Can Rupee save India from rising wholesale inflation?

Siddharth Purohit Senior Equity Research Analysts – Banking of Angel Broking said, “We believe a strong rupee should result in lower crude oil prices for Indian basket and that should keep both CPI and WPI under check in the near term.”

India's wholesale price index (WPI) inflation which have been consistently rising since April 2016, eased down in the last month of financial year 2016-17.

As per Ministry of Commerce & Industry, the WPI inflation came down to 5.75% in March 2017, compared to 6.55% of February 2017. However rose against 0.45% in the same month of previous year.

source: tradingeconomics.com

Following the February numbers where WPI reached to 4-year high, analysts at Motilal Oswal and Care Ratings expected WPI to be around 6.3% for last month of FY17.

Also Read: WPI Inflation stood at 5.7% in March; Jan WPI revised

Siddharth Purohit Senior Equity Research Analysts – Banking of Angel Broking said, “The WPI for March cooled off to 5.7% vs 6.55% in February, largely due to softening manufacturing and fuel inflation. However, food inflation remained on higher side at 3.12% vs 2.69% mom due to higher vegetable prices. Out of the six major categories of WPI index five have show some cool off while the food inflation remains sticky.”

He added, “We believe a strong rupee should result in lower crude oil prices for Indian basket and that should keep both CPI and WPI under check in the near term.”

Similar opinion was from FICCI, Care Ratings and Motilal Oswal.

Pankaj Patel, President, FICCI said, "Further, the recent strengthening of Rupee vis-a-vis the USD will also contribute towards limiting imported inflation".

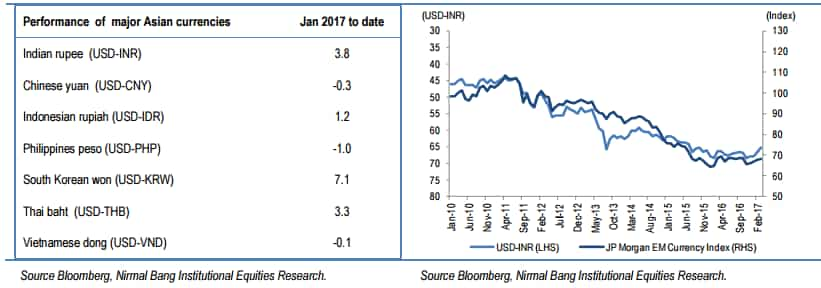

Indian rupee continues to outperform its Asian peers over the past three months and has touched 17- month high against US dollar. From January – March 2017, INR has appreciated by over 3% against dollar.

Rupee's performance till now has been an outcome of improvement in macroeconomic factors like decline in current account deficit (CAD), higher levels of foreign reserves and lower inflation.

A part of the appreciation-level was also added by PM Narendra Modi's BJP government win in Uttar Pradesh elections and US Federal Reserve 25 basis point rate hike which weakened dollar index further.

Due to above scenarios, foreign investors have become quite optimistic in Indian equity and debt market.

Foreign Portfolio Investors, who were net sellers in FY16 with Rs 18,176 crore, became net buyers in FY17 investing nearly Rs 48, 500 crore in Indian markets. FPIs have pushed a record of Rs 56, 261 crore in Indian capital market alone in March 2017.

Start of financial year 2017-18 has also been good so far. Within two weeks of April 2017, foreign investors have pumped in Rs 17,984 crore. This is a clear indication, that rupee will continue to appreciate against dollar.

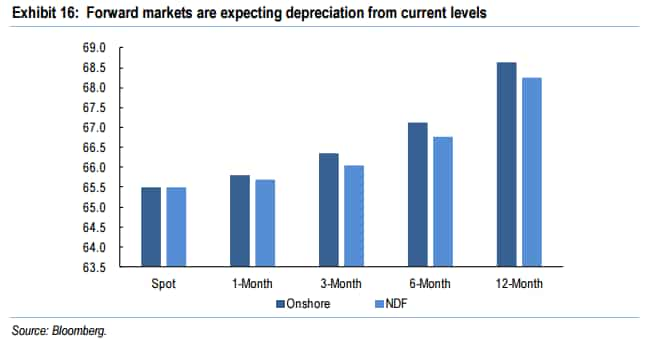

A survey carried out by Nirmal Bang stated that forward market expect rupee to depreciate further from the current levels.

Moreover while the INR may have outperformed its Asian peers in recent times, it has broadly moved in line with other emerging markets.

Nirmal Bang said, “This means that we are destined to witness intermittent bouts of appreciation and depreciation in tandem with portfolio flows.”

Vinod Nair, Head Of Research at Geojit Financial Services said, "Risk will emerge if we continue to outperform other EMs in the long-term, whereas this is an intermediary phenomenon led by strong FIIs inflow post the overwhelming state election result which will stabilize in the near-term."

Although economic factors have supported INR appreciation for now, the same factors are indicating a depreciating bias.

Teresa John, analyst, Nirmal Bang said, "Considering the fact that the US inflation target is 2% and India’s medium term inflation target is 4%, it implies depreciation of about 2% of the INR against the USD to maintain competitiveness. Besides, Indian inflation in the short term is expected to be around 5%+, which means that the depreciation could well be higher than 3%."

She added, “This relationship may not hold if interest rates in India rise significantly to curb inflation, attracting capital flows, which leads to strengthening of the currency. However, given the fact that interest rates are rising globally, and we are expecting only a calibrated increase in interest rates in India, we expect the relationship to hold true at least partially, which suggests a depreciation bias for the INR.”

Also Read: Wholesale Inflation eases in March but likely to rise going further

On an average, the USD-INR is expected at 68.5 in FY18 and 70 in FY19.

Meanwhile, monsoon is expected to haunt food prices from July – September 2017, which will indicate that WPI will rise further.

RBI, in its first bi-monthly monetary policy, has also shown concern over monsoon forecast, saying, “The main one stems from the uncertainty surrounding the outcome of the south west monsoon in view of the rising probability of an El Niño event around July-August, and its implications for food inflation.”

To determine INR appreciation, the central bank will also intervene by purchasing USD in times of heavy inflows and thereby limiting swings in INR.

Patel added, "Food inflation, however, has increased a bit, and this would require greater monitoring in light of the evolving weather conditions. The government is keeping a close tab on the progress made on irrigation projects, cold chain projects etc. and improvement in these areas is likely to yield positive results."

ICRA expects average WPI inflation to rise to 4.0% in FY2018 from 3.7% in FY2017, led by minerals and non food manufactured products.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Tamil Nadu Weather Alert: Chennai may receive heavy rains; IMD issues yellow & orange alerts in these districts

SIP vs PPF: How much corpus you can build in 15 years by investing Rs 1.5 lakh per year? Understand through calculations

SIP+SWP: Rs 10,000 monthly SIP for 20 years, Rs 25 lakh lump sum investment, then Rs 2.15 lakh monthly income for 25 years; see expert calculations

Top 7 Mutual Funds With Highest Returns in 10 Years: Rs 10 lakh investment in No 1 scheme has turned into Rs 79,46,160 in 10 years

SBI Senior Citizen Latest FD Rates: What senior citizens can get on Rs 7 lakh, Rs 14 lakh, and Rs 21 lakh investments in Amrit Vrishti, 1-, 3-, and 5-year fixed deposits

12:04 PM IST

WPI inflation in January eases to 4.73%

WPI inflation in January eases to 4.73% Wholesale inflation falls to 21-month low of 5.85% in November, FM Nirmala Sitharaman gives credit to PM Modi

Wholesale inflation falls to 21-month low of 5.85% in November, FM Nirmala Sitharaman gives credit to PM Modi Wholesale price inflation declines to 21-month low of 5.85% in November

Wholesale price inflation declines to 21-month low of 5.85% in November December wholesale price inflation eases to 13.56%; RBI may hold rates next month

December wholesale price inflation eases to 13.56%; RBI may hold rates next month WPI Inflation hits near 2-year low at 2.45% in May, 2019 - All details here

WPI Inflation hits near 2-year low at 2.45% in May, 2019 - All details here