Borrowing set to become expensive for large corporates

The RBI said that if the corporates borrow beyond their prescribed limits then the banks will have to make higher provisions and assign higher risk weights for the loans. Apart from this, they will also have to take higher capital from it as a security.

The Reserve Bank of India (RBI) has tightened the norms for lending to large corporates.

From FY18 onwards, the cost of money is set to become dearer for large corporates that avail huge loans, Zee Business said.

The move has been made by the RBI in an effort to bring down the lenders' exposure to stressed corporate entities.

With loan defaults like the Rs 9,000-crore Kingfisher Airlines' debt plaguing the banks, the new norms will help in safeguarding them to a certain extent.

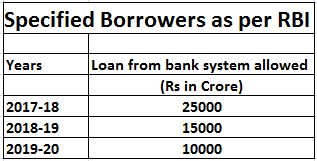

Under the new norms, big corporate borrowers will be accorded with the title of 'specified borrower'.

A specified borrower is defined as a borrower with an aggregate fund-based credit limits of more than Rs 25,000 crore at anytime during FY18, Rs 15,000 crore at any time during FY19, and Rs 10,000 crore at any time from April 1, 2019.

The RBI said that if the corporates borrow beyond their prescribed limits then the banks will have to make higher provisions and assign higher risk weights for the loans. Apart from this, they will also have to take higher capital from it as a security.

50% of the corporates' loan amount will be considered Normally Permitted Lending Limit (NPLL).

If a banks sanction loans that overshoot NPLL, then they will be expected to keep 3% aside for provisioning. An additional 75% risk weightage will also be levied by the banks on the borrower if they exceed the NPLL.

It is this additional provisioning and risk weightage that will make borrowing money more expensive for corporates, Zee Business said.

Banks can buy companies' bonds

Moreover, if the loans of a corporate exceed the NPLL limit, then banks will be also allowed to buy bonds of those companies.

These companies will have to ensure that the bonds are converted into cash in a phased manner within three years of availing the loans.

This means, if the loan is availed in FY18, then they will have to convert 30% of the bonds into cash by March 31, 2019, 60% by 2020, and 100% by 2021.

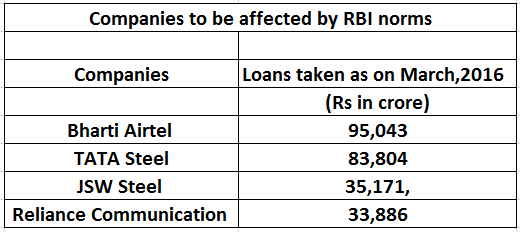

Under the new regulations, these are the companies that are likely to be affected:

Bharti Airtel Ltd, which has a total debt of Rs 95,043 crore upto March 31, 2016, Reliance Communications Ltd (Rs 33,886 crore), Tata Steel Ltd (Rs 83,804 crore) and JSW Steel Ltd (Rs 35,171 crore).

These companies, according to the new lending norms, may be accorded the 'specified borrowers' title, which will put a premium on further bank funding.

Large companies have accounted for 58% of total bank credit of Rs.65.47 trillion as on March 31, 2016.

It will also help in keeping non-performing assets (NPAs) at bay.

Gross non-performing assets for public sector banks rose 100% to Rs 5.71 lakh crore versus a 27% increase last year. The gross NPA ratio doubled in Q1 FY17 to 10.42% from 5.38% in FY15 and 4.52% in FY14.

While private banks performed better than the public sector lenders, they are also facing the NPA pressure. The provisioning done by private banks stood at 69% at Rs 7,046 crore, down from 77% in FY15. NPAs in the private sector rose to 3.03% from 2.14% in FY15 and 1.94% in 2014.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

01:21 PM IST

Electricity distribution companies continue to remain a burden on state finances: RBI

Electricity distribution companies continue to remain a burden on state finances: RBI Rupee hits all-time low; RBI intervenes to curb further losses

Rupee hits all-time low; RBI intervenes to curb further losses Rupee slumps to record closing low of 84.88 vs dollar

Rupee slumps to record closing low of 84.88 vs dollar Bank stocks rally up to 2% after RBI cuts CRR to 4%

Bank stocks rally up to 2% after RBI cuts CRR to 4% RBI raises retail inflation estimate for FY25 to 4.8% amid rising food prices

RBI raises retail inflation estimate for FY25 to 4.8% amid rising food prices