Anil Singhvi’s Strategy September 6: Market Trend is Neutral; Metal sector is Positive; NBFC is Negative

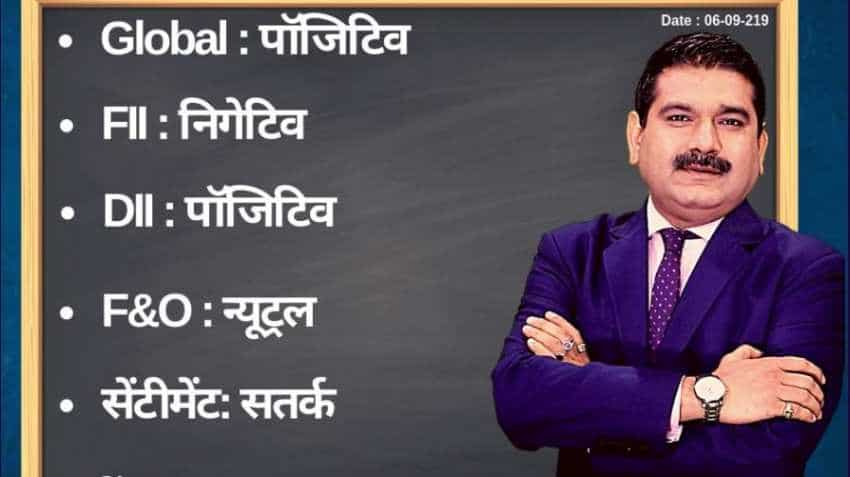

On account of positive global markets, DIIs, neutral F&O and negative FIIs, the short-term trend of the Indian markets will be neutral, says Zee Business Managing Editor Anil Singhvi.

Amid positive global markets, domestic institutional investors (DIIs), neutral futures and options (F&O) and negative foreign institutional investors (FIIs) cues, the short-term trend of the domestic Indian markets will be neutral today on Friday, September 6, 2019, while sentiment will remain cautious.

Earlier, the domestic markets remained flat amid volatility. On the day, Sensex at the Bombay Stock Exchange fell 80.32 points, or 0.22 per cent, to close at 36,644.42. But, the Nifty at the National Stock Exchange gained 3.25 points, or 0.03 per cent to end at 10,847.90 while Bank Nifty lost 204.15 points, or 0.75 per cent to settle at 26,919.70.

See Zee Business Live TV streaming below:

Zee Business's Managing Editor Anil Singhvi's Market Strategy for September 6:

10,900 and 27,000 are going to be the deciding levels on Nifty and Bank Nifty respectively.

Small day range for trading on Nifty stands at 10,800-10,925 while the medium and bigger range lies between 10,750-10,950 and 10,700-11,025 respectively.

Small day range for trading on Bank Nifty stands at 26,800-27,125 while the medium and bigger range lies between 26,750-27,250 and 26,650-27,650 respectively.

For Existing Long Positions:

Nifty intraday and closing stop loss 10,800.

Bank Nifty intraday and closing stop loss 26,800.

For Existing Short Positions:

Nifty intraday and closing stop loss 10,925.

Bank Nifty intraday and closing stop loss 27,300.

For New Positions:

Buy Nifty with a stop loss of 10,800 and target 10,925, 10,950, 10,975.

Sell Nifty in 10,975-11,000 range with a stop loss of 11,025 and target 10,900, 10,850.

Buy Bank Nifty with a stop loss of 26,950 and target 27,125, 27,250, 27,450.

Sell Bank Nifty near 27,250-27,300 range with a stop loss of 27,350 and target 27,150, 26,950.

The put-call ratio (PCR) is at 1.24 and the volatility index (VIX) is 17.27.

Sectors:

Positive: Metals

Negative: NBFC

No stock in F&O Ban

Stock of the Day:

Sell Indiabulls Housing Cash: Stop loss 450 and target 430, 425, 410. PIL filed against the company.

Buy Equitas Futures: Stop loss 114.50 and target 118.50, 121. Expect Small Finance Banks listing guidelines soon.

Aaj ka Hero:

Sell Sun Pharma Cash: Stop loss 439 and target 425, 415. The company accepted a forensic audit for 3 years of accounts.

Buy Bharti Airtel Cash: Stop loss 343 and target 353, 356, 358. Jio fibre plan is not aggressive for competitors.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Top 7 SBI Mutual Funds With Best SIP Returns in 1 Year: Rs 25,252 monthly SIP investment in No. 1 scheme has sprung to Rs 3,74,615; know about others

Power of Compounding: At 12% expected annualised return, how soon can Rs 8,000, Rs 9,000, Rs 10,000 monthly SIPs build Rs 5 crore corpus?

Power of Compounding: How can you create Rs 5 crore, 6 crore, 7 crore corpuses if your monthly salary is Rs 20,000?

Top 7 Large and Mid Cap Mutual Funds With Highest SIP Returns in 1 Year: Rs 27,27,2 monthly SIP investment in No. 1 fund has zoomed to Rs 4,05,296

PPF vs SIP: With Rs 12,000 monthly investment for 30 years; which can create highest retirement corpus

08:41 AM IST

Final Trade: Sensex drops 451 points, Nifty ends below 23,650

Final Trade: Sensex drops 451 points, Nifty ends below 23,650 Sensex swings between gains and losses amid volatility, Nifty below 23,800

Sensex swings between gains and losses amid volatility, Nifty below 23,800 JSW Energy stock climbs 8% on $1.47 billion deal to acquire O2 Power

JSW Energy stock climbs 8% on $1.47 billion deal to acquire O2 Power First Trade: Sensex opens 50 points lower at 78,640; Nifty at 23,750

First Trade: Sensex opens 50 points lower at 78,640; Nifty at 23,750 Pre-market: GIFT Nifty Futures signal tepid start on D-Street amid weak Asian markets

Pre-market: GIFT Nifty Futures signal tepid start on D-Street amid weak Asian markets