Big relief for Jyoti Structures employees; NCLAT gives lifeline

Over 1,300 employees of Jyoti Structures, a Mumbai-based engineering, and procurement (EPC) company, are heaving a sigh of relief as the National Company Law Appellate Tribunal (NCLAT) has granted a stay on the liquidation order passed against the insolvent firm.

Over 1,300 employees of Jyoti Structures, a Mumbai-based engineering and procurement (EPC) company, are heaving a sigh of relief as the National Company Law Appellate Tribunal (NCLAT) has granted a stay on the liquidation order passed against the insolvent firm.

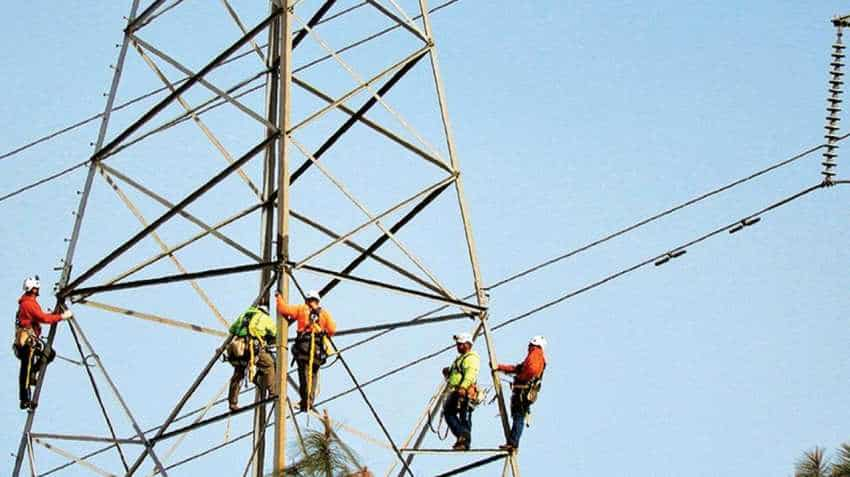

Its employees are spread over two manufacturing units in Nashik and Raipur, and at various project sites.

The stay order comes after the company’s employees, as well as a group of investors led by Netmagic’s Sharad Sanghi (the resolution applicant), appealed against a previous order by the NCLT at NCLAT.

The appellate tribunal will hear the case on September 18.

In July, the Mumbai bench of NCLT had ordered liquidation of the debt-ridden company after it rejected the plan submitted by resolution professional (RP), Vandana Garg, despite the fact that 82% of the lenders, including State Bank of India with 26% secured debt, voted in favour of the resolution.

While the RP pleaded for an eight-day extension, a couple of financial creditors opposed it on a technical ground.

Under the Insolvency and Bankruptcy Code (IBC) 2016, a resolution plan has to be arrived at within 270 days, failing which the firm goes into liquidation.

NCLT rejected the resolution plan and asked the RP to file for liquidation on July 25.

Jyoti Structures, which has dues of Rs 6,400 crore, is in the first list of cases that the Reserve Bank of India (RBI) directed to be admitted for insolvency proceedings under IBC.

After having admitted to NCLT, Jyoti Structures got a lone bid from a clutch of wealthy investors, including Sharad Sanghi, chief executive of Netmagic Solutions, and Madhusudan Kela, formerly with Reliance Capital.

The resolution plan involved an equity investment of Rs 170 crore upfront and the repayment of debt over an average maturity period of 9.8 years.

Watch this Zee Business video here:

Bankers were also to get 15% equity in the company, as per the resolution plan.

What delayed the resolution process is the opposition by two smaller lenders, DBS Bank and IndusInd Bank, each having less than 0.8% of secured debt, objected to the resolution plan, saying that it outstripped the 270-day deadline of the IBC by six days. In addition, a minor delay in getting the lenders to vote in favour of the resolution after an approval from their respective Boards had also given DBS and IndusInd some technical ground to oppose the insolvency process. Surprisingly, the resolution professional’s plea for an eight-day extension based on the time elapsed between the admission of the company to go through the Corporate Insolvency and Resolution Process and issue of order appointing the RP was not considered, despite previous precedence in a similar case.

According to the amended IBC regulations, any resolution plan needs to be approved by a minimum of 66% of the lenders as against the 82% approval secured in the firm’s case.

Employees pin the hopes on the preamble to the IBC Act, which states that the object of the Code is resolution and not liquidation.

Source: DNA Money

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

10:14 AM IST

Shares of these 12 companies plunge as banks begin meet to resolve NPA issue

Shares of these 12 companies plunge as banks begin meet to resolve NPA issue