Companies challenge Sebi over “shell” allegation

Companies have denied the shell allegation imposed by the Sebi on August 07, 2017. A list of 331 companies have been suspected as shell companies.

Key Highlights:

- Sebi identifies 331 listed firms as shell companies

- Sensex, Nifty at one-month low

- Few companies challenge the allegation of Sebi

A list of firms have shown their anger after being accused as “shell companies” by the market regulator Securities Exchange and Board of India (Sebi).

On August 07, 2017, Sebi directed BSE, National Stock Exchange (NSE) and Metropolitan Stock Exchange to identify listed companies out of the list of 331 suspected shell companies received by the Ministry of Corporate Affairs vide letter dated June 09, 2017.

These 331 companies have been moved to stage VI of Graded Surveillance Measure (GSM) under which trading in the these firms will be permitted for trading once a month under trade-to-trade category.

Stock exchanges will be appointing an independent auditor to conduct audit of such listed companies and if necessary, even conduct forensic audit of such companies to verify its credentials/fundamentals.

Among the suspected list – companies like Prakash Industries, J. Kumar Infraprojects Limited, Parsvnath Developers Limited, Gallantt Ispat Limited, Gallantt Metal Limited, Inter Globe Finance and SQS India BFSI Limited have denied the allegation.

J.Kumar Infraprojects in its filing said, “It is hereby clarified that J.Kumar Infraprojects is not a shell company and the suspicion of the regulator is uncalled for. Our company's compliance track record both with the exchanges and registrar of companies have been impeccable.”

“We are seeking legal advice in the matter and we are approaching the regulator i.e Sebi requesting it to recall its direction qua us. We shall co-operate with all the authorities for any verification by them,” added J.Kumar.

While Parsvnath said, “You may also note that the respective stock exchanges have, in their enthusiasm to give effect to the impugned directions, already placed our stocks in the GSM stage VI category. Before placing our stocks in GSM stage VI, the stock exchanges ought to have initiated the process if verificaion of our credentials, which is the mandate of para (c) of the directions. Serious prejudice has been caused because of this to the company and its shareholders. Such a drastic action, without verification and cause, by Sebi, is not only unwarranted but also a misplaced action.”

Gallantt Group for its two subsidiary namely Gallantt Metal and Gallantt Ispat said, “The Circular does not purport to list out any reasons why our Company has been categorized as a "Shell Company" . We categorically deny that our Company could be categorized as a, "Shell Company" under any parameter or circumstances whatsoever.”

SQS BFSI stated that the notification issued is without following due legal process. List of 'suspected' has been identified without setting out the criterion applied or even a mention of the legal provisions relevant for such identification. There is no criterion or legal provisions that defines a 'shell company' thus the issuance of the notification against the company is arbitary.

NSE on August 09, has started collecting information about 48 firms, that are listed on its platform, out of the 331 suspected shell companies referred by markets regulator.

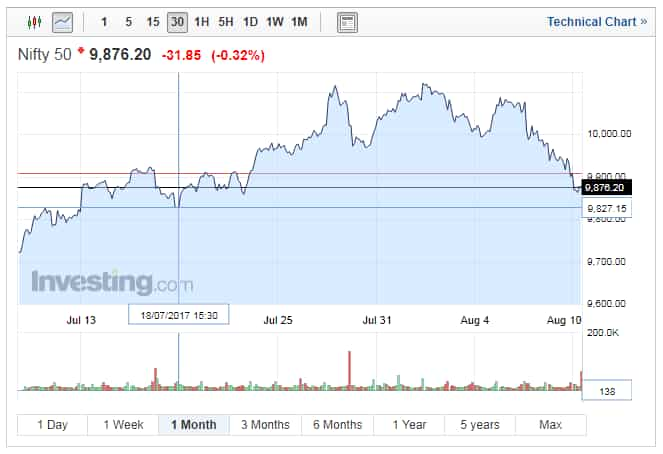

While the identification of shell companies continue, Sensex and Nifty both have reached to one-monthly low.

Sensex which touched a record high of 32,686.48 when August kicked off has now reached to even lower 31,670-mark – a level last seen on July 19, 2017.

Similarly Nifty which earmarked a 10,000-target on July 26, 2017, has given away all its gain in last three days by trading below 9,860-level.

Both Sensex and Nifty has dropped by nearly 3% in last three days.

ALSO READ

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

11:07 AM IST

Massive Action on Chinese Firms! MCA busts the racket of shell companies

Massive Action on Chinese Firms! MCA busts the racket of shell companies Rs 250 crore black income detected by I-T department after raids on Kolkata business group

Rs 250 crore black income detected by I-T department after raids on Kolkata business group Black Money: 2.25 lakh companies to be struck-off by FY19, all details here

Black Money: 2.25 lakh companies to be struck-off by FY19, all details here  PNB fraud: 200 shell firms, benami assets under ED, I-T dept scanner

PNB fraud: 200 shell firms, benami assets under ED, I-T dept scanner Disqualified directors of shell companies may soon get relief

Disqualified directors of shell companies may soon get relief