Cabinet gives relief to rural banks, extends recapitalization scheme for more 3 years; all details here

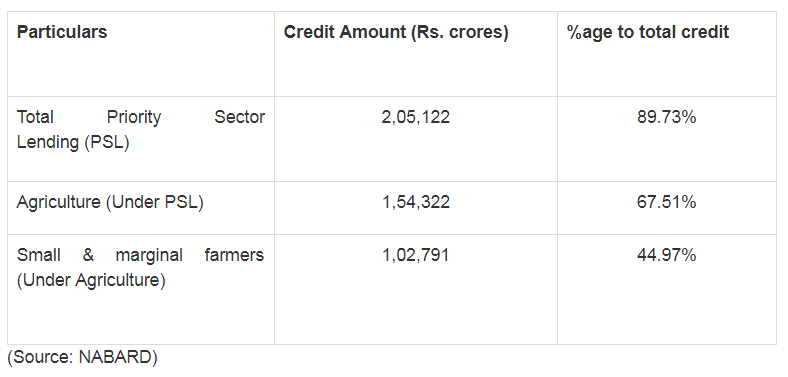

Currently, there are somewhat 56 RRBs functioning in India, and as on March 2017, these banks recorded credit of about Rs 2,28,599 crore.

The Union Cabinet chaired by the Prime Minister Narendra Modi today has approved the extension of the scheme of recapitalization of Regional Rural Banks (RRBs) for the next three years which is upto 2019-20. The cabinet highlighted that, this will enable the RRBs to maintain the minimum prescribed Capital to Risk Weighted Assets Ratio (CRAR) of 9%. The members of cabinet added, a strong capital structure and minimum required level of CRAR will ensure financial stability of RRBs which will enable them to play a greater role in financial inclusion and meeting the credit requirements of rural areas.

Currently there are some 56 RRBs functioning in India, and as on March 2017, these banks recorded credit of about Rs 2,28,599 crore.

Scheme of Recapitalization of RRBs started in FY 2010-11 and was extended twice in the year 2012-13 and 2015-16. The last extension of recapitalization was made upto March 2017.

A total amount of Rs 1107.20 crore, as Gol share, out of Rs 1450 crore, has been released to RRBs by end of FY17.

Thereby, remaining amount of Rs 342.80 crore will be utilized to provide recapitalization support to RRBs whose CRAR is below 9% from FY18 till FY20.

Identification of RRBs requiring recapitalization and the amount of capital to be provided, will be decided in consultation with NABARD.

The above mentioned movement is in addition to the announcement made in Finance Minister's Budget Speech for 2018-19 relating to allowing financially strong RRBs to raise capital from sources other than Gol, State Government and Sponsor Bank.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

06:19 PM IST

Union Cabinet approves 'One Nation, One Election' bill; key things to know

Union Cabinet approves 'One Nation, One Election' bill; key things to know GSI gets Cabinet nod for signing pact with Italy's CNR-IRPI on landslide forecast & early warning

GSI gets Cabinet nod for signing pact with Italy's CNR-IRPI on landslide forecast & early warning Cabinet clears Atal Innovation Mission 2.0 with Rs 2,750 crore outlay

Cabinet clears Atal Innovation Mission 2.0 with Rs 2,750 crore outlay Union Cabinet gives nod to Rs 1,000 crore VC fund for space startups

Union Cabinet gives nod to Rs 1,000 crore VC fund for space startups Cabinet approves 'Mission Mausam' to equip India with highly accurate and timely weather-climate information

Cabinet approves 'Mission Mausam' to equip India with highly accurate and timely weather-climate information