Budget 2019 LIVE updates and analysis: Modi govt boosts Middle Class, Farmers, Workers' Josh!

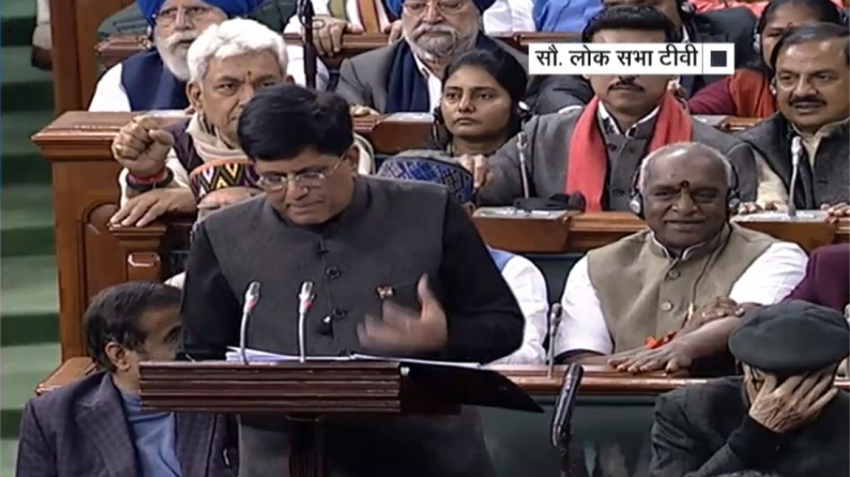

Interim Budget 2019 India, Income Tax Slab Rate Expectations: Budget 2019 will be presented by Finance Minister Piyush Goyal today.

Budget 2019 LIVE UPDATES: Welcome to Zee Business Online's LIVE Budget 2019 coverage. Union Minister Piyush Goyal presents Interim Budget 2019 in the Lok Sabha. Coming just a few weeks before political parties get into full election mode, Union Budget 2019 is expected to bring some cheer to the common man, especially farmers and job seekers. Some relief may also be announced for the government employees. For common taxpaying individuals, the budget is expected to raise the exemption limit to Rs 5 lakh from the current Rs 2.5 lakh.

Budget 2019 LIVE Streaming on Zee Business:

Check Budget 2019 LIVE Updates:

- Pawan Gupta, Co-Founder, Curofy, tells Zee Business Online: "The budget, as expected, had a lot for the farmers, and the middle class. The direct transfer for farmers and the tax cut for the middle class will be a big boost to consumption in the country especially in the rural areas. For startups, this will result in more and more people buying smartphones, and getting connected to the internet. Further, this should increase the number of people transacting online. The continuous increase in tax payer base is signalling that the economy is getting further formalised, which is extremely good for the country and the employees."

- Opposition reacts on Budget 2019: Former finance minister P Chidambaram Friday has termed the union budget as an "account for votes" and not a "vote on account". "It was not a Vote on Account. It was an Account for Votes," Chidambaram tweeted soon after the presentation of the Union Budget. He also thanked Finance Minister Piyush Goyal for "copying" the Congress declaration that the poor will have the first right to resources of the country. The senior Congress leader claimed that the government had missed the fiscal deficit target, as warned by him earlier.

1.30 pm: Arun Jaitley reacts on INterim Budget 2019:

- The Interim Budget presented by Piyush Goyal today marks a high point in the policy directions that the Government headed by Prime Minister Shri Narendra Modi has given to this nation.

- The Budget furthers the agenda of the Government headed by Prime Minister Narendra Modi ji to comprehensively address the challenges of the economy.

- Interim Budgets are also an opportunity for the Government of the day to introspect their performance of the last five years and place its facts before the people.

- The Budget expands spending while pragmatically sticking to fiscal prudence.

- The Budget is unquestionably Pro-Growth, Fiscally prudent, Pro-Farmer, Pro-Poor and strengthens the purchasing power of the Indian Middle Class.

- Between 2014-19, every Budget has given significant relief to the Middle Class.

12.50 pm: Guzar Didwania of Deloitte points out:

- Govternment recognises contribution of taxpayers in funding all the significant schemes

- Focus on clean rivers and safe drinking waters may result in announcement of big infrastructure projects by the Govt.

- Middle and small class taxpayers given some income tax benefit in this interim budget.

- Digitisation and complete overhaul of customs administration envisaged to eliminate any physical interface for clearance of imported and exported goods.

- Government claims credit for massive reforms and increase in exemption limits under GST for small traders, manufacturers and service providers comprising 90% GST tax payers.

- Rs 5 lakh exemption proposed is a huge benefit extended to small taxpayers ; likely to spur domestic consumption

- Digitisation and complete overhaul of customs administration envisaged to eliminate any physical interface for clearance of imported and exported goods.

- Government claims credit for massive reforms and increase in exemption limits under GST for small traders, manufacturers and service providers comprising 90% GST tax payers.

- Small taxpayers given a tax bonanza in the election year.

- No change in income tax rate but increase in income tax exemption is a gift to salary class tax payers.

12.40 pm: Decoded! Income Tax relief measured announceed by FM Piyush Goyal

- Benefit of rollover of capital tax gains to be increased from investment in one residential house to that in two residential houses, for a taxpayer having capital gains up to 2 crore rupees; can be exercised once in a lifetime.

- TDS threshold on interest on bank and post office deposits raised from 10,000 to 40,000 rupees.

- Standard tax deduction for salaried persons raised from 40,000 rupees to 50,000 rupees.

- Individual taxpayers with annual income up to 5 lakh rupees to get full tax rebate. Around 3 crore middle class taxpayers will get tax exemption due to this measure.

- "On behalf of all the people of India and our Government, thank all our taxpayers for their valuable contribution to nation-building and for providing a better quality of life to poor and marginalized," says Goyal.

- 12.35 pm: Joe Verghese, Managing Director, Colliers International India, says, “Proposal to give tax rebate for income up to 5 lakhs will help in increasing the home buyer's budget and can provide a big boost in increasing demand for housing.”

- 12.30 pmGagan Randev, National Director, Capital Markets and Investment Services, "The decision to fully exempt tax for Individuals upto 5 Lakhs (effectively 6.5 lakhs with Investment deductions) is a big step and massively positive for first time home buyers. With the benefits of the PMAY scheme, this would spur a lot of people sitting on the fence of thinking about their first home”.

- 12.25 pm: Aashish Agarwal, Head-Consulting Services at Colliers International India, says, “The government has reiterated their commitment to electric vehicles, but the Budget remains silent on tangible steps to provide the supporting infrastructure to achieve the objective. Collaborative commitment of utilities, planning agencies and real estate developers will be required to ensure sustainable adoption.”

- 12.20 pm: Finally, Modi govt announces massive Income Tax relief to middle class of income up to Rs 5 lakh!

- 12.22 pm: Interim Budget analysis for Real Estate: Gagan Randev, National Director, Capital Markets and Investment Services, says, “The point on vision of India over the next 10 years focusing on Infrastructure creation - physical and social bodes very well as it means even more focus on the “Housing For All” objective and ensuring that infrastructure - roads, social infrastructure become bedrocks as cities go outwards backed by strong infrastructure”.

12.20 pm: Shilpi Agarwal, Partner, TASS Advisors, says, "There are no major announcements regarding the direct taxes. This could be due to the interim budget. Government may have taken a call to defer the major announcements to new term."

12.17 pm: Gagan Randev, National Director, Capital Markets and Investment Services, says, "The acting FM Minister Mr. Goyal’s comment that 'The Govt has referred the matter of the high incidence of GST on home buyers to the GST Council, who are going through this in detail is encouraging and the industry and home buyers will remain hopeful that the changes will be communicated and implemented sooner than later”.

12.15 pm- Shipli Agarwal, Partner, TASS Advisors, says, "3% tax benefit on women owmed MSMEs which indicates strong movement towards women empowerment Increase in gratuity limit is quite encouraging and provides a relief to salaried class. It will result in tax saving up to 300,000 at the time of retirement."

12.14 pm: - Gulzar Didwania of Deloitte says, "Government has claimed credit for massive reforms and increase in exemption limits under GST for small traders, manufacturers and service providers comprising 90% GST tax payers. Coordination of GST council has been outstanding … significant reforms have been made during the last one and a half year and the same will continue."

12.12 pm- "Direct tax collections from 6.38 lakh crore rupees in 2013-14 to almost 12 lakh crore rupees; tax base up from 3.79 crore to 6.85 crore," says Goyal.

- "Simplification of direct tax system to benefit tax payers has resulted in increase of filingof tax returns and collection of direct taxes which is utilised to serve the poor and improve the infrastructure. Returns, assessments, and queries all are happening online which has resulted in reduction of personal interaction between the assesse and tax officer," says Sanjay Agarwal of TASS Advisors.

- "100000 digital villages to be created in next 5 years. A move to connected rural population with urban population a good move to support growth and development of poor," says Sanjay Agarwal of Tass Advisors.

"Digital india revolution - india is leading the world in consumption of mobile data which has increased 50 times in the last 5 years."

11.58 am: "Acceptance of increasing crude oil imports as indigenous production not substantially able to meet domestic requirements," says Gulzar Didwania of Deloitte India.

11.53 am: Government to create 1 lakh digital villages in five years, says Goyal.

11.51 am: Deloitte India experts say new scheme on Artificial intelligence is a futuristic scheme which may promote use of technology and digitisation

11.48 am: Budget for railway passengers: All unmanned railway crossings have been eliminated, says Goyal.

11.44 am: Atul Gupta, Senior Director, Deloitte India says GST compliant small scale registered persons to be recognised for granting loan at concessional rate. Likely to encourage compliance behaviour amongst small scale business units.

11.40 am: Atul Gupta, Senior Director, Deloitte India, says, "Introduction of PM Kisan Yojana - Direct income support of Rs.6000 per year for small farmers who own less than 2 hectares is a step in right direction to support small farmers."

11.39 am: Sanjay Agarwal, Partner, TASS Advisors, tells Zeebiz.Com,"Gratuity payment threshold limit raised to Rs 20 lakh from existing 10 lakh. This would ensure commitment to an employees to stay connected with a single employer for a longer term. ESI scheme threshold limit raised to Rs 21000 from the existing Rs 15000. This will ensure bigger coverage under this scheme."

11.34 am: Mega Pension Yojana, namely Pradhan Mantri Shram Yogi Mandhan, to provide assured monthly pension of 3000 rupees per month, with contribution of 100 rupees per month, for workers in unorganized sector after 60 years of age

11.32 am: High growth and formalization of economy has resulted in increased EPFO membership by 2 crore in last two years, says Goyal.

11.27 am: Government to set up a separate department of fisheries.

11.22 am: Big news for Farmers: To provide assured income support to small and marginal farmers, PM Kisan Samman Nidhi has been approved. Under the scheme, small farmers have up to 2 hectare land will get direct income support of Rs 6000 per year. This income support will be transferred directly into the bank account of beneficiary farmers in three installments of Rs 2000 each and it will be totally funded by government of India.

11.19 am: 22nd AIIMS to be opened in Haryana, says Goyal.

1.17 am: On Bank Recapitalization: Recapitalization of banks amounting to 2.6 lakh crore has been done of banks amounting to 2.6 lakh crore has been done, says Goyal.

11.15 am: "As a tribute to Mahatma Gandhi, world's largest behavioural change movement Swachh Bharat initiated; more than 98% rural sanitation coverage has been achieved; more than 5.45 lakh villages declared ODF; mindset change achieved, becoming a Jan Andolan," says Goyal.

11.13 am: On Current account deficit: Goyal says it is expected to be 2.5% this year. Inflation in December 2018 was 2.1%. Fiscal deficit has been brought down to 3.4% in the revised estimate of 2018-19. "Inflation is a hidden and unfair tax; from 10.1% during 2009-14, we have broken the back of back-breaking inflation," says the minister.

11.11 am: On Cleanliness: With Swachha Bharat Mission, India has achieved over 98% rural sanitation coverage. This is the largest behavioral change national movement ever launched in India, says Goyal.

11.09 am: Earlier only small businessmen faced the pressure of bank loans. Now, even large businessmen are facing the heat, says Goyal.

11.08 am: Fiscal deficit for 2018-19 at 3.4%, says Goyal.

11.04: Our government has broken the back of back-breaking inflation, says Goyal.

11.01 am: India is back on track, marching towards glory, says Finance Minister Piyush Goyal

11.00 am: Finance Minister Piyush Goyal starts Interim Budget speech. Hails reforms carried out by Narendra Modi government.

10.55 am: Pre budget customs duty expectations: Atul Gupta, Senior Director, Deloitte India tells Zee Business Online:

1. Increase in Customs duty on consumer goods to promote domestic manufacturing’

2. Decrease in critical raw materials import duties to encourage domestic production and manufacturing

3. Customs Law amendments for allowing the utilization of MEIS & SEIS scrips towards the payment of GST on imports and domestic procurements

4. Related party imports valuation process to be made simpler – doing away with Extra Duty Deposit

10.34 am: Will Homebuyers Get Relief in Budget 2019? Ankur Dhawan- Chief Investment Officer, PropTiger.com, tells Zee Business Online, "While there are talks to reduce the GST rates on housing, the average homebuyer under the current scenario needs much more support than ever before. Raising the income tax exemption limits on paying home loan interest is a potential way to incentivise homebuyers. Currently, the overall tax benefits is limited to Rs 2 lakh, which if raised to Rs 3 lakh can enhance the purchasing power of homebuyers in a significant way. Similarly modifying personal income tax slabs and reducing surcharges can provide additional income in the hand of home buyers. Typically governments do not provide changes in taxation structure in interim budget and only provide for expenditure but expectations are high this time as India has seen good growth in direct tax collection."

#BudgetWithZEE | @smcglobal के नितिन मुरारका से जानिए आने वाले नतीजों पर कमाई का ऑप्शन।#NitinKaPCR @nitinmurarkasmc #Budget2019 @AnilSinghviZEE pic.twitter.com/7m3aBhLv35

— Zee Business (@ZeeBusiness) February 1, 2019

10.14 am: Rail Budget 2019 - Minister of State for Railways Manoj Sinha tells news agency ANI that the way the government has increased the investment in railways, from installing CCTV cameras to WiFi, further investment in railways will certainly be increased.

10.12 am: Historic and unprecedented! PM Narendra Modi to make major announcement at 11:45 AM. This Budget 2019 may witness something unprecedented and historic. When there is PM Narendra Modi, we can expect big surprises as we witnessed demonetisation. Now, highly-placed sources have told Zee Business that PM Narendra Modi will make a major announcement from Parliament. This announcement is expected to take place around 11.45 AM. Reportedly, Finance Minister will start the Budget 2019 speech at 11 AM and thereafter PM Modi will take over to make a big announcement. READ MORE

10.02 am: Zee Business Exclusive: Surprise good news for investors! Piyush Goyal likely to remove LTCG tax in budget 2019 | Amid huge protest by the mutual fund and the equity investors, the Narendra Modi government may withdraw the LTCG (Long Term Capital Gains) on securities and the mutual fund investments. READ MORE

9.55 am: Budget 2019 expectation for real estate sector: Gagan Randev, National Director, Capital Markets and Investment Services, Colliers International, tells Zee Business Online:

The Real Estate industry is waiting with baited breath to see some positive steps that the Govt would take to reduce some of the stress that the sector has faced in the last couple of years. While there are a lot of expectations, the industry would be keenly awaiting good news on the following :

1. A reduction in the rate of GST for under construction units from 18% to 12% with Input Tax credit intact. This would be a spur to the industry. A delight item would be eliminating this all together. This would spur sales of under construction units.

2. A possible reduction in GST on Cement. This is taxed at an abnormally high rate of 28%. Cement is a very large component of construction cost and any reduction to say 18% would reduce construction costs significantly.

3. PMAY limit enhancement - PMAY has been a runaway success and has encouraged several first time home buyers to take the plunge. An increase in the income limit to say 25 Lakhs and /or increase in subsidy interest rates would encourage even more people to buy houses.

4. Enhancement of 80 C benefits - an increase in the 80 C benefits for Interest/Principal repayment benefits would again be a big relief to homeowners who have availed Home loans and also an encouragement to possible buyers to own vs rent.

5. Direction to the Banks to start lending to the RE sector - the industry is starved of funding - the NBFC’s have slowed down post the IL&FS crisis and the Banks (specially the PSU ones) have curtailed lending to RE Developers. Funding is critically required for survival of a lot of Developers and any steps towards addressing this would be a big step forward.

9.46 am: We will be joined by Atul Gupta, Senior Director, Deloitte India for Budget 2019. He will be accompanied by his team: Gulzar Didwania, Director; Akshay Goyal, Deputy Manager and Subham Saraf, Assistant Manager. Atul, along with his team will provide expert opinions on budget 2019.

As per tradition, Finance Minister @PiyushGoyal calls on #PresidentKovind at Rashtrapati Bhavan before presenting the Union Budget pic.twitter.com/yZfFL8uVKs

— President of India (@rashtrapatibhvn) February 1, 2019

9.38 am: For live coverage and analysis of Budget 2019, we are joined by Gagan Randev, National Director, Capital Markets and Investment Services, Colliers International.

9.24 am: Railway Budget 2019 - Three top factors could well be the focus of Railway Budget 2019 - Safer, Faster and Better. Notably, the Railway Minister Piyush Goyal has also said that there is a rising demand for better quality, safer, more comfortable, efficient, reliable and cheap transport and only the Indian Railways can provide that. Therefore, the focus may be on improving facilities rather than announcing new trains. READ MORE

9.18 am: Sensex opens at 36311.74; Nifty opens at 10851.35. Check Share Market Live Updates here

9.13 am: PM Narendra Modi to address the nation after Piyush Goyal's Budget speech.

Great news for banking sector - 3 banks (Bank of Maharashtra, Bank of India and Oriental Bank of Commerce) have come out of PCA norms which will enable credit flow. This will especially benefit MSME sector & home buyers with easier access to affordable credit.

— Piyush Goyal (@PiyushGoyal) January 31, 2019

8.45 am: Union finance minister Piyush Goyal arrives at the Ministry of Finance. He will present interim Budget 2019-20 in the Parliament today. Union Cabinet will give approval to the Budget before it is presented in the parliament.

- Finance Minister Piyush Goyal after giving Final touches to Budget 2019-20 in his office in North Block on Thursday, interacting with Members of his Budget Team. Both the Minister of State for Finance Shiv Pratap Shukla was also present on the occasion. (Image: Twitter/FinMinIndia)

7.37 am: Will Budget 2019 be a common man's budget? Here is a big opportunity for the NDA government before General Elections 2019 to address concerns of common people. Shilan Shah, Senior India Economist at Capital Economics says “The government will undoubtedly have an eye on the general election in its plans for the upcoming fiscal year (FY19/20) too. But it faces two major constraints. First, wholesale changes are rarely announced in interim budgets. And even if they were, the second constraint is that it needs to demonstrate some fiscal rectitude to markets.” READ MORE

7.19 am: Ahead of the Budget speech, industries have raised the banner of protest against Long Term Capital Gains (LTCG) tax. What everyone wants are reforms. It would not be wrong to say that LTCG taxes were the most surprising thing about Budget 2018. However, now that Prime Minister Narendra Modi led government is all set to present interim Budget 2019-20, many industries are expecting some good news in regards to LTCG on equity returns. Debadrata Bhattacharjee, Head of Research, CapitalAim said, "If the news on LTCG and STT changes is confirmed by finance ministry on budget day then we would say that this will help markets get access to liquidity as foreign Institutions will invest more."

6.54 am: According to Fitch ratings agency, longer-term trends are more important to the sovereign rating profile. "We believe the central government may still be able to meet its fiscal deficit target of 3.3 per cent of GDP for FY19, which would help support its fiscal credibility, although this may be achieved by deferring capital expenditure and postponing bill payments until after March," it said.

06.46 am: Fitch Ratings agency said in its report, "The BJP has reportedly lost votes in some recent state elections due to rural distress and public concerns over job creation. Targeted cash programmes appear the most likely form of support, as they would avoid downside risks of alternatives, such as the farm loan waivers that undermined the loan repayment culture in the past," it said. Populist spending, it said, would aggravate fiscal pressures, which are already building due to revenue shortfalls. Higher pre-election spending could risk a second consecutive year of fiscal slippage relative to the government's targets and would further delay plans to reduce the high general government fiscal deficit and debt burden."

#BudgetWithZEE | वित्त मंत्री पीयूष गोयल ने मीडिया को बजट ब्रीफकेस दिखाया।#Budget2019 @PiyushGoyal pic.twitter.com/Lh8PtqyrQd

— Zee Business (@ZeeBusiness) February 1, 2019

6.37 am: Will your benefits from fixed deposits, savings rise? There has emerged a strong possibility that government may look into providing some tax relief for your deposits in bank. For banks, the pressure arises from government’s small savings schemes, which forced the lenders to aggressively hike deposit rates beyond their ability to keep up with the Centre’s investment tools. Currently, there is a massive gap between interest rates offered by banks on their deposits and government on their small saving schemes. For banks, deposits are seen as an expenditure as they pay interest to customers, on the other hand, lending is their way to earnings as they receive interest from customers.

6.33 am: Budget 2019 warning - Ahead of BJP-led NDA government presenting the final budget of its tenure, Fitch Ratings Thursday warned of a second consecutive year of fiscal slippage in the event of Finance Minister Piyush Goyal resorting to populist spending to win over lost vote base. The interim budget to be presented Friday could give some indication of the government's commitment to fiscal consolidation, which is one of the main sensitivities in the sovereign ratings, Fitch said. "Pressure for new expenditure to attract votes, particularly among rural and small-business owner voters, has increased as polls have shown the ruling Bharatiya Janata Party (BJP) is becoming less assured of victory in the general elections. (PTI)

6.19 am: Budget time: Budget 2019 will be presented by Piyush Goyal at 11 am in the Lok Sabha.

6.16 am: Union minister Piyush Goyal will present Interim Budget 2019 today.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

02:19 PM IST

Social Stock Exchange: What is it? Will it benefit social enterprises in India?

Social Stock Exchange: What is it? Will it benefit social enterprises in India? Housing for all by 2022: Outlook positive for affordable housing in the next 3 years

Housing for all by 2022: Outlook positive for affordable housing in the next 3 years Hit by massive trouble, NBFC sector gets a big boost; here is how

Hit by massive trouble, NBFC sector gets a big boost; here is how Investment tips: These 10 stocks can help your wealth grow in July 2019

Investment tips: These 10 stocks can help your wealth grow in July 2019  Sensex crash! Rs 5.61 lakh crore of investor wealth wiped out in 2 days - 8 reasons why

Sensex crash! Rs 5.61 lakh crore of investor wealth wiped out in 2 days - 8 reasons why