Blue-chip companies' results, PSB recapitalisation drove markets this week

The long-awaited Goods and Service Tax (GST) Bill is likely to be taken up in the Parliament this week. All eyes will be on this development.

Domestic equity markets witnessed a lot of ups and down in the week ended July 22 on the back of corporate results announced by some of the blue-chip companies including Reliance Industries.

On Friday, the 30-share benchmark Sensex closed the week at 27,803.24, up 92.72 points, or 0.33% higher from previous day's close. Compared to a week ago, Sensex was only 33 points down.

The 50-share Nifty 50 ended the week at 8541.20, up 31.10 points, or 0.37% from previous day's close.

This week, the fourth tranche of the Sovereign Gold Bonds were launched through the stock exchanges. This time, the government has tweaked some features to attract more takers. According to Jimeet Modi, CEO of SAMCO Securities Ltd, the scheme is a win-win for the country and the investors, as it offers an interest rate of 2.75% per year. Capital gains tax exemption on redemption after eight years is also one of the winning highlights of the scheme, he said.

Following the launch of the scheme on Monday, Sensex crossed 28,000-mark for the first time in 2016. Nifty also to 8,576.50 during the day.

This week, the government released the second tranche of funds to recapitalise public sector banks. The government pumped Rs 22,915 crore in 13 state-run units, which led to a huge buying in the banking sector.

On the day, State Bank of India, which received the most funds from the Centre, was top pick among investors. SBI's share price surged 0.81% to Rs. 231.45, followed by Andhra Bank at Rs. 59.65 up by 0.68% and Canara Bank which rose 0.54% at Rs. 260.45. IDBI Bank, Indian Overseas Bank and Union Bank, however, were trading below 0.50% level.

Reliance Industries' April-June results beat analyst expectations by a wide margin. In the period, the company's profit after tax rose 18%. It's stock went up nearly 3% but later lost its gains on the back of profit booking.

Hindustan Unilever posted a 10% rise in its PAT but its share price fell for three sessions because its market growth slowed in both, value and volume terms amid a challenging environment, the company said.

HDFC Bank posted 20% rise in its profits while Kotak Mahindra Bank posted a four-fold rise in its numbers; ITC's profits were up 10% and Ultratech posted a 29% rise in quarterly PAT which boosted the markets through the week.

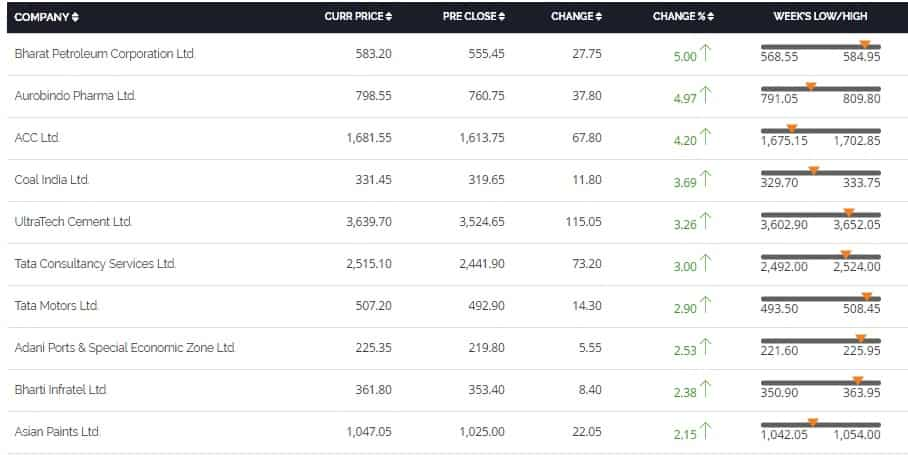

On Nifty50, among the top gainers were Bharat Petroleum Corporation (5%), Aurobindo Pharma (4.97%), ACC Ltd (4.20%), Coal India (3.69%) and UltraTech Cement (3.26%).

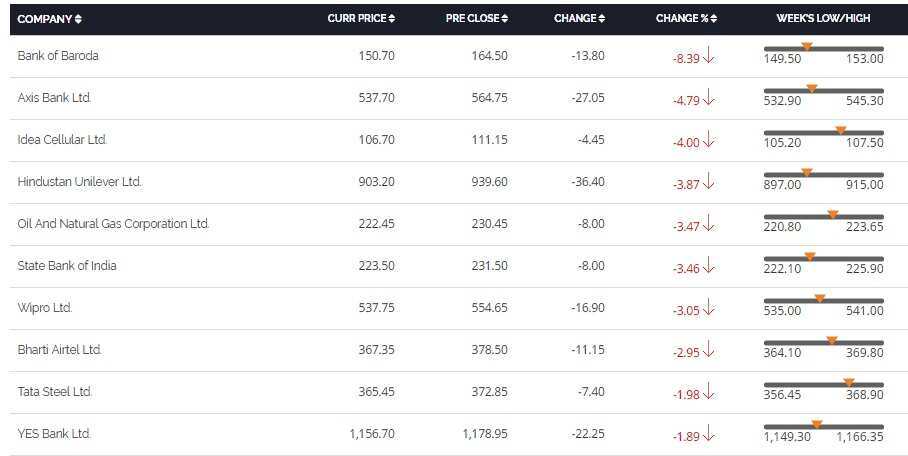

On the same benchmark, among the top losers were Bank of Baroda (8.39%), Axis Bank (4.79%), Idea Cellular (4%), Hindustan Unilever (3.87%) and Oil and Natural Gas Corporation (3.47%).

The stocks that saw the most activity in terms of the number of shares exchanging hands in the day were Larsen & Toubro (up 1.06%), Mahindra & Mahindra (up 0.40%), Housing Development Finance Corporation (up 1.81%), HDFC Bank (0.18%) and Hindustan Petroleum Corporation (0.90%).

Market outlook:

With the going Monsoon Parliament session, the long-awaited Goods and Service Tax (GST) Bill is likely to be taken up in the Parliament this week. All eyes will be on this development.

Along with GST Bill, four other bills are lined up-- Bills relating to Afforestation Fund, Prevention of corruption, Benami transactions, Whistle Blowers Protection will be on the agenda for second week of Monsoon session of Parliament.

SAMCO's Modi said, "Rainfall is progressing well across the country, bringing cheer to the farmers. This will play an important role in reviving the growth for the country. Important bills lined up before the Parliament, should they be cleared, will further drive our markets into the higher territory otherwise they may languish with a positive upward bias in the short-term".

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

12:23 PM IST

Final Trade: Sensex tumbles 1,200 points, Nifty slips below 23,600; IT stocks cushion the fall

Final Trade: Sensex tumbles 1,200 points, Nifty slips below 23,600; IT stocks cushion the fall Zomato set to debut in Sensex, replacing JSW Steel

Zomato set to debut in Sensex, replacing JSW Steel Sensex drops 170 points, Nifty below 23,950; oil & gas stocks rebound

Sensex drops 170 points, Nifty below 23,950; oil & gas stocks rebound FIRST TRADE: Equities fall for fifth consecutive day; Nifty holds on to 23,900 levels, Sensex down 208 pts

FIRST TRADE: Equities fall for fifth consecutive day; Nifty holds on to 23,900 levels, Sensex down 208 pts GIFT Nifty futures drop 60 pts; markets to open on a cautious note

GIFT Nifty futures drop 60 pts; markets to open on a cautious note