Anil Singhvi's Market Strategy October 11: Trend is negative; NBFC, Banks, IT & Metals under cloud too

Amid positive domestic institutional investors (DIIs), neutral future and option (F&O), negative global market, neutral foreign institutional investors (FII) and cautious sentiment cues, the short-term trend of the Indian market is likely to be negative on October 11, 2018.

Domestic stock markets closed in the green on October 10, 2018. On the day, Nifty 50 went up by 159.05 points or 1.54 per cent before closing at 10,460.10 and S&P BSE Sensex went up by 461.42 points or 1.35 per cent to close at 34,760.89.

Nifty Bank also saw a rise of 794.05 points or 3.24 per cent and closed at 25,321.70.

Amid positive domestic institutional investors (DIIs), neutral future and option (F&O), negative global market, neutral foreign institutional investors (FII) and cautious sentiment cues, the short-term trend of the Indian market is likely to be negative on October 11, 2018.

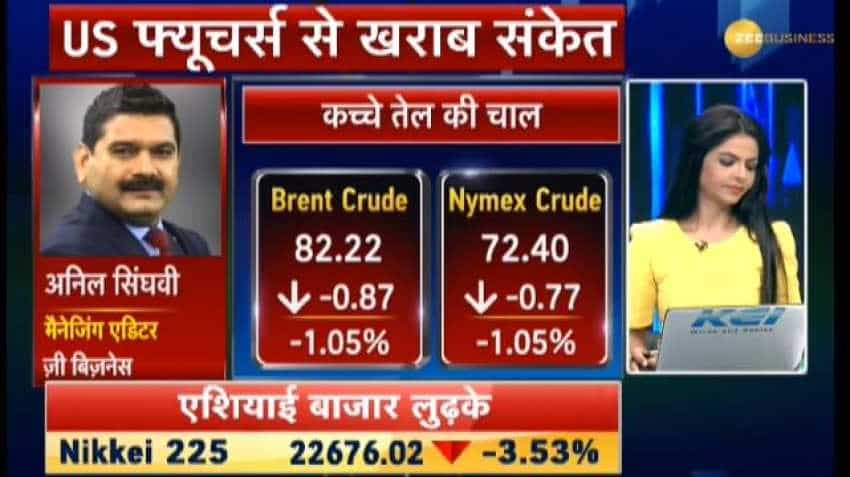

Zee Business's Managing Editor Anil Singhvi's Market Strategy for October 11:

Global volatility, Trump speech and weak sentiment to create pressure again.

10,300 and 24,750 are going to be the deciding levels on Nifty and BankNifty.

The small trading range on Nifty stands at 10,250-10,350 and the bigger range lies between 10,200-10,400.

A risk of fall up to 9,950-10,050 can be seen at Nifty if it breaks below the mark of 10,200 during intraday trade or it closes below 10,050.

The small and bigger trading range on BankNifty lies between 24,750-24,900 and 24,500-25,000 respectively.

A risk of fall up to 24,000 can be seen in coming days if BankNifty breaks below 24,250 intraday or closes below 24,400

Traders are advised to close their buying positions if the two indices trade below the mark of 10,300 and 24,400 respectively.

However, traders can hold their buying positions if Nifty and BankNifty close above the mark of 10,400 and 25,000.

Sell Strategy on Nifty & BankNifty

Sell Nifty with a stop loss of 10,350 and target 10,250-10,200.

Sell BankNifty with a stop loss 25,000 and target 24,750-24,650-24,500-24,400.

In F&O Ban: IDBI

The put-call ratio (PCR) stands at 1.16 and the volatility index (VIX) is 17.90.

Sectors:

Negative: NBFC, Banks, IT, Metals

Stocks of the Day:

Sell Mindtree Futures: Stop loss 1015 and a target of 985, 965.

Sell IBull Housing Futures: Stop loss 980 and a target of 940, 920.

Watch this Zee Business video

Sell DHFL Futures: Stop loss 295 and a target of 270, 262, 250.

Sell Jet Air Futures: Stop loss 190 and a target of 183, 180.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Top 7 Flexi Cap Mutual Funds With up to 52% SIP Return in 1 Year: Rs 20,000 monthly SIP investment in No. 1 fund has generated Rs 3.02 lakh; know about others too

Rs 55 lakh Home Loan vs Rs 55 lakh SIP investment: Which can be faster route to arrange money for Rs 61 lakh home? Know here

09:45 AM IST

Anil Singhvi Market Strategy December 19: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 19: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy December 18: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 18: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy December 16: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 16: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy December 13: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 13: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy December 11: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 11: Important levels to track in Nifty50, Nifty Bank today