Budget 2019: Where does the rupee come from and where the rupee goes? Find out

Budget 2019: According to the budget document, major chunk of the central government's total income comes from corporate tax, GST, income tax and borrowings.

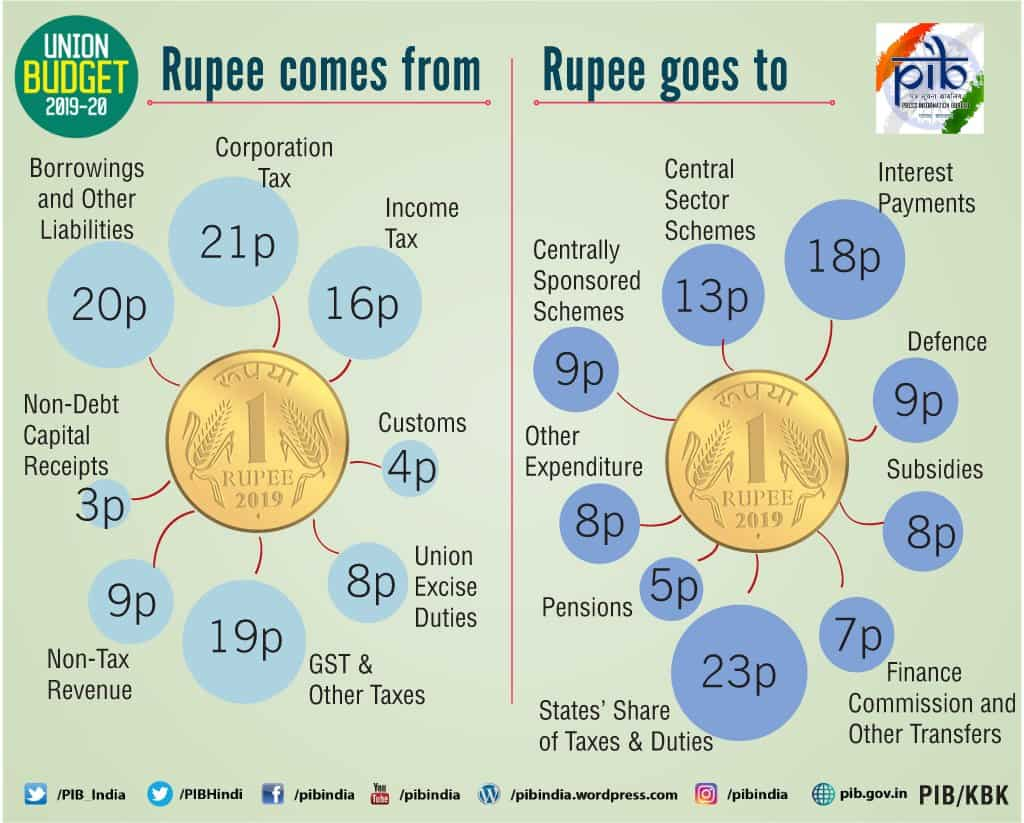

Finance Minister Nirmala Sitharaman tabled Union Budget 20190-20 in Parliament today, presenting the details of the government's income as well as expenditure. According to the annual financial statement, the biggest source of the government's income is corporate tax, while the largest share of expenditure is the amount earmarked to states by the Centre. These funds are given to states in the form of shares in tax and duty. In short, here is where the rupee comes from and where the rupee goes:

Where does the rupee come from?

According to the budget document, major chunk of the central government's total income comes from corporate tax, GST, income tax and borrowings. The Centre gets 21 percent of its total income from corporate tax, 20 per cent amount it receives through borrowings, share of income-tax is 16 per cent, while GST provides 19 per cent.

Apart from this, nine per cent comes from non-tax income, 4 per cent from custom, 8 per cent from central excise duty and 3 per cent through non-debt capital gains.

Where does the rupee go?

As far as the Central government's expenditure is concerned, the highest share goes to the states. The Centre gives 23 per cent of its total income to the states in form of shares in tax and duty. After this, 18 per cent of the total income is spent on paying the interest on the debt, 13% amount is spent in the central government schemes, while 9 per cent is spent on the centrally sponsored schemes. Apart from this, 8% is spared on subsidies, 9% on defence and 5% on pension.

Finance Minister Niramals Sitharaman also informed the house about the ten points of government’s vision given below:

1. Building physical and social infrastructure;

2. Digital India reaching every sector of the economy;

3. Pollution free India with green Mother Earth and Blue Skies;

4. Make in India with particular emphasis on MSMEs, Start-ups, defence manufacturing, automobiles, electronics, fabs and batteries, and medical devices;

5. Water, water management, clean Rivers;

6. Blue Economy;

7. Space programmes. Gaganyan, Chandrayan and Satellite programmes;

8. Self-sufficiency and export of food-grains, pulses, oilseeds, fruits and vegetables;

9. Healthy society – Ayushman Bharat, well-nourished women & children. Safety of citizens

10.Team India with Jan Bhagidari. Minimum Government Maximum Governance.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

06:07 PM IST

Social Stock Exchange: What is it? Will it benefit social enterprises in India?

Social Stock Exchange: What is it? Will it benefit social enterprises in India? Housing for all by 2022: Outlook positive for affordable housing in the next 3 years

Housing for all by 2022: Outlook positive for affordable housing in the next 3 years Hit by massive trouble, NBFC sector gets a big boost; here is how

Hit by massive trouble, NBFC sector gets a big boost; here is how Investment tips: These 10 stocks can help your wealth grow in July 2019

Investment tips: These 10 stocks can help your wealth grow in July 2019  Sensex crash! Rs 5.61 lakh crore of investor wealth wiped out in 2 days - 8 reasons why

Sensex crash! Rs 5.61 lakh crore of investor wealth wiped out in 2 days - 8 reasons why