As India Inc looks away, public and private banks' turf war now shifts to retail loans

Retail loan has less exposure in banks stressed assets and has been considered a favourable segment which can boost the lenders credit cycle.

Key Highlights:

- Bank's credit growth continues at muted level

- Retail loan has only 2.1% exposure in banks NPA issue

- Retail loan stood at Rs 16.24 lakh crore by FY17

Recent data compiled by the Reserve Bank of India (RBI) showed that gross lending by banks stood at over Rs 69.45 lakh crore in July 2017 – recording growth of just 4.7% year-on-year (YoY) basis.

Between April 2017 – August 2017, bank credit growth tumbled by over Rs 1.37 lakh crore, down 1.8% as against the similar period of the previous year.

Soumya Kanti Ghosh, Group Chief Economic Adviser at State Bank of India (SBI) said, "The deceleration in credit growth also highlights the role of supply side factors – stressed assets and capital constraint – in hindering a revival in the credit cycle.”

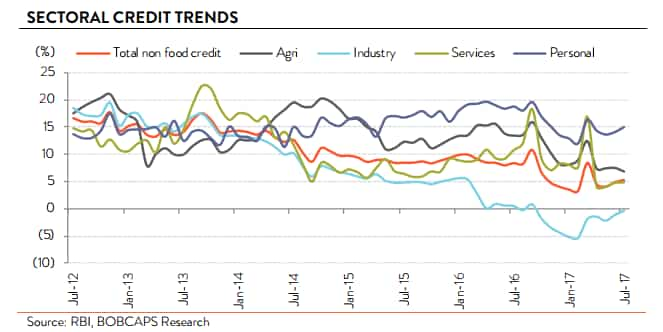

Banks credit cycle is divided in four major parts – agriculture, industry, services and retail loans.

Interestingly, retail loans have significantly low exposure in banks non-performing assets (NPA) issues and is thus currently the most preferred segment for most banks.

Highest NPA exposure is in industry by 23% with stressed loans of Rs 6.16 lakh crore, followed by service sector with stress of Rs 1.29 lakh crore (7%) and agriculture at Rs 62,525 crore with exposure of 6.3%.

Retail loans stood at Rs 16.24 lakh crore by FY17 – with stressed loan just Rs 34,108 crore which was 2.1% of overall banks.

Sanjeev Prasad, Sunita Baldawa and Anindya Bhowmik, analysts at Kotak Institutional Equities said, "We expect the retail credit market to see more competition as the structure of India’s credit markets will change dramatically over the next 1-2 years led by powerful forces of (1) corporate deleveraging, (2) digital and technological disruption and (3) formalisation of the economy."

Crisil said, “Retail sector growth will continue to show higher growth as consumption demand gradually picks up and cost of borrowing falls.”

Retail segment mainly consists of loans like housing, auto and credit cards, etc.

Among many indicators in lending, only retail loans managed to stay at a firm double-digit growth of 15% in July 2017, however, still lower compared to 18.8% in the similar month of the previous year.

This segment has grown at a compounded annual growth rate (CAGR) of 15.27% between FY12 – FY17.

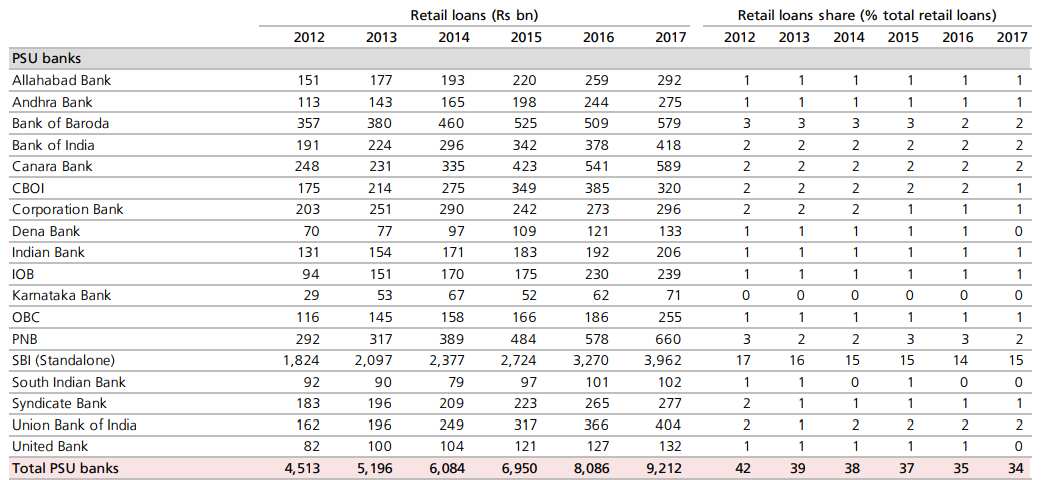

In value terms, PSBs retail loan which stood at Rs 4.51 lakh crore FY12 increased to Rs 8.08 lakh crore in FY16 and further to Rs 9.21 lakh crore in FY17.

However, market share of PSBs has been declining consistently during these periods. Market share of PSBs was at 34% in FY17 compared to 35% in FY16 and 42% in FY17.

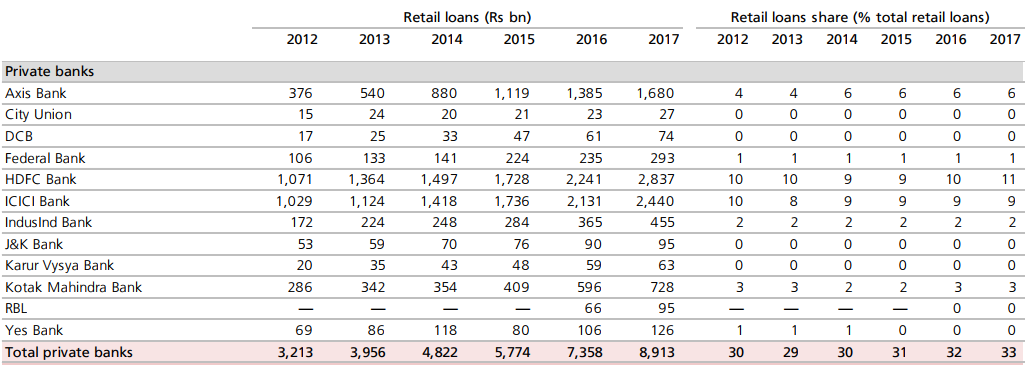

Unlike PSBs, private banks market share grew to 33% in FY17 as against 32% in FY16 and 30% in FY12. In value terms, the growth was at Rs 8.91 lakh crore in FY17 versus Rs 7.36 lakh crore in FY16 and Rs 3.21 lakh crore in FY12.

The trio at Kotak stated that retail debt-to-GDP is around 20%, providing long runway of growth in retail loans. Also quality retail lenders trading at 3.5-5X FY2019E book value.

ICICI Securities said, "We expect retail credit demand to be driven by home loans, given the increased affordability on falling product rates, favourable demographic drivers (nuclear families, internal migration) and government incentivisation (upfront interest subvention in affordable housing)."

Housing loans which was over Rs 8.21 lakh crore in January 2017 increased to Rs 8.60 lakh crore in March 2017 and further to Rs 8.64 lakh crore in July 2017.

RBI along with government has been trying to push housing loan - by cutting standard asset provisioning on this segment, increasing loan-to-value (LTV) ratio and also reducing statutory liquidity ratio.

Chanda Kochhar, MD and CEO, ICICI Bank, said, "The SLR cut and reduction in risk weights for housing loans are positive moves that will support bank liquidity and encourage growth in housing loans.”

In line with the recent decline in MCLR and base rates and sharp increase in affordability - this will aid improvement in retail loans.

Push in retail loans can actually take banks credit growth between 8 – 10% in current fiscal year 2017 – 18.

NPAs in retail loans on the rise?

Earlier, RBI in its paper “Bank lending and Loan Quality” - explained that at every one-percentage point increase in loan growth is associated with an increase in NPLs over total advances (NPL ratio) of 4.3% in the long run with the response being higher during expansionary phases.

It added NPL ratios of banks are found to be sensitive to the interest rate environment and the overall growth of the economy.

This segment is highly interest rate sensitive.

According to RBI, NPLs of private banks are more reactive than NPLs of public banks to changes in interest rates, because of the greater credit exposure to retail loans that are more reactive to monetary policy changes.

Share of retail loans was 22% for private banks and 14% for public banks. Housing held a share of 8% for public banks, while its share was 12% for private banks.

Credit card receivables accounted for less than 1% of the total loan portfolio of public banks, while it was 2% of the loan portfolio of private banks.

Aadesh Mehta and Pankaj Agarwal, analysts at Ambit Capital stated in its report that asset quality risk in home loans is now manifesting. The duo said, “Home buyers in some delayed projects are considering stopping EMIs as banks have started insolvency proceedings against these developers under the new IBC.”

So far, RBI has brought major corporate under the radar of Insolvency & Bankruptcy code. It has clearly specified that directions will be issued to banks for identifying individual cases for filing under IBC. These cases will be accorded priority by the National Company Law Tribunal (NCLT).

Ambit said, "Given the weak real estate sales in India, stretched balance sheet of some developers and developer subvention schemes being a sizable part of disbursement over the last 2 - 3 year, there could be few more such cases around the corner.”

Ambit estimate that overall system gross NPAs in home loans could increase by 70 - 170 basis points if 30-70% of the borrowers default.

ALSO READ:

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

01:53 PM IST

Retail loan securitisation beat pandemic blues, soars 56 per cent to Rs 1.76 lakh crore in FY23

Retail loan securitisation beat pandemic blues, soars 56 per cent to Rs 1.76 lakh crore in FY23 Retail loan is not a nirvana, Mundra warns bankers

Retail loan is not a nirvana, Mundra warns bankers Q3 review: Credit growth, weak NII, fee income to impact banking sector

Q3 review: Credit growth, weak NII, fee income to impact banking sector Demonetisation impact: Banks' loan growth likely to drop by 5% in Q3FY17

Demonetisation impact: Banks' loan growth likely to drop by 5% in Q3FY17