Cheque, cash transactions moderate post demonetisation: RBI study

Demonetisation were meant for flushing out black money, eliminate Fake Indian Currency Notes (FICN), to strike at the root of financing of terrorism and to give a big boost to digitalisation of payments to make India a less cash economy.

It has become more than a year now for PM Narendra Modi's demonetisation drive, and looks like the move has bear fruits in terms of electronic payment modes in India.

RBI in it's recent study report titled as “From Cash to Non-cash and Cheque to Digital: The Unfolding Revolution in India’s Payment Systems,” revealed that usage of cheques and cash transaction has seen reduction prior to demonetisation.

The data was grouped into three time buckets namely - pre-demonetisation period from April 2016 to October 2016; demonetisation period from November 2016 to March 2017; and post-demonetisation period from April 2017 to August 2017.

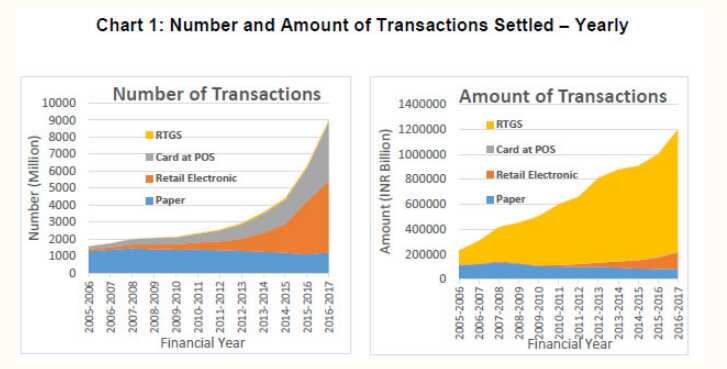

To capture the real impact of demonetisation, cash and non-cash transactions was categorised into groups viz., paper-based, retail electronic payment systems, cards at point of sale (POS) terminals, RTGS system and cheques.

From RBI's data it was observed that RTGS system has minimum volume but maximum value while retail payment transactions and card usage are growing in both volume and value terms.

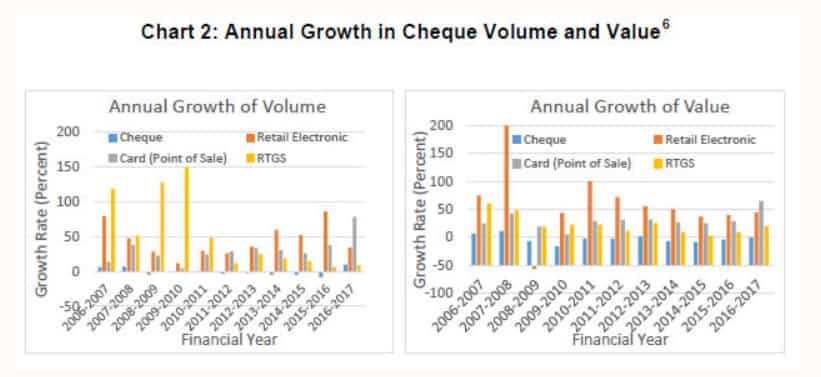

Even as retail payment systems, card transactions at POS, and the RTGS system have been growing steadily, while cheque volumes and values have shrunk from 2008-2009 to 2016-2017 except for 2012-2013 in value terms and 2016-2017 in volume terms.

RBI said, “Cheque volumes and values contracted during the pre-demonetisation period but recorded positive growth during demonetisation as well as post-demonetisation period. There was a sharp growth in card transactions at Point of Sale (POS) for both demonetisation and post-demonetisation periods.”

Increase in usage of cheques was an effect of noteban, as cash availability was restricted and this indicator became a convenient instrument to transfer funds.

RBI has intervened to reduce the usage of paper-based instruments on several dimensions.

Cap on service charges for electronic payment products and for outstation cheque collection that was prescribed since October 8, 2008, incentivised migration to alternate modes, viz., Real Time Gross Settlement (RTGS), National Electronic Fund Transfer (NEFT) and Electronic Clearing Service (ECS) transactions by bank customers.

As for card transactions, policy initiatives have been taken to enhance security measures like introduction of additional factor of authentication (AFA), separating merchant discount rates for debit and credit cards, and relaxing the AFA requirement for transactions up to Rs 2000 notes.

Overall RBI concluded, "Demonetisation impacted the inter-bank payment and settlement systems significantly in moving cash transactions to non-cash modes of payments in three segments, viz., retail electronic payments, card usage at POS terminals and cheques."

It added, "The increased usage of these three instruments during the demonetisation period has been sustained in the post-demonetisation period as well, suggestive of a fundamental shift being underway in payment habits of the Indian economy."

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

03:51 PM IST

Rs 7,755 crore worth of withdrawn Rs 2,000 banknotes still in circulation

Rs 7,755 crore worth of withdrawn Rs 2,000 banknotes still in circulation 2,000-rupee note: A barrage of memes on social media as RBI presses 'exit' on 2,000 currency bill

2,000-rupee note: A barrage of memes on social media as RBI presses 'exit' on 2,000 currency bill Bye bye, Rs 2,000 banknote! 10 things to know about the bill that has been in circulation for 6 years

Bye bye, Rs 2,000 banknote! 10 things to know about the bill that has been in circulation for 6 years Finance Minister Nirmala Sitharaman says govt hasn't stopped banks from filling Rs 2000 notes in ATMs

Finance Minister Nirmala Sitharaman says govt hasn't stopped banks from filling Rs 2000 notes in ATMs Demonetisation in India: Timeline

Demonetisation in India: Timeline