporate ones has been reflecting gradual growth despite the bank credit growth reaching to six decade low of 5.01% in FY17.

Recent data compiled by the Reserve Bank of India showed this gross lending by banks stood at over Rs 69.45 lakh crore in July 2017 – recording growth of just 4.7% year-on-year (YoY) basis.

Can banking system do some magic?

Rating agency CRISIL in one of its report stated that bank credit growth to remain muted at 8-10% in fiscal 2018 yet higher from the estimated at 5%-8% in fiscal 2017, led by low industrial capital expenditure and continued refinancing through bond markets.

Ind-Ra believes tepid investment demand and excessive banking sector deposits are likely to force banks to increase their focus on capturing incipient credit demands, precisely for ‘AAA’ and ‘AA’ rated category borrowers. This could impact activities in the primary bond market.

It added that a further sharp downside in bond yields appears to be limited in the foreseeable future.

Moreover, stronger banks with relatively better capital could intensify competition by reducing deposit and lending rates simultaneously, thus benefiting borrowers with optimal cost and easy access to financing, as per Ind-Ra.

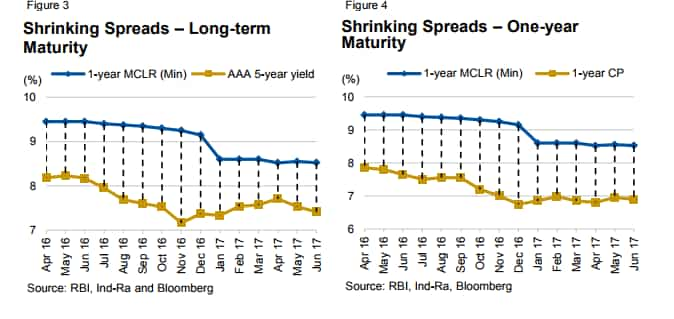

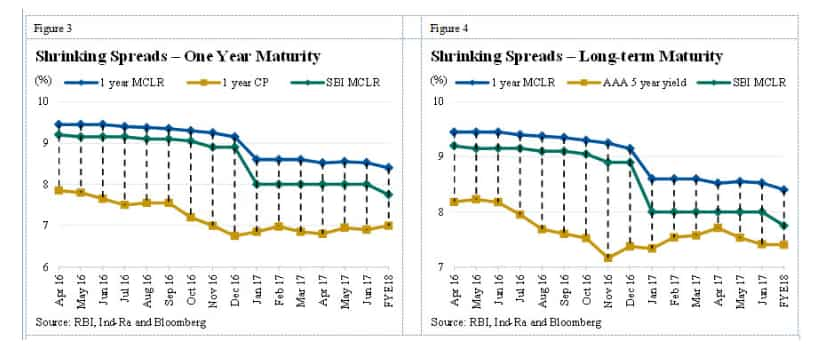

During January – March 2017 period, the base rate of banks came down from a range of 9.3 – 9.7% to 9.1% - 9.6% while the MCLR reduced from 8.95% to 7.75 – 8.20%. The one-year bank deposit rate had moved from the range of 7-7.5% in FY16 to 6.5-7% by March 2017.

Currently, short-term rates for commercial papers and rates for ‘AAA’ rated borrowers have tumbled in response to sloshing system liquidity and favorable demand-supply conditions, which have made banks’ lending rate costlier.

However, Ind-Ra believes in concurrence with the current development, banks can regain their market shares, while the scope for a further reduction in rates for the bond market appears limited.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

03:48 PM IST

We are open to idea of alternate financing models for MSMEs: Piyush Goyal

We are open to idea of alternate financing models for MSMEs: Piyush Goyal Bank credit grows by 15% in August in India, agriculture and industry pick up

Bank credit grows by 15% in August in India, agriculture and industry pick up Traders to discuss declining bank credit with Commerce Minister Piyush Goyal on Wednesday

Traders to discuss declining bank credit with Commerce Minister Piyush Goyal on Wednesday Bank credit to industry rises 8.5% in March: RBI data

Bank credit to industry rises 8.5% in March: RBI data Growth in bank credit to industry decelerates to 7.8% in January: RBI

Growth in bank credit to industry decelerates to 7.8% in January: RBI